Early this year we made a video talking about the possible low in commodities like GOLD , SILVER and OIL which means those instrument ended the downside cycle from the 2011 peaks and that’s why they rallied strongly this year 2016 . However, since the start of summer the commodity sector started pulling back in a corrective way which represents an opportunity to join the rally using Elliott waves sequence .

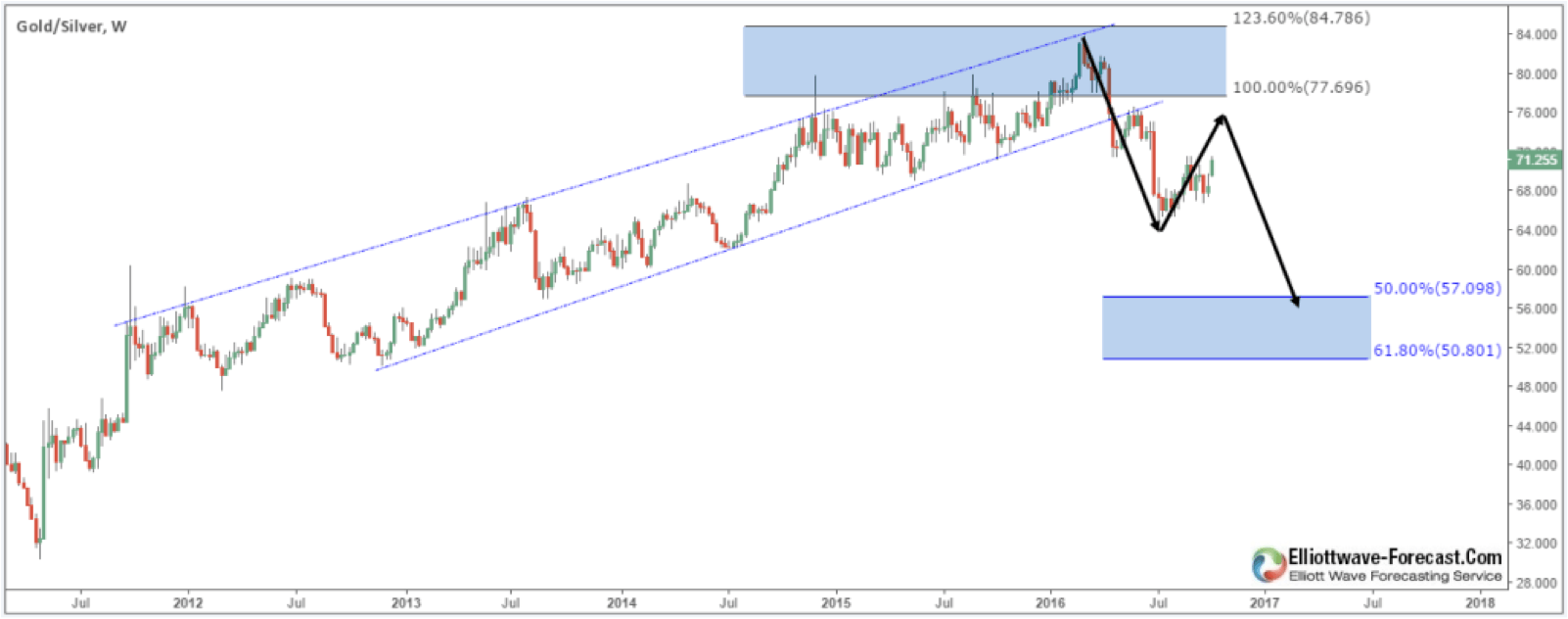

When trading we are always looking for the instrument that will outperform the others , that’s why we need to take a look at the Gold-Silver ratio chart to understand the current market situation before investing in the metals . The weekly chart showing that the cycle from 2011 lows has clearly ended in early February and since then the instrument started the correction lower ideally looking for the 50%-61.8% of the rally in 3 swings which can be currently confirmed as Silver is up +27% since the start of the year while Gold is only up +14% .

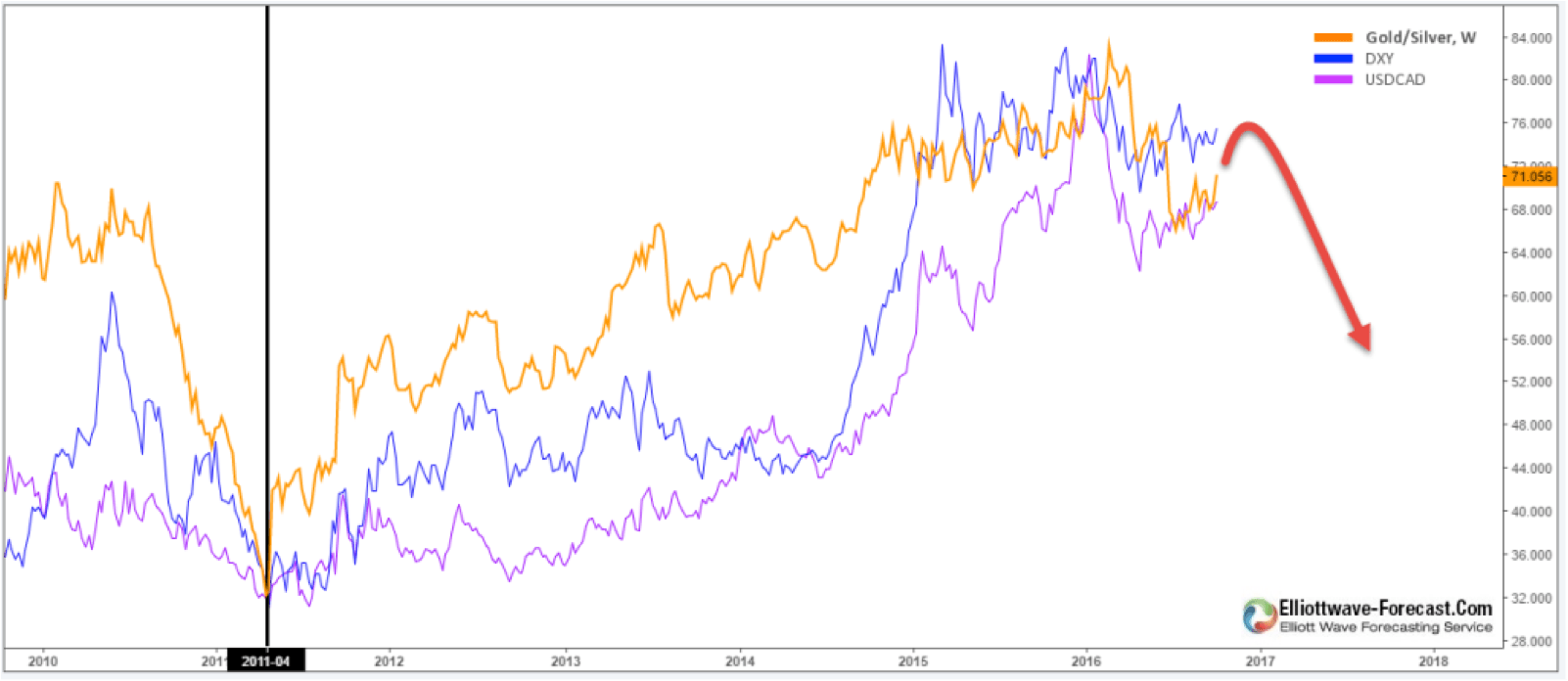

Yesterday the metals took a big hit as silver saw its biggest one-day drop ( -5% ) in nearly 20 Months and gold dropped 3% , the strong movement to the downside caused fear for investors and many are switching sides thinking the downtrend has resumed. We need to understand that the market is correlated and it’s just moving in different dimensions so when there is a shift in a major trend it should affect all the instruments , to clarify the situation I added DXY ( US Dollar ) & USDCAD ( Commodity Dollar ) to Gold/Silver ratio chart .

We can clearly see these 3 instruments are sharing the 2011 lows then rallying for 5 years and finally starting the 2016 correction together so it’s the same cycle that’s has already ended for the Dollar & Commodities and after finishing the current pullback these instruments should resume lower .

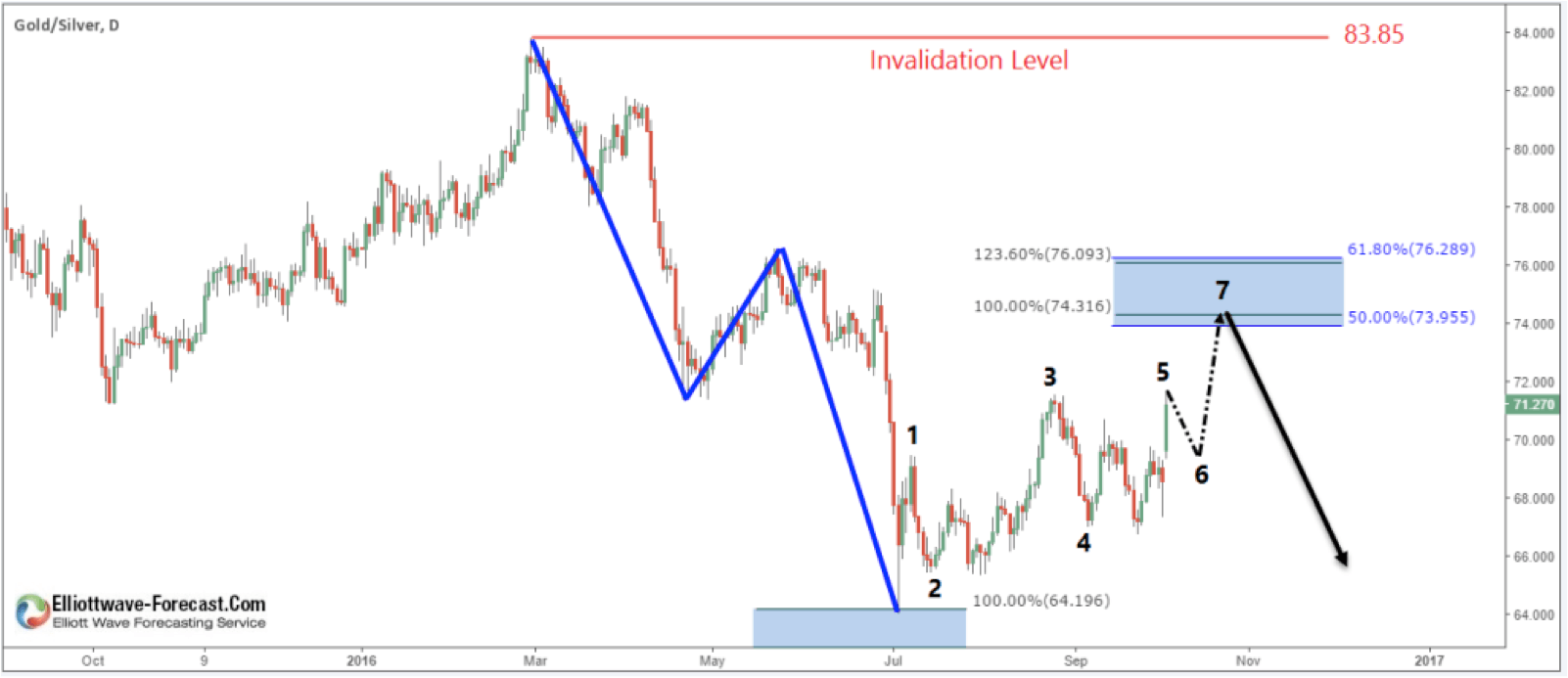

Focusing on the daily chart of gold-silver ratio we can see it ended the first leg lower of the correction doing a double three reaching 100% from the 83.85 peak and then bouncing higher reflecting the drop in both metals . The bounce is showing 5 swings from the lows which is an incomplete bullish sequence in our system so the instrument should continue higher towards equal legs area ( 74.31 – 76.09 ) to end 7th swings against the February peak. Once the bounce is complete the instrument should resume the downside which will be the ideal timing to invest in Silver as it should rally more than Gold .

After understanding the bullish outlook for Silver , you can start looking for investing opportunities either by buying stocks in silver mining companies like Silver Wheaton ( SLW ) or directly trading Silver against the dollar ( XAGUSD ) in 3 , 7 or 11 swings sequence . Both instruments are pulling back in a double three correction and should end 7 swings from the peaks at equal legs area which coincide with the 50%-61.8% of the 2016 rally .

Gold and silver are extremely volatile commodities if you are looking to own or trade these precious metals to hedge against economic instability or to balance your portfolio you need to be on the right side of the market that’s why at EWF we forecast the market using Elliott Wave, market correlation, cycles, sequence of swings and distribution to always stay with the correct trend .

For further information on how to find levels to trade forex, indices, and stocks using Elliott Wave and the 3 , 7 or 11 swings technique, try us free for 14 days. You will get access to Professional Elliott Wave analysis in 4 different time frames, Daily Elliott Wave Setup Videos , Live Trading Room and 2 live Analysis Session done by our Expert Analysts every day, 24 hour chat room support, market overview, weekly technical videos and much more so if you are not a member yet, use this opportunity and sign up to get your free trial . If you enjoyed this article, feel free to read other diversified articles at our Technical Blogs and also check Chart of The Day .

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.