There are several decisions that must be made prior to entering a trade or investment. One must first decide what to invest in. Then the choice of when to invest comes and finally where to exactly enter. Most people decide what to invest in due to a recommendation from a broker, a friend, or even from television or print media. Any casual observer of the stock market can easily see that the stock market goes through a cycle of bullish and bearish movements. What many do not know is that there is also a cycle with sectors that also go through these same movements.

What you need to realize about the markets is that roughly 50-60% of a stock’s move is directly related to the movement of the broad market. There are exceptions, but as the saying goes, a high tide will raise all boats in the marina. This means that in a bullish market, most stocks will rise, and they will similarly fall in a bearish one.

There will be different participation in these bullish or bearish markets depending on the sector the stocks belong to. The sector movement and trend can influence up to 30-40% of a stock’s movement. That only leaves about 10-20% of the movement attributed to the company’s fortunes itself.

When we are selecting trades or even long-term investments, we want to be diversified but also invest with focus and purpose. We should start with a top down approach where we analyze the markets first and determine the most probable trend direction.

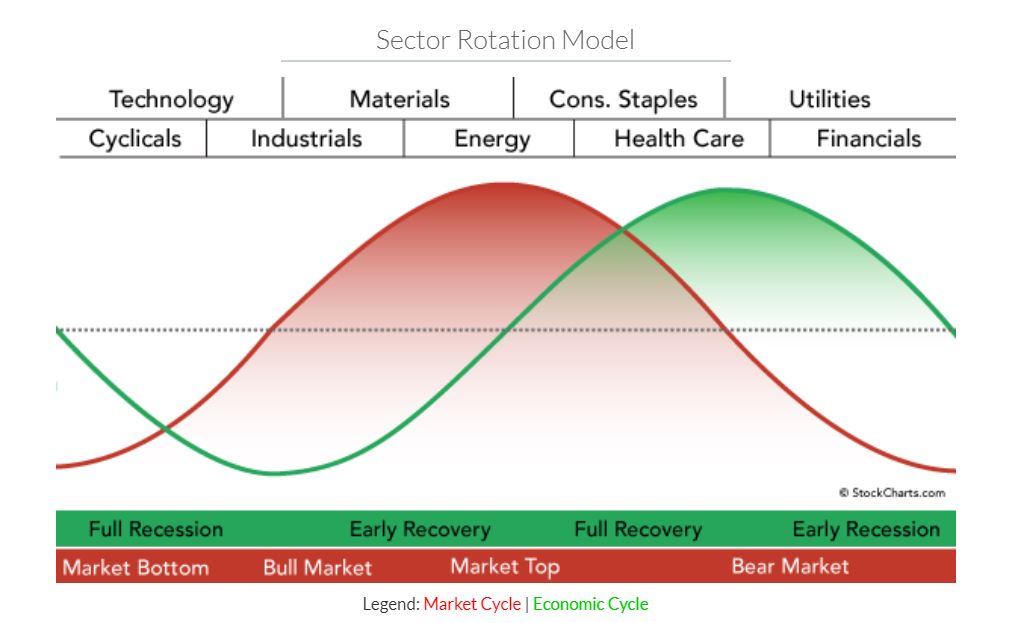

Once that is done, then the focus changes to choose the sector or sectors that are likely to move the best in that market environment. As mentioned earlier, the stock market follows a sector rotation model that can be used both to identify opportunities in the markets as well as letting us know where we are in the economic cycle. As seen below in the figure from John Murphy’s www.stockcharts.com website, sectors in the stock market outperform the broad market in different economic cycles.

You may notice that the stock market cycle seems to lead the economic cycle. This is because people and institutions speculate in the market on what the companies and the economy will do in the future, therefore the market naturally leads the economic cycle.

When the markets have been beaten down in a bear market, institutions will look to buy cheap stock in sectors that are set to perform well when the economy turns upward. These sectors include consumer cyclicals, technology and industrials.

Cyclical stocks represent companies whose products are purchased when the public has extra money to spend. When the economy is picking up, there will be new jobs created as well as raises in pay. This will cause increased spending in these and even luxury items. Technology will also expand and become higher in demand. People can afford to buy these products when fully employed. The industrial stocks will rise with an increase in production of all these goods. This is where we seem to be currently.

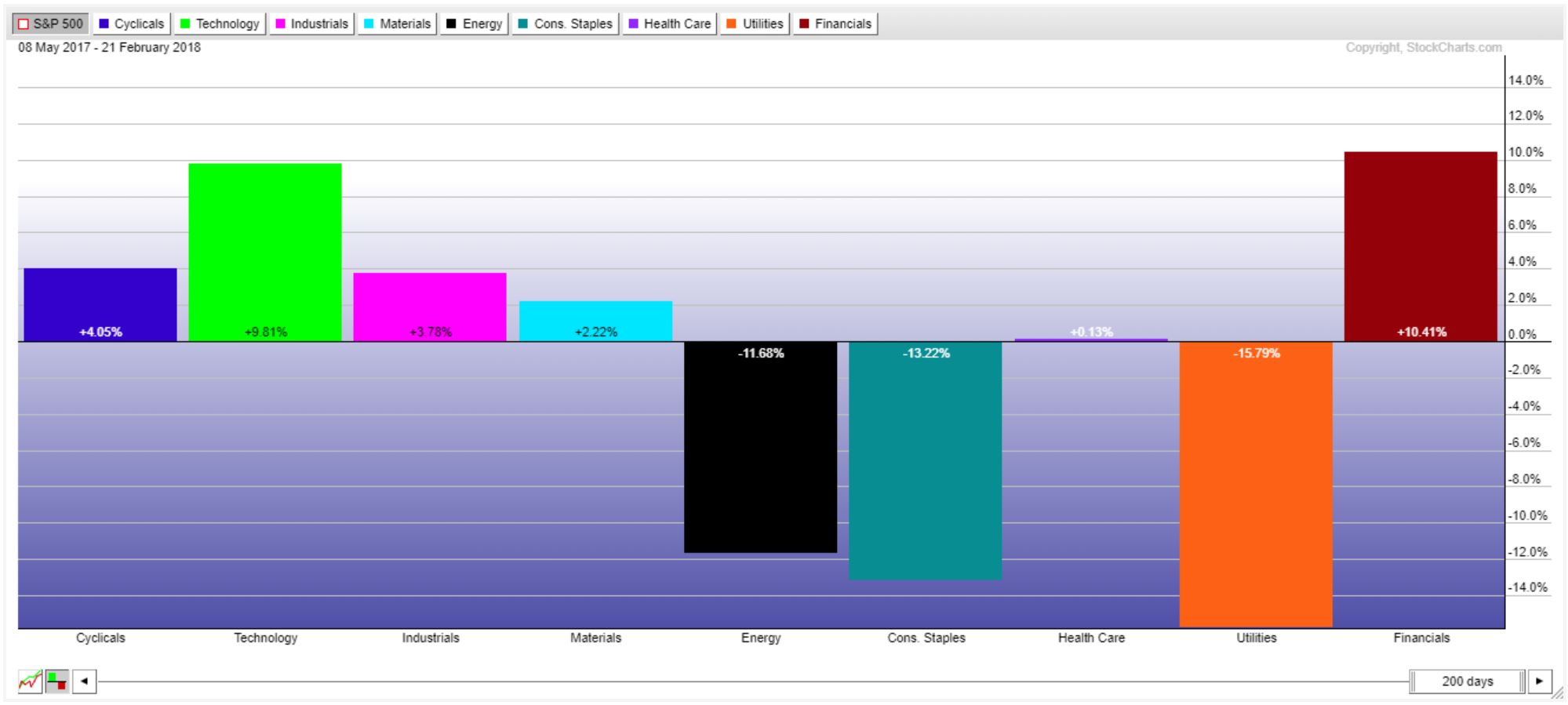

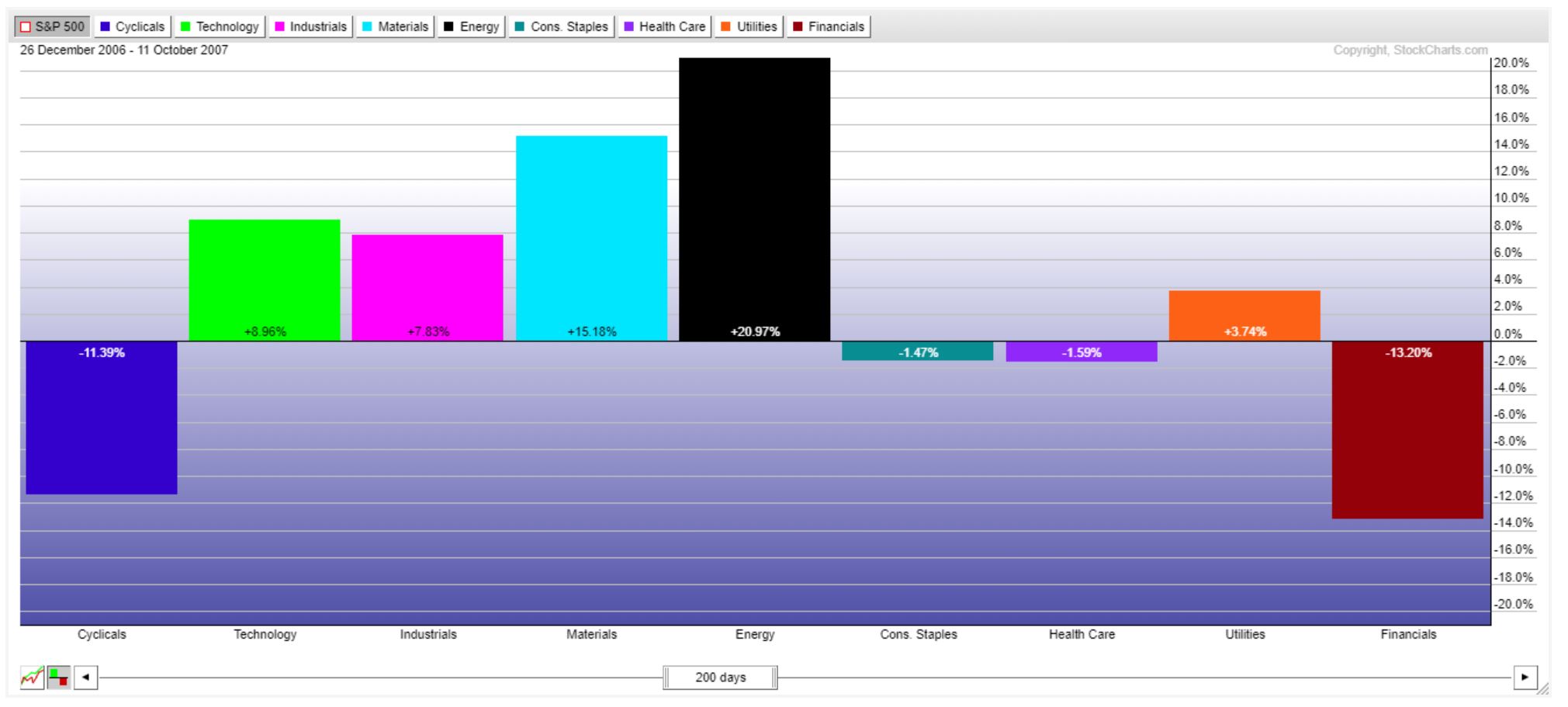

As the markets are in a full bullish swing, there will be a high demand for materials to produce goods. This leads to an increase in prices for those materials and in inflation. The material producers benefit initially from this increase. Another sign of inflation is the high cost of energy. When energy producers are leading the markets, the Federal Reserve may be forced to step in and raise interest rates to curb inflation. This is what the markets looked like when they peaked in 2007.

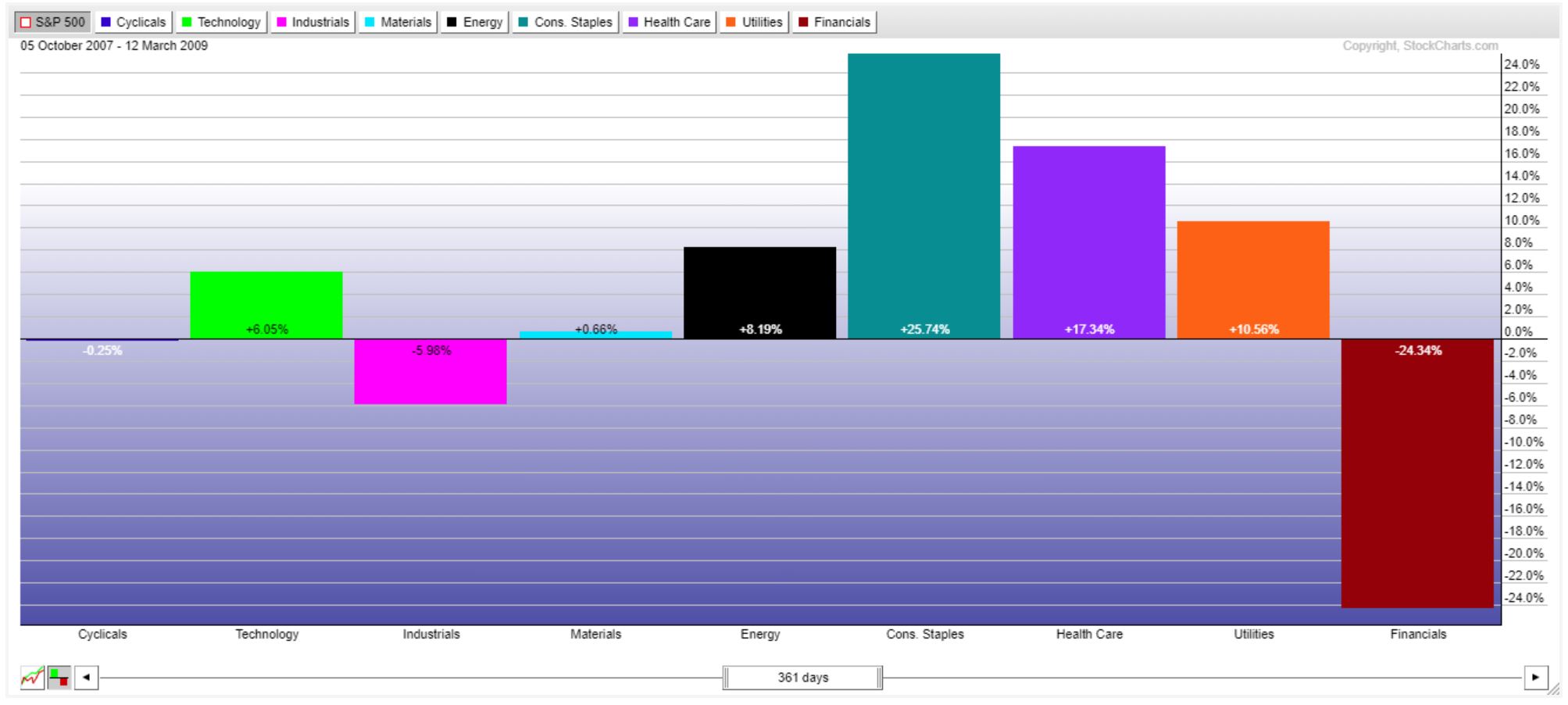

Once the stock market begins to stall, then money will flow out of the cyclical stocks in a flight to safety. This safe investment can be found in consumer staples. These are companies that produce everyday items we consistently use. Toiletries, alcohol, tobacco and even auto part stores will be valued as people will try to keep older cars functioning rather than buy new ones if their job is in jeopardy.

Additionally, healthcare is something that people do not want to do without. This industry will general outperform when the markets are starting to decline. As the market continues to drop, the economy will also start to show weakness. The Federal Reserve will eventually step in and cut interest rates.

The lower interest rate environment favors the utility sector and the financial sector for two related reasons. Utility companies operate with high debt levels. When the interest rates drop, these utility companies can recall their outstanding bonds and issue new ones at lower rates to improve their operations. Low interest rates also attract borrowing from companies which allows them to expand operations. This benefits the financial sector who make money from lending services.

The cycle will repeat itself over and over again as the consumer cyclicals will again be on everyone’s radar before the economy climbs.

We can see this phenomenon in the below chart based on the bearish market in 2008. Realize, that while the chart looks like you could have made money in the bearish market by buying the bearish sectors, this is not entirely true. The charts are showing the sectors versus the S&P 500 index. If we remove the index comparison, you can see that you would have lost money in nearly any position during the crash.

Knowing what to trade is valuable. We can utilize the sector rotation model when selecting the sector we wish to invest in. To learn more about how to select the correct investment or trade, come visit us at your local Online Trading Academy center today.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.