Alibaba Stock News and Forecast: BABA falls despite talk of ANT Group license

- BABA stock falls on Wednesday in Hong Kong.

- Alibaba subsidiary Ant Group is back in the headlines for potential spin-off.

- BABA shares down nearly 2% in early premarket on Wednesday.

Alibaba (BABA) stock is down currently in Wednesday's premarket. This can be partly explained away by the strong performance on Tuesday being partially reversed on a global scale this morning. The continued choppy trading ranges see investors full of optimism one day, only to reverse course and sentiment the next session. BABA stock had rallied 4% on Tuesday.

Also read: Amazon Stock Deep Dive: AMZN price target at $106 with near-term risks offset by long-term growth

Alibaba stock news: New ANT Group IPO?

The sorry tale of ANT Group's botched IPO is once again returning as Bloomberg carried a report that the group is set to apply for a financial holding company license. The report further goes on to state that ANT Group is likely to receive such authorization citing people familiar with the matter. This could set the company up for a renewed IPO.

The initial IPO plan was shelved back in late 2020 after Alibaba CEO Jack Ma appeared to criticize the Chinese leadership in a speech. Last week reports surfaced that the Chinese leadership had approved a plan for Ant Group to IPO in Hong Kong and Shanghai. Chinese state media denied this. So, it appears the trials and tribulations are set to continue.

In the meantime, shareholders are left trying to gauge the direction of their investment. BABA stock has recovered some ground recently but remains down 12% year to date. This is better than the Nasdaq and S&P 500 year-to-date performance and is largely the result of a 20% gain in the past month for BABA stock.

BABA stock forecast

Strong support at $80 has helped initiate the current BABA stock rally. That and some conciliatory commentary between Chinese and US regulators over auditing access and potential delisting concerns. However for now Alibaba remains on the SEC watchlist for potential delisting. With such a noose around its neck, it makes us incredibly wary of investing in the name. Yes, alternative listings in Hong Kong are fungible giving some comfort but the recent earnings meltdown from the US peer Amazon (AMZN) provides another headwind in our view.

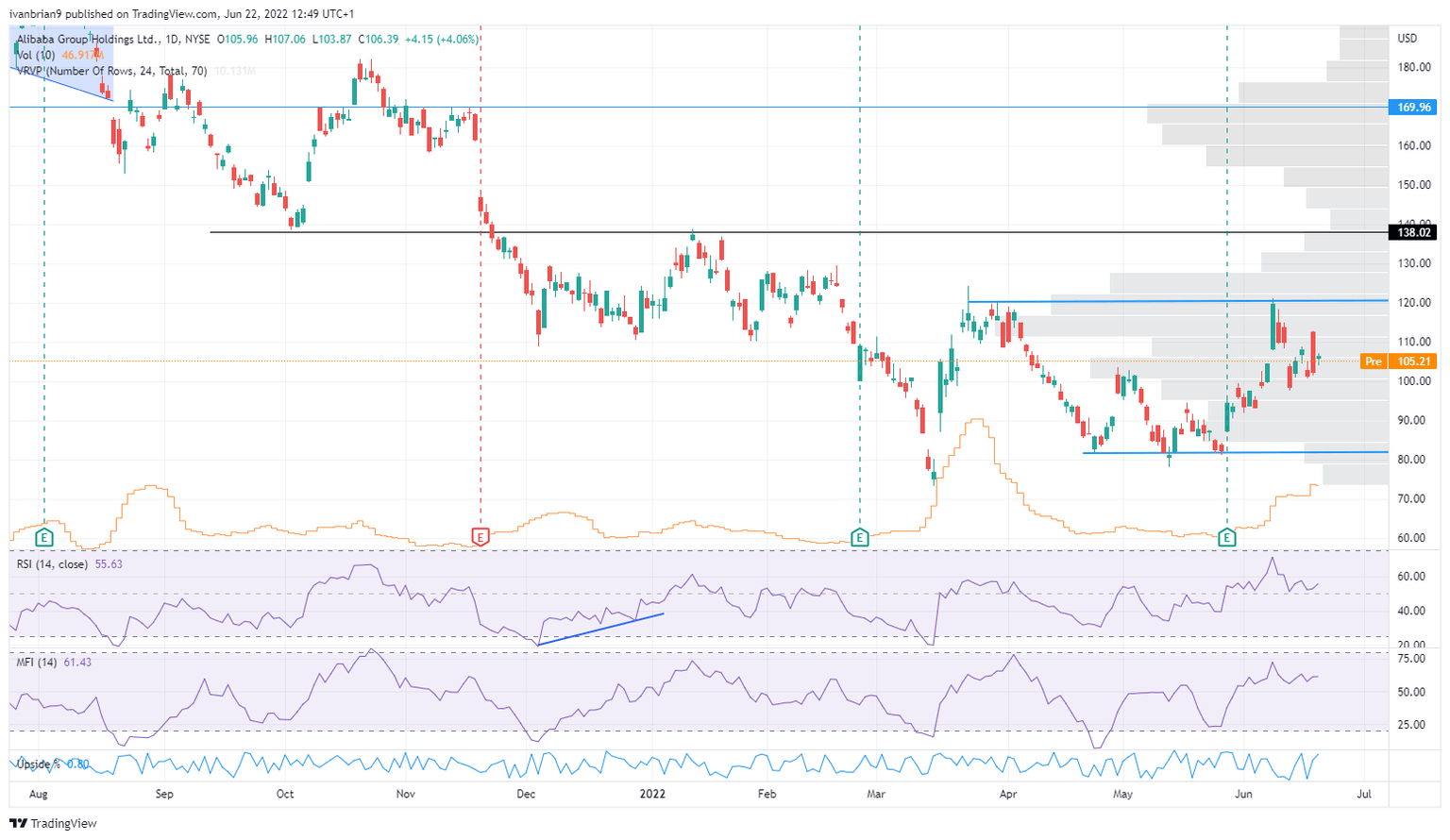

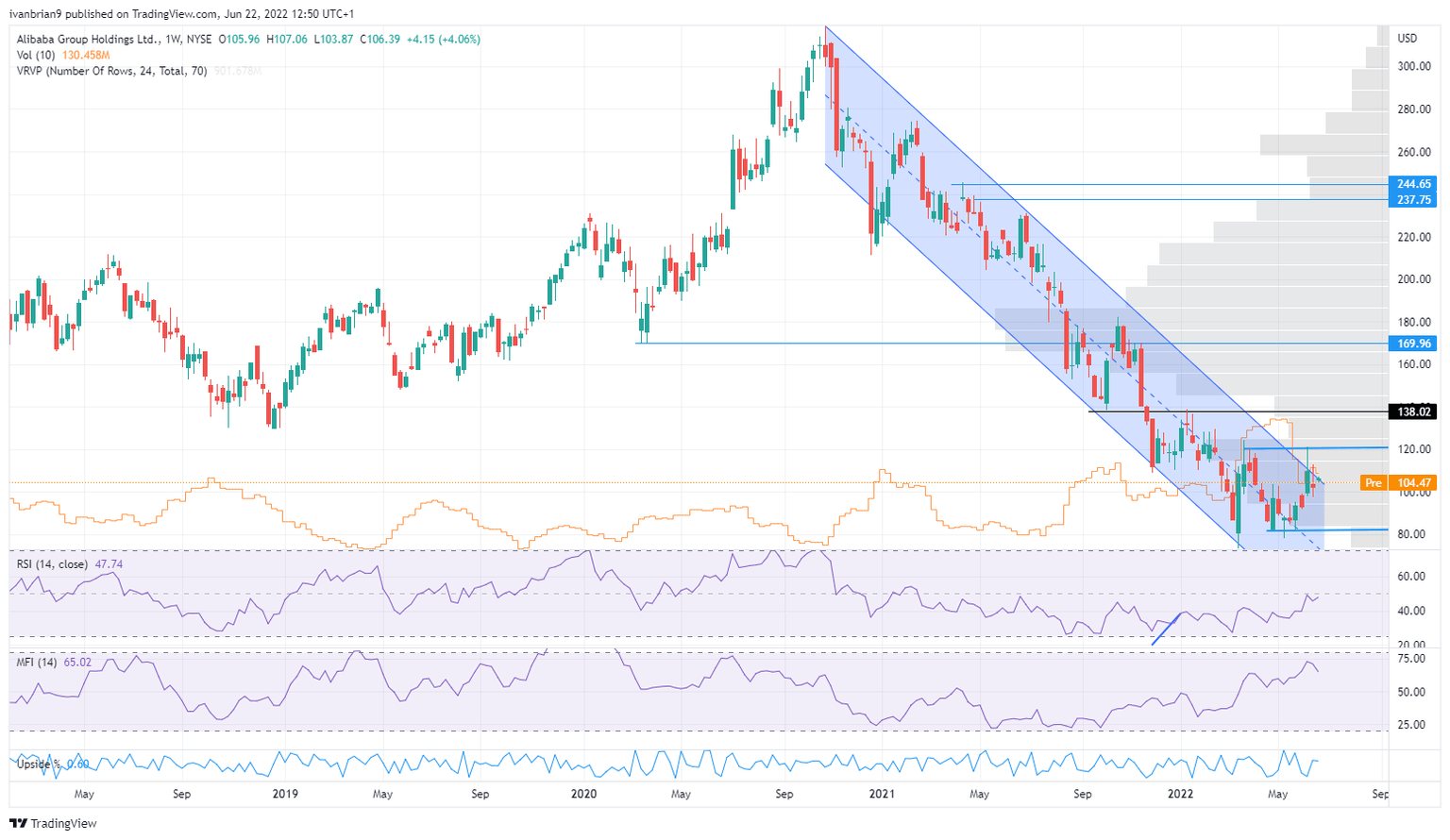

$80-to-$120 remains the current range and a break on either side could finally lead to a trend formation and provide a longer-term BABA stock trading view. Or you could just stick with the current well-established downtrend, see the second chart below.

Alibaba (BABA) chart, daily

Alibaba (BABA) chart, weekly

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.