AMC Stock Price: AMC Entertainment trades flat despite broader market rally

- NYSE:AMC gained 0.04% during Tuesday’s trading session.

- December was the best month for the box office since the pandemic started.

- Meme stocks are holding inflated prices as we approach the 1-year anniversary of the Reddit Rebellion.

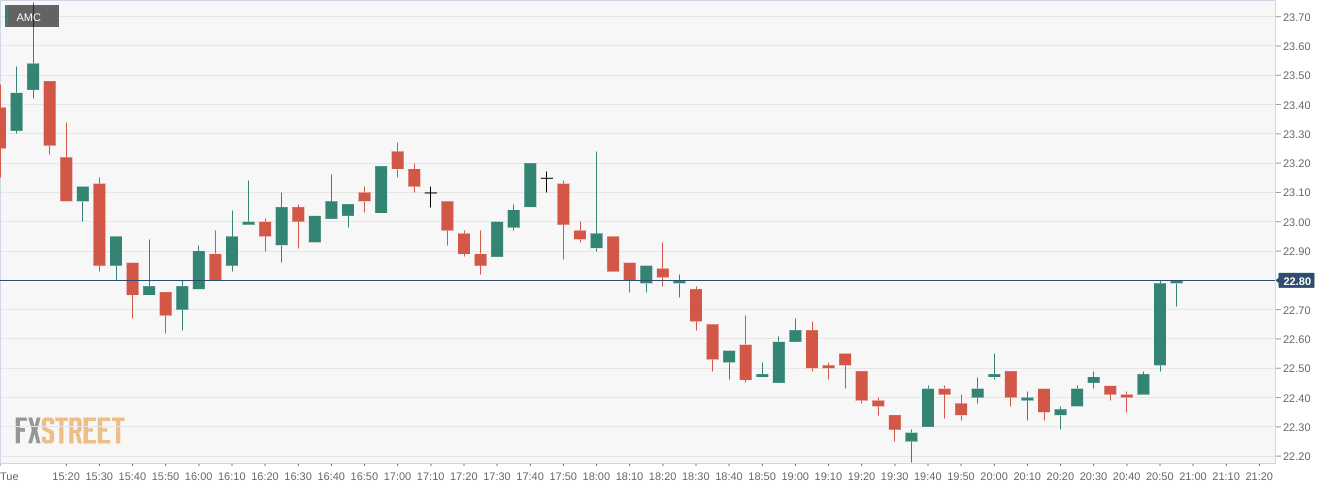

NYSE:AMC failed to capitalize on a market rebound on Tuesday as the lead meme stock continues to struggle in 2022. Over the past six months, shares of AMC have now dropped by 46.5% following the most recent squeeze in June. On Tuesday, shares of AMC edged higher by 0.04% and closed the trading day at $22.79. It was a nice day of recovery for the broader markets as all three major indices finished higher. The NASDAQ led the way after its recent brutal selloff, as the tech-heavy index gained 1.41% for its second consecutive positive day to start the week.

Stay up to speed with hot stocks' news!

Unfortunately for AMC Apes, the stock continues to fall despite December of 2021 being the best month for box office ticket sales since the pandemic started. Much of this success was brought on by easing restrictions in most metropolitan areas, as well as the mega-success of the latest Marvel movie Spider-Man: No Way Home. Still, it must be discouraging to investors who are waiting for another squeeze, as AMC has shown no indication of being able to return to those previous highs.

AMC stock forecast

We are fast approaching the one-year anniversary of the Reddit rebellion that took the global markets by storm in January of 2021. Of note, AMC and GameStop (NYSE:GME) are still holding a lot of their inflated stock prices, as the two stocks are still up 895% and 553% respectively over the past 52-weeks. The two primary meme stocks have certainly fallen from their all-time highs, but one-year later we still see the stock prices separate from the fundamentals of the company.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet