Asia and London are two Forex trading hot spots on the planet. I live in Chicago but also spend time in both Asia and London. When I am with traders in those parts of the world, I notice they tend to try and make so many different Forex strategies work, yet I meet very few who achieve the success they are in search of. They don’t realize the key factor in trading is proper market timing.

Market timing is the ability to identify market turning points and market moves in advance, with a very high degree of accuracy. In other words, this Forex strategy gives you the ability to identify where market prices are going to go, before they go there. The main reason you want to know how to time the market’s turning points in advance is to attain the lowest risk, highest reward and highest probability entry into a position in the market. Think about it, by entering as close to the turn in price as possible, you enjoy three key factors:

1) Low Risk: Entering at or close to the turn in price means you are entering a position in the market very close to your protective stop (risk). This allows for maximum position size while not risking more than you are willing to lose. The further you enter the market away from the turn in price, the more you will have to reduce position size to keep risk low and in line.

2) High Reward (profit zone): Similar to number one above, the closer your entry is to the turn in price the greater your profit zone. The further you enter into the market from the turn in price, the more you are reducing your profit zone (and increasing risk).

3) High Probability: Proper Market Timing means knowing where banks and financial institutions are buying and selling in a market. When you are buying where the major buy orders are in a market, that means you are buying from someone who is selling where the major buy orders are in the market and that is a very novice mistake. When you trade against a novice market mind, the odds of success are stacked in your favor. You can either bet with consistently successful banks, or novice market speculators.

So, how do we time the market’s turning points in advance? It all begins and ends with understanding how to properly quantify real bank and financial institution supply and demand in any and all markets. Once you can do that, you are able to identify where supply and demand is most out of balance and this is where price turns (where banks buy and sell). Once price changes direction, where will it move to? Price moves to and from the price levels with significant buy (demand) and sell (supply) orders in a market. So, again, once you know how to quantify and identify real supply and demand in a market, you can time the markets turning points in advance, with a very high degree of accuracy.

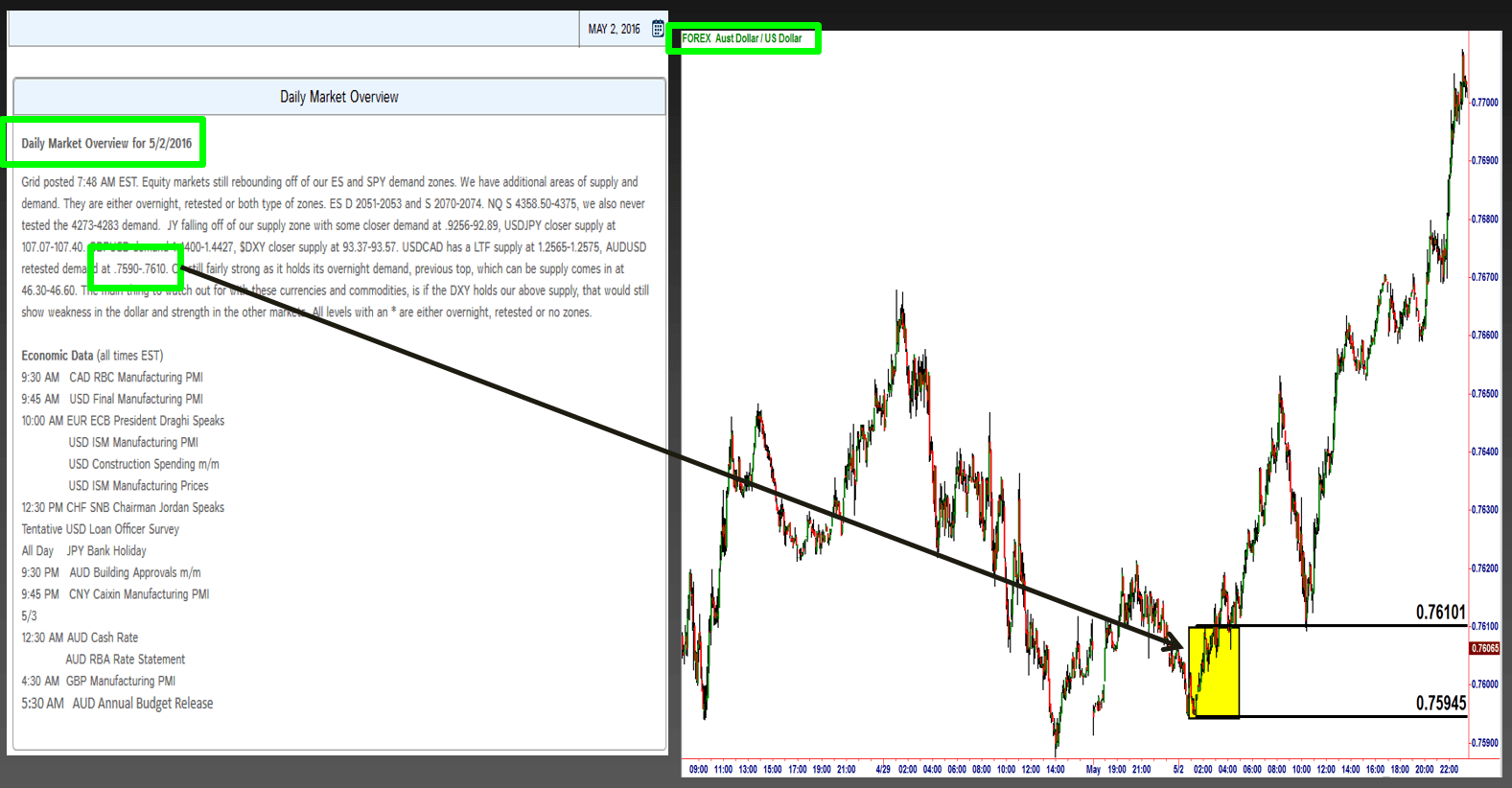

While this article focuses on using this as a Forex strategy, everything I am suggesting here applies to any and all markets. To better understand how to do this, let’s take a look at a recent trading opportunity that was identified in our live online trading program, the Extended Learning Track (XLT) utilizing one of our daily services, the Daily Market Overview. The XLT is a two – hour live market income and wealth trading session with our students three to four times a week. During the session, we identified an area of Demand in the AUDUSD (highlighted in yellow). The two lines create a “buy zone”, allowing us to apply our simple rules for entering the entire position. This was an area of Bank Demand for a few reasons.

First, notice the strong initial rally in price from the demand level. Also, notice that price rallies a significant distance before beginning to decline back to the Demand level. These two factors tell us that Demand greatly exceeds Supply at this level, banks are aggressive buyers. The fact that price rallies a significant distance from that level before returning back to the level clearly shows us what our initial profit zone is. These are two of a few “Odds Enhancers” we cover in the live trading sessions. They help us quantify bank dealer desk Supply and Demand in a market which is the key to knowing where the significant buy and sell orders are. The plan with this trade was to buy if and when price declined back to that area of Demand.

This trade was high probability, but how do we know that? Well, being very confident that there is significant Demand at that level, this tells us that we will be buying from a seller who is selling at a price level where Demand exceeds Supply. Selling after a decline in price and at a price level where Demand exceeds Supply is the most novice move a trader can take. Furthermore, these are the two most novice decisions a buyer and seller of anything can make. These are “retail” sellers selling where “banks and institutions” are buying. The retail sellers are selling with the odds stacked against them which means they are stacked in the buyer’s favor, at the demand level.

OTA: May 2016 Daily Market Overview – AUDUSD

As you can see, what happens next is price declines down to our pre-determined Demand level where Banks and XLT members are able to buy from sellers who are selling at “wholesale” (Demand) prices. They are selling after that big decline in price and into that price level where Demand exceeds Supply. So, by changing our mindset to thinking like a bank, which leads to acting like a bank, we can then buy where banks are buying which is opposite of what most traders and investors do; which is exactly what we did when price returned to our Demand level.

Next week we will look at the outcome of this low risk, high reward, high probability trading opportunity.

Until then, have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

AUD/USD remains capped by 0.7100, focus on inflation data

AUD/USD shrugs off Monday’s pullback and regains composure on Tuesday, coming close to the 0.7070 region despite the Greenback trading with modest gains ahead of the opening bell in Asia. In the meantime, the Aussie Dollar should remain under scrutiny in light of the publication of critical inflation data in Oz early on Wednesday.

EUR/USD risks a deeper drop below 1.1750

EUR/USD keeps its vacillating mood in place as the the NA session drwas to a close on Tuesday, hovering below the 1.1800 hurdle amid acceptable gains in the US Dollar. In the meantime, market participants and the FX galaxy are expected to closely follow President Trump’s SOTU speech around 2AM GMT.

Gold appears offered around $5,150

Gold is giving back a good portion of the recent multi-day rally, receding to the $5,150 zone per troy ounce amid the decent bounce in the US Dollar and mixed US Treasuty yields. In the meantime, markets’ attention remain on upcoming comments from Fed speakers.

Ripple’s DeFi shift in focus: Navigating XRPL EVM sidechain growth, XRPFi migration and liquidity

The Citrini report: How a debatable AI narrative can shake Wall Street Premium

That AI-related headline alone was enough to rattle investors.US stocks slid sharply on Monday after a widely circulated Citrini Research memo outlined a hypothetical “2028 Global Intelligence Crisis”, warning that rapid AI adoption could push US unemployment into double digits as early as by mid-2028.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.