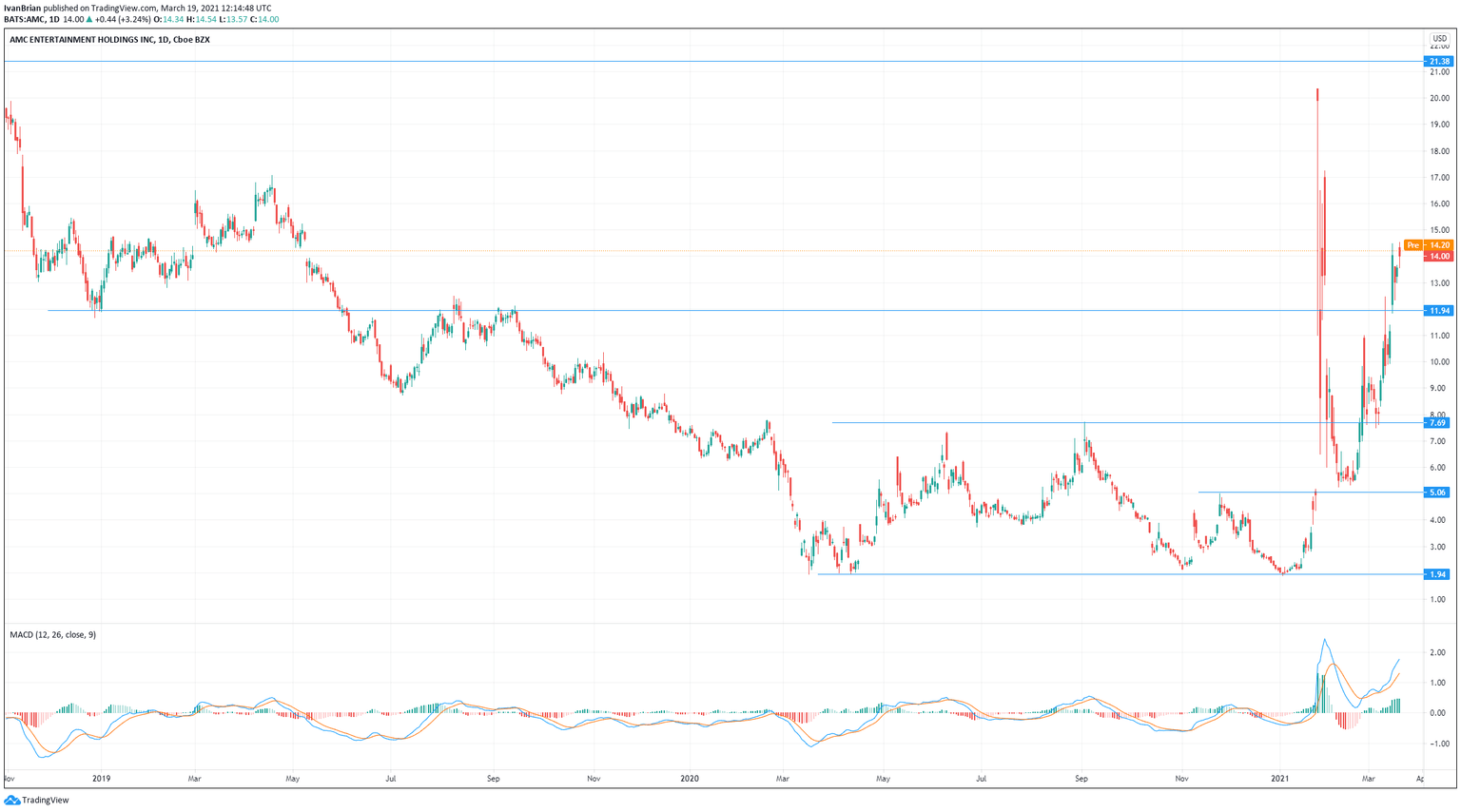

AMC Stock Price and News: AMC extends slide to fresh weekly lows below $12

- AMC price down 14% on Monday, below $12.

- Shares up 560% so far in 2021.

- AMC cinemas are reopening in the US as Europe lags.

Update: AMC Entertainment Holdings Inc shares started the new week deep in the negative territory and remained under pressure to touch the lowest level in a week at $11.77 during the first half of the session. In the absence of company-related headlines, profit-taking seems to be weighing on AMC, which touched a six-week high of $14.54 last Thursday. At the time of press, the stock was trading at $12.08, where it was down 13.3% on a daily basis. Meanwhile, the broader market mood remains upbeat Monday amid a 2% decline in the benchmark 10-year US Treasury bond yield. Currently, the S&P 500 Index is rising 0.82% at 3,945.

AMC shares have been on a wild run again this week notching impressive gains as traders bet on the reopening of the US economy. Good news has been plentiful as AMC has been gradually able to reopen in New York, California, and now nationwide. AMC says it should have 98% of theatres open by today March 18 and 99% by March 26.

AMC operates cinema theatres globally and understandably has suffered as a result of the pandemic. AMC operates in the US and Europe with theatres in 44 US states and 13 European countries.

Stay up to speed with hot stocks' news!

AMC Stock Prediction

So AMC has been saved by the masses it would appear! The huge price appreciation, driven by the retail investor, enabled AMC to raise cash to stave off bankruptcy.

On January 25 AMC "announced today that since December 14, 2020, it has successfully raised or signed commitment letters to receive $917 million of new equity and debt capital. This increased liquidity should allow the company to make it through this dark coronavirus-impacted winter". Adam Aron, AMC CEO and President, said, “Today, the sun is shining on AMC. After securing more than $1 billion of cash between April and November of 2020, through equity and debt raises along with a modest amount of asset sales, we are proud to announce today that over the past six weeks AMC has raised an additional $917 million capital infusion to bolster and solidify our liquidity and financial position. This means that any talk of an imminent bankruptcy for AMC is completely off the table.”

So the company is saved and now the winter of discontent is over and the pandemic can be consigned to history! Well not quite. The US is clearly opening up aggressively and has a strong vaccination system in place. However, Europe is not going so well and this represents a large part of AMC's revenue.

AMC has nearly 8,000 screens in the US representing its biggest market but it has nearly 3,000 screens in Europe. Europe is not opening up anytime soon as the slow pace of vaccination and new lockdowns introduced in France, Italy, and Germany demonstrates.

Added to this is the increasing debt pile AMC now has to service following its successful efforts at avoiding bankruptcy this year, $5.8 billion in 2020, up $1 billion on 2019. The big bond repayments don't kick in until 2024-2026 but servicing this debt while trying to keep shareholder value will require a huge jump in cashflow. The retained earnings deficit gives a picture of just how far AMC has to go. The last time this was not in the deficit was 2016!

AMC was struggling before the pandemic, now it has a larger debt pile and so does not make for a compelling investment case. Shorter-term players may be able to jump in and out quickly but this is not for the long haul.

Previous updates

Update: Shares in AMC are suffering a steep fall on Monday. AMC shares are trading at $11.96, a drop of over 14%. Retail investors have been betting on AMC throughout 2021 but in order to survive the company had to raise capital. This diluted shareholders and increased debt. AMC needs a massive jump in future revenue streams to justify its current valuation metrics.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.