What Is the VIX?

The Chicago Board Options Exchange’s Volatility Index (known as the VIX) is an indicator that tells option traders whether options are currently cheap or expensive, relative to their normal values. This is an indication of whether it is a better time to be a buyer of options or a seller.

The VIX is calculated in real time based on the prices at which options on one particular underlying instrument, namely the Standard & Poor’s 500 Index, are trading.

A mathematical formula, derived from the Black Scholes option pricing model, translates the price at which an option is trading (which reflects the price at which people are willing to buy the option), into those buyers’ expected rate of change of the underlying asset. This expected rate of change is called the underlying asset’s implied volatility or IV. When the underlying asset we’re measuring is the S&P 500 index, then its IV has a special name – the VIX.

What Does Implied Volatility Tell Traders?

Implied volatility is expressed as an annual percentage of expected price change. A VIX of 20 means that S&P option buyers, on average, believe that the S&P index will move in the future at the annual rate of 20% per year. A VIX of 10 would mean that, collectively, they believe that it will move at the rate of only 10% per year. In the last 25 years, the VIX has ranged from a low of 9.5% to a high of over 90%; and spent most of that time in the range of 12% to 25%.

When option buyers believe that the S&P 500 is going to make a large move in the near future, they will be willing to pay high prices for its options. In that case we would see a high VIX reading, meaning S&P options are expensive. If they don’t think it will move much, then the VIX will be lower, meaning that options are cheap.

By the way, the direction people expect the index to move doesn’t matter – only the expected speed of that movement. If the index is expected to move fast, both puts and calls will be expensive (high VIX). When it is expected to move slowly, then both puts and calls will be cheap. When traders’ opinions change, then the VIX changes, reflecting the fact that options have become relatively cheaper or more expensive.

Option Trading and the VIX

The VIX itself is volatile and can easily double or be cut in half over the course of a month. Its movement reflects the changes in option buyers’ expectations, and that change can sometimes overcome the change in an option’s price that results from the actual movement in the index. In other words, in certain cases, it can happen that the index goes up but the price of a call goes down. An option buyer could be right about the direction of the underlying asset, for example, the S&P goes up; and have made a bullish option trade, buying a call; and still lose money if they are wrong about implied volatility (IV) causing the call price to go down.

So, whenever an option trader makes an option trade, he is simultaneously making two trades – one based on underlying price direction and one based on implied volatility.

A bullish trader would do a bullish trade – buying calls or selling puts.

A bearish trader would do a bearish trade – selling calls or buying puts.

Overlaid on this is the trader’s opinion on whether IV will go up or down. This is separate and apart from his opinion on the price of the underlying.

If he believes IV is most likely to go up, then he should be a buyer of options – calls if bullish or puts if bearish. If IV does go up, it will push up on the price of both calls and puts. This effect will be in addition to the effect of the actual price movement of the underlying.

If the trader believes that IV will go down, then he should be a short seller of options – calls if bearish on the underlying or puts if bullish. If he is correct and IV drops, that will push downward on the price of the puts or calls that he has sold short, making money faster than the effect of underlying price movement alone.

The S&P 500 index is a major barometer of the stock market. This is true both of its level (when the S&P is at a high, then many of the 500 stocks that make it up must be at highs too), and of its IV. When the VIX (the S&P’s IV) is high, then the IV of many of its constituent stocks is also high and options are expensive in general.

So, where are we now?

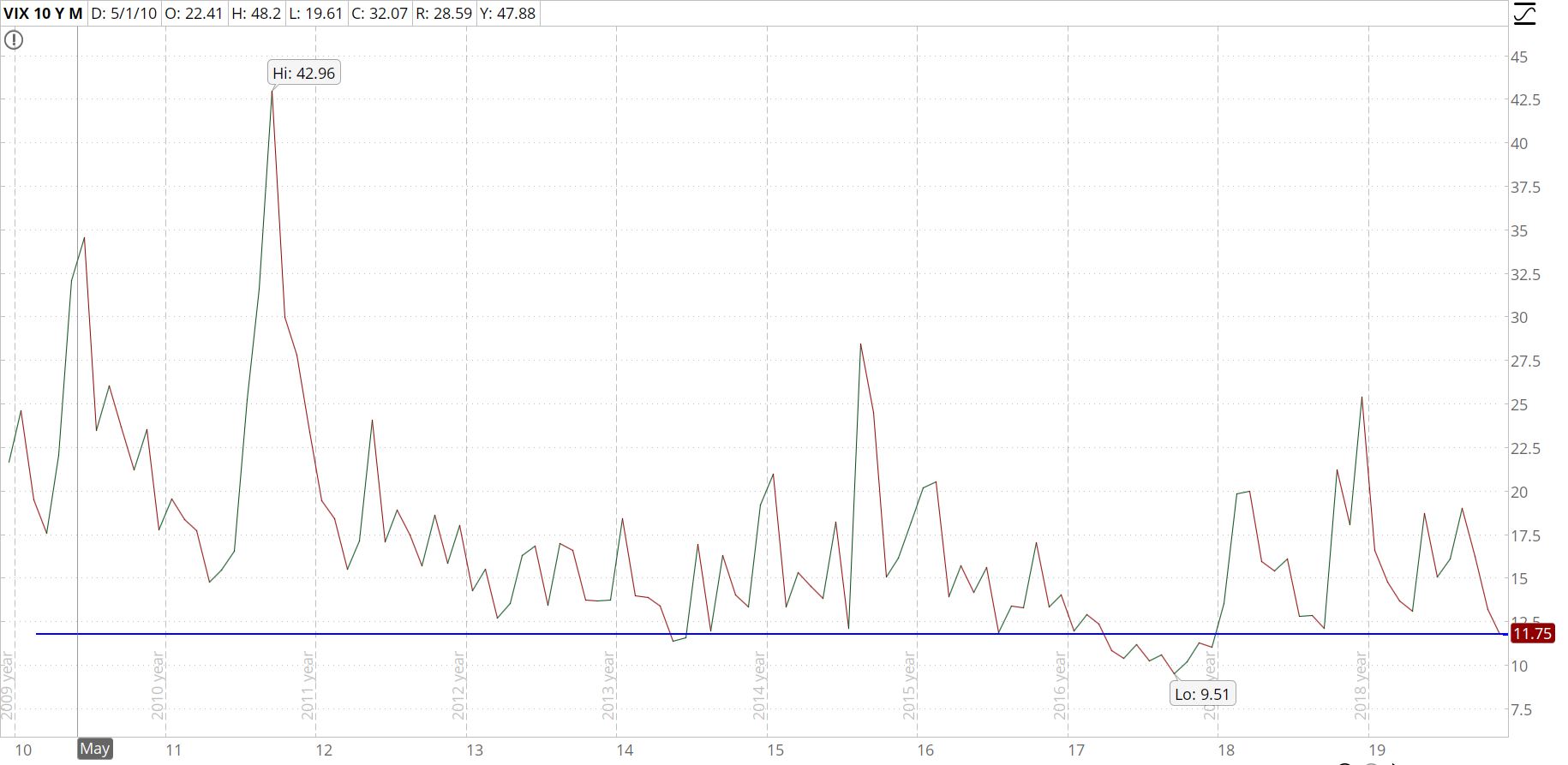

On November 27, the VIX stood at 11.75, as shown here:

This was lower than the VIX had been for almost all of the last ten years. It meant that options were relatively very cheap, and much more likely to get more expensive (i.e.to go back to a more normal level) than to get even cheaper. In short, it was a good time to buy options.

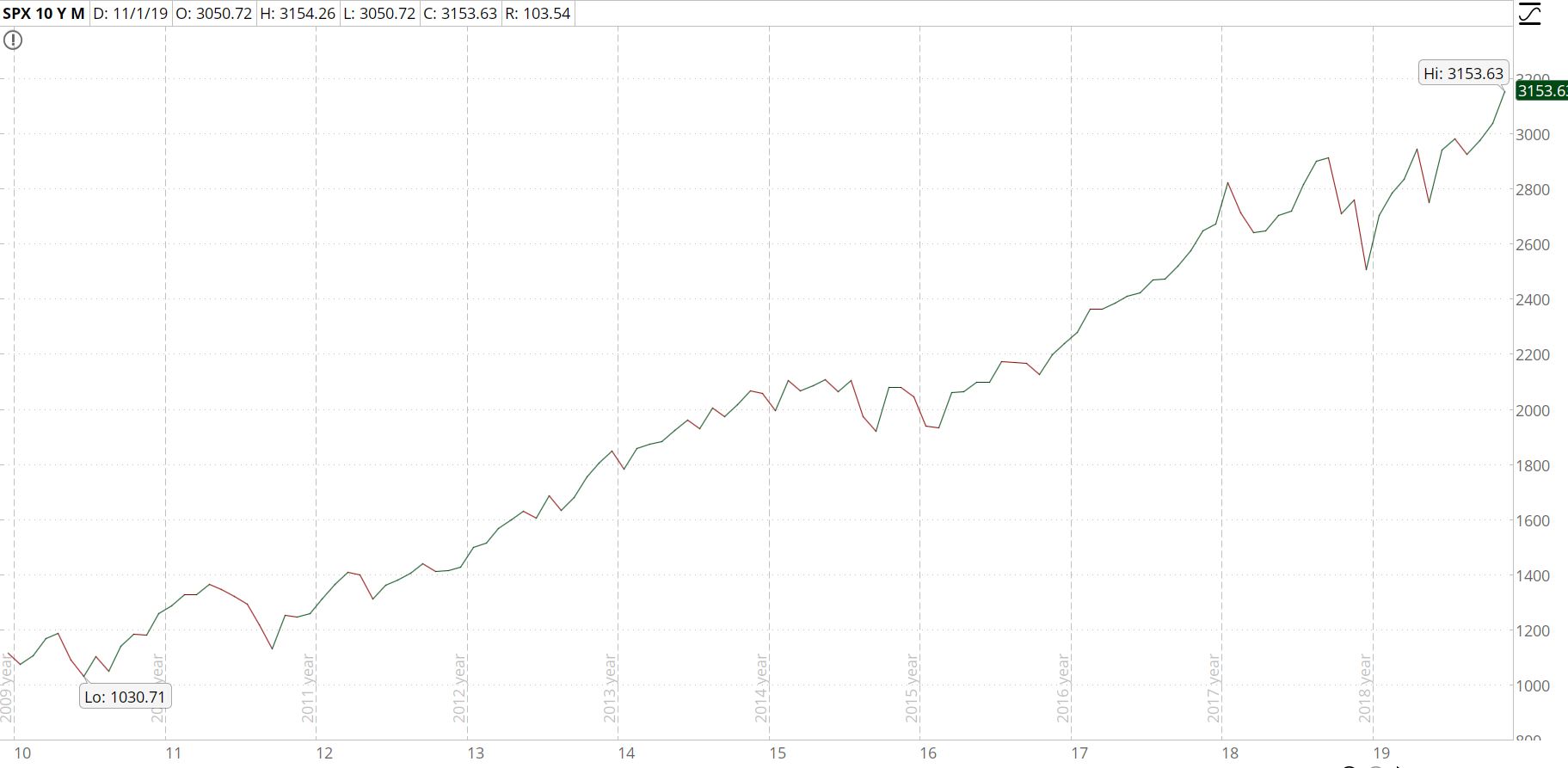

Meanwhile, the S&P 500 index itself stood at an all-time high of 3,153.

For anyone with a stock portfolio, insurance in the form of puts on the S&P was very cheap. Anyone who wanted to lock in the majority of their profits could do so for a very low cost.

The low VIX also meant that, for all option traders it was a better time to be a buyer of options than a seller – in option lingo, a time to concentrate on debit trades instead of credit trades.

The implied volatility of any underlying asset whose options we want to trade is a critical factor when deciding what option strategy to use. And the VIX indicates which way the volatility winds are blowing.

For more on option trading strategies and how they can benefit traders in both short-term market moves and in protecting a long-term portfolio, contact your local center about our Options program.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD weakens to near 1.1900 as traders eye US data

EUR/USD eases to near 1.1900 in Tuesday's European trading hours, snapping the two-day winning streak. Markets turn cautious, lifting the haven demand for the US Dollar ahead of the release of key US economic data, including Retail Sales and ADP Employment Change 4-week average.

GBP/USD stays in the red below 1.3700 on renewed USD demand

GBP/USD trades on a weaker note below 1.3700 in the European session on Tuesday. The pair faces challenges due to renewed US Dollar demand, UK political risks and rising expectations of a March Bank of England rate cut. The immediate focus is now on the US Retail Sales data.

Gold sticks to modest losses above $5,000 ahead of US data

Gold sticks to modest intraday losses through the first half of the European session, though it holds comfortably above the $5,000 psychological mark and the daily swing low. The outcome of Japan's snap election on Sunday removes political uncertainty, which along with signs of easing tensions in the Middle East, remains supportive of the upbeat market mood. This turns out to be a key factor exerting downward pressure on the safe-haven precious metal.

Bitcoin Cash trades lower, risks dead-cat bounce amid bearish signals

Bitcoin Cash trades in the red below $522 at the time of writing on Tuesday, after multiple rejections at key resistance. BCH’s derivatives and on-chain indicators point to growing bearish sentiment and raise the risk of a dead-cat bounce toward lower support levels.

Follow the money, what USD/JPY in Tokyo is really telling you

Over the past two Tokyo sessions, this has not been a rate story. Not even close. Interest rate differentials have been spectators, not drivers. What has moved USD/JPY in local hours has been flow and flow alone.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.