Markus is a self-made multi-millionaire who was born in Germany. He came to the US in 2002 with $30,000 in his pocket and a dream to become a successful trader.

Over the past 20 years, he traded and invested his way to success in the stock and real estate market, making millions of dollars in the process.

Markus has written three best-selling books about trading and investing that have been translated into multiple languages. His youtube channel with over 4 million views is dedicated to his favorite topic — which is trading stocks and options.

He lives in Austin, TX where he enjoys spending time on the lake watching his kids racing their sailboats.

denisismagilov via depositphotos.com

In this article, we’ll talk about how much money you need to trade for a living. I’ll share with you my three-step approach and give you an example from my trading account.

“How much money do you need to trade for a living?” is one of the most frequently asked questions I get.

“Can I start with $5,000 dollars, do I need $25,000 dollars, or maybe even more? You see, this is a super important question. Now, here’s the deal. There’s no standard answer because making a living is different for everybody.

Some traders can live on $5,000 a month. For others, trading for a living means making at least $15,000 a month.

Let’s talk about step number one.

How Much Do You Want To Make Each Month?

Step number one is figuring out how much money you want to make per month. This is the first thing determining what your income goal should be, and it really depends on a few different factors.

For example, what are your monthly expenses? How many dependents rely on your income? That’s different for every trader. Additionally, what income do you need to buy cool stuff like cars, boats, whatever it might be?

These are just a few examples of what should be taken into account when you figure out how much income you need to generate every month.

Now, as boring as this sounds, it definitely helps to make a budget. You don’t have to account for everything, but you should list your major expenses.

So in your budget, there should be, for example, expenses for housing. In housing, you include your mortgage, your insurance, your taxes, and expenses for your house maintenance.

The next thing to account for is transportation. Unless you’re using a helicopter, for most people this is a car payment or a lease. This also includes car insurance.

The next major category is food. Food includes groceries and also restaurants.

Now, the next major category is utilities such as gas, water, power, Internet, TV, phone insurance. Some of you also buy your own health and life insurance. You also need to consider any medical expenses like co-pays.

The next one is a fun one, travel and entertainment. Where do you want to travel? How often do you want to travel? What else do you do for entertainment? You have to factor these activities in too.

This next one is not so fun. This is of course the dreaded taxes we have to pay.

Now you need to add all of this up and you will get to a number, which is the amount you need to make each much to cover your expenses. For me personally, this number is $15,000. So you know what my number is, and I’ll show you how I trade for a living so that I can make this $15,000.

What Is The ROI of Your Trading Strategy?

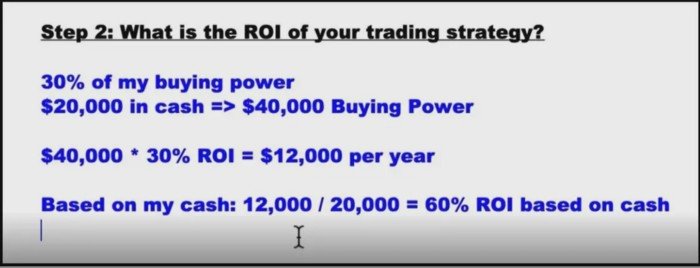

Now that we have figured out what your number is, it’s on to step number two: factoring in the return on investment (ROI) of your trading strategy.

I like to trade the PowerX Strategy, and I also like to trade The Wheel Strategy. These are my two favorite strategies, and for both strategies, I want to see at least 30 percent ROI based on my buying power.

Photo Taken By Author via youtube.com/user/rockwelltrading2008

Let me explain what this means. As an example, let’s figure out 30 percent of my buying power. I’m trading a margin account and this means that I can borrow up to 100 percent of my cash from my broker.

Let’s say I were to put $20,000 in cash in this account. $20,000 in cash into a margin account would give me $40,000 in buying power, so back to my ROI, the return on investment.

I want to see at least 30 percent based on my buying power. So in this example here, if my buying power is $40,000 and we want to find out what 30% would be, we take 40,000 and multiply it by 0.30. This comes to 12,000, so this means that I want to make at least $12,000 per year with $40,000 in buying power in a margin account.

To find the ROI based on the cash I put in, which is $20,000, we take the $12,000 (profit we would make with margin) and divide by $20,000 (cash I put in), this comes to 0.60, or 60 percent ROI based on cash.

I know this sounds like a lot of numbers, but here’s the good news. This is the most complicated step.

Now, I know that for some of you 30% sounds low, doesn’t it? I know that most traders would like to see 50% or more ROI, maybe even 100–200%. But you see for me, it’s more important to be able to generate SRC profits which stand for systematic, repeatable, and consistent.

I’ll take 30% in SRC profits any day over 100% in irrational profits trading stocks like GameStop. For me, 30% is good enough to support my lifestyle, but hey, every trader is different, just make sure that you use YOUR number.

By the way, if you don’t know your ROI yet, trade your strategy on a simulator first. After 40 trades on a simulator, you will get close to your strategy’s ROI.

Determining Your Account Size

Let’s move on to step number three because now things get exciting. So step number three is where you use a formula to determine your account size, and I want to give you the formula right now so that you can plug it in.

Everything that I do is very, very systematic. Now you know how much income you must make every month, this was step number one. For step number two, you learned how to figure out how much ROI you can expect from your trading strategy.

Here is a very simple formula that you can use to calculate how much you should have in your trading account so you can generate the amount of money every month that you determine.

Photo Taken By Author via youtube.com/user/rockwelltrading2008

In order to determine the buying power you need in your trading account, all you need to do is take the desired annual income that you determined in step number one and divide it by the expected ROI that you determined in step number two.

Let’s say that you want to make $10,000 per month. If you want to make $10,000 per month, that would be $120,000 per year. For some, this might be very realistic. So this is step one where you used a budget to figured this out.

For step number two, say you’re using either the PowerX Strategy where you can easily make 30% a year, or you’re using The Wheel Strategy which can also help you to make 30% per year. You have determined that you can make 30% per year based on your buying power.

Here’s how you would figure out how much buying power you need in your trading account. Your buying power should equal $120,000 desired annual income divided by 0.3 (30% ROI). This means that you need $400,000 in buying power in your account.

Now, $400,000 in buying power would mean if you’re using a margin account, you only need $200,000 in cash. This might be more than you expected, and that’s okay. You can actually trade for growth in the beginning.

I just want to show you what your goal needs to be if you have a smaller account right now so you know at what level you can actually start trading for income, and at what level you can quit your job.

Have Realistic Expectations

If right now you’re looking at this example here and you currently have $10,000 or $20,000 in your account, that is really good, but don’t quit your job just yet.

I like to keep it real, right? With me, it’s real money, real trades, and also realistic expectations.

Well, that is possible if you have a decent-sized account, but let me cover another example so you can see how simple the formula is, and how it works in action.

The Numbers In Action

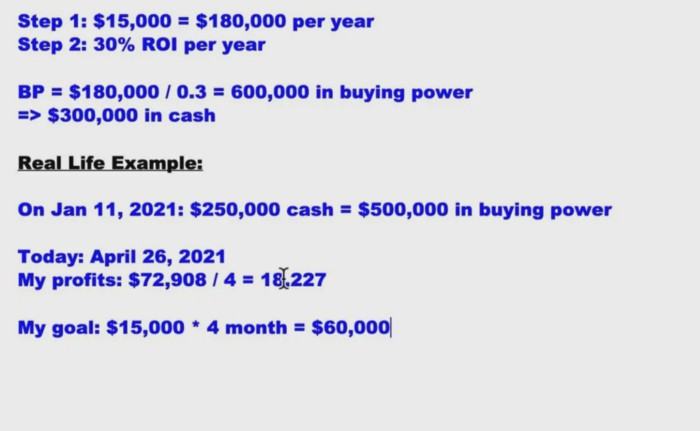

So let’s say in step number one you determine, like I did, that you want to earn $15,000 per month, $180,000 per year. Now, again, we are assuming that we’re using The Wheel Strategy and the PowerX Strategy, which gives me 30% ROI per year.

Photo Taken By Author via youtube.com/user/rockwelltrading2008

Here’s how I determine how much buying power I need to have in my account in order to make $15,000 a month consistently. Again, we take our desired annual income, which is $180,000, divided by 0.3.

So that would be $600,000 in buying power. Now, $600,000 in buying power means that you need to have, if you’re using a margin account, $300,000.

This is how this worked out for me. At the beginning of the year, on January 11th, 2021, I put $250,000 in cash into a margin account, and this gave me $500,000 in buying power.

So $500,000 in buying power, and at the time of this writing on April 26, 2021, my profit thus far this year is $72,908 in REALIZED profits.

This means that on average, over the past four months, I made $18,277 per month. Now, my goal was to make, as I told you earlier, $15,000 per month, which means my goal would have been to make $60,000 in a 4-month span.

Since I’ve earned $72,908 over the past four months, this means I’m overachieving this goal. This is the important thing because the question is “how much money do I need to trade for a living?”

Summary

As you can see it’s quite easy to calculate the money that you need in your trading account to trade for a living. However, it is completely unrealistic to open an account with $5,000 and expect to trade for a living, unless making a living means making $125 per month.

And I know that there are many people who tell you that you can start with $5,000, and then they do some magic math and tell you they can show you how to turn that $5,000 into a million dollars within a year. This just isn’t realistic.

It’s probably not what you want to hear, but I know that this is what you need to hear. The good news is, if your account is not large enough yet to trade for a living, that’s absolutely fine. You can trade for growth and use money management to grow your account.

The main difference when you’re trading for income vs trading for a living as I do is, every month I wire profits out of my trading account into my personal checking account. While you’re trading for growth, you keep all of the profits that you make and keep them in your trading account.

If you’re still at a smaller account, that is absolutely fine, but now you know what level you need to get. If you’re here right now and you need to get there, then during this time you might need other sources of income.

I wanted to do this article to show you a really simple formula so that you can determine how much money you need in your account to trade for a living.

Remember, it is possible to make a living trading. It is possible, it is doable. Just have realistic expectations and a plan.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

AUD/USD keeps range near 0.6700 despite strong Chinese PMIs

AUD/USD is keeping its range near the 0.6700 handle for the third day in a row on Wednesday. The Australian Dollar remains unimpressed by the unexpected expansion in the Chinese business PMIs for December. The year-end trading lull dominates, leaving the pair gyrating in a tight band.

USD/JPY flatlines below 156.50 amid the year-end grind

USD/JPY remains caught in near-term congestion below 156.50 on the final trading day of 2025. The pair traders are battling headwinds on multiple fronts, with the Fed- BoJ monetary policy divergence to play out in 2026 amid looming Japanese forex intervention risks.

Gold attempts another run toward $4,400 on final day of 2025

Gold price makes another attempt toward $4,400 in Asian trading on Tuesday, keeping the recovery mode intact following Monday's over 4% correction. The bright metal seems to cheer upbeat Chinese NBS and RatingDog Manufacturing and Services PMI data for December.

Top Crypto Gainers: Canton, Four, Plasma rally secures double-digit gains

Canton, Four, and Plasma are the top-performing crypto assets over the last 24 hours with double-digit gains. The extended recovery in Canton is gaining traction while Four and Plasma target a decisive close above the 200-period Exponential Moving Average on the 4-hour chart.

Bitcoin Price Annual Forecast: BTC holds long-term bullish structure heading into 2026

Bitcoin (BTC) is wrapping up 2025 as one of its most eventful years, defined by unprecedented institutional participation, major regulatory developments, and extreme price volatility.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.