In a minute, you'll uncover the key benefits of leveraging multiple evidence points in trading.

But first:

To provide you with some context - what better way than to incorporate a real-trading example as follows:

Below you can see the same short entry using three chart variations. The numbers one to five we'll come to shortly.

To lay the foundation:

Imagine a level you can't see on a naked chart - neither highs or lows or support or resistance.

But despite the price moving freely above and below this level for days now - what's unique about this level is most market participants are choosing to transact only above this level. Very few are making trades below it. Hold that thought...

Points of evidence

The numbers one to five represent our multiple evidence points to both qualify and time our short trade.

The first point of evidence (horizontal blue line) is the level we just covered.

But due to a recent shift in sentiment:

The price has stopped moving freely above and below this level.

In fact - this transition between where most participants do and don't do business is now anchoring price to the downside.

For our second point of evidence:

A systematic trading model is currently controlling price movement.

The model ensures price remains trading between the first and second standard deviations of VWAP anchored to the trading hours of a secondary market - the London Stock Exchange.

Evidence point three:

By isolating the activity of European region traders - right now - most of these traders won't transact at prices higher than the number three arrow is pointing to.

Evidence point number four:

Each intraday bar includes the volume traded at all the prices the bar encompasses.

Notice the difference between the last two bars and those that precede them?

Between the two arrows:

Little volume exists. In comparison - the preceding bars display more even volume distributions at all prices traded.

This 'hole' is likely to be filled - requiring the price to move downwards.

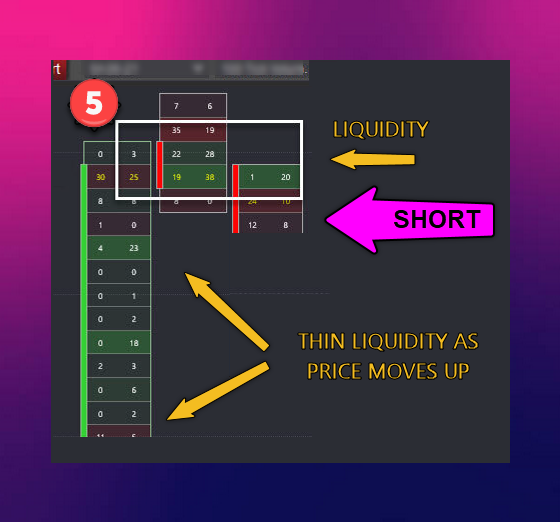

Our fifth evidence point shows price has moved up on on very thin volume (low liquidity).

You can see row after row where the total number of contracts traded is close to zero. It's important to mention these low liquidity moves occur extremely quickly.

A market maker or an HFT created a melt-up in price on thin liquidity.

It's only near the highs do you see many contracts trade - likely FOMO buyers chasing the fast price increase because rapid movement attracts buyers like a moth drawn to a flame.

But see how these buyers are entering near the other evidence points including:

- The first deviation of VWAP anchored to London equities plus

- The transition from accepted to less accepted prices for Europe plus

- The big-picture price ceiling?

What happens next?

While the outcome followed the evidence resulting in a winning trade - the point here is not to highlight a winning trade.

Rather

We can see a group of traders who don't know what they don't know.

They wouldn't have entered a long trade if they had the necessary skills and expertise to trade successfully. Agree?

Their problem isn't a single losing trade - it's much bigger.

You see

If they don't know why their long trade was a poor decision, they're destined to repeat the same losing trade repeatedly. Right?

What do they do?

When you don't know what you don't know - most people look to their psychology as the problem.

But no amount of 'being more disciplined' or working on your trading psychology will fix this problem. Right?

Speaking of psychology

When you're trading decisions come from stacked evidence - there's no feeling anxious about entering a trade. Nor is there any anxiety about the outcome while in the trade.

That's because stacked evidence - when used correctly - provides you with a set of crystal clear set of instructions to follow.

So clear - they remove ambiguity or shades of grey about the decision to make - right now.

But that's not all

When you use multiple points of evidence as a strategy you're applying a unique approach to trading - which is how you unlock uncrowded trades.

Uncrowded trades are what the majority miss because the opportunity is unknown to them.

People who are successful are approaching markets in unique ways to unlock uncrowded trades. This is well documented through the Market Wizard series and is often referenced by Dr Brett Steenbarger based on his work with many of the world's brightest, most talented traders.

Look

Do the same as many other traders and you give up edge because what could have been effective is diluted by so many traders doing the same thing. Make sense?

On the flip side

Uncrowded trades retain an edge - getting in early on moves before the crowd picks up on it - so there’s more for you.

I can’t over-emphasise enough how important uncrowded trades are for success.

And finally

One of the most common trading problems people experience is over-trading. It's a major contributor to eroding account performance.

But as you've seen:

Stacked evidence clearly distinguishes between price movement that's not safe to trade and what's a genuine trading opportunity... putting an end to over-trading.

In summary

When you have the knowledge and expertise to apply evidence multiples, you're protecting yourself against the perils of trading while simultaneously identifying and timing high-probability opportunities.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

USD/JPY gathers strength to near 157.50 as Takaichi’s party wins snap elections

The USD/JPY pair attracts some buyers to around 157.45 during the early Asian session on Monday. The Japanese Yen weakens against the US Dollar after Japan’s ruling Liberal Democratic Party won an outright majority in Sunday’s lower house election, opening the door to more fiscal stimulus by Prime Minister Sanae Takaichi.

Gold: Volatility persists in commodity space

After losing more than 8% to end the previous week, Gold remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000. The US economic calendar will feature Nonfarm Payrolls and Consumer Price Index data for January, which could influence the market pricing of the Federal Reserve’s policy outlook and impact Gold’s performance.

AUD/USD eyes 0.7050 hurdle amid supportive fundamental backdrop

AUD/USD builds on Friday's goodish rebound from sub-0.6900 levels and kicks off the new week on a positive note, with bulls awaiting a sustained move and acceptance above mid-0.7000s before placing fresh bets. The widening RBA-Fed divergence, along with the upbeat market mood, acts as a tailwind for the risk-sensitive Aussie amid some follow-through US Dollar selling for the second straight day.

Week ahead: US NFP and CPI data to shake Fed cut bets, Japan election looms

US NFP and CPI data awaited after Warsh’s nomination as Fed chief. Yen traders lock gaze on Sunday’s snap election. UK and Eurozone Q4 GDP data also on the agenda. China CPI and PPI could reveal more weakness in domestic demand.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.