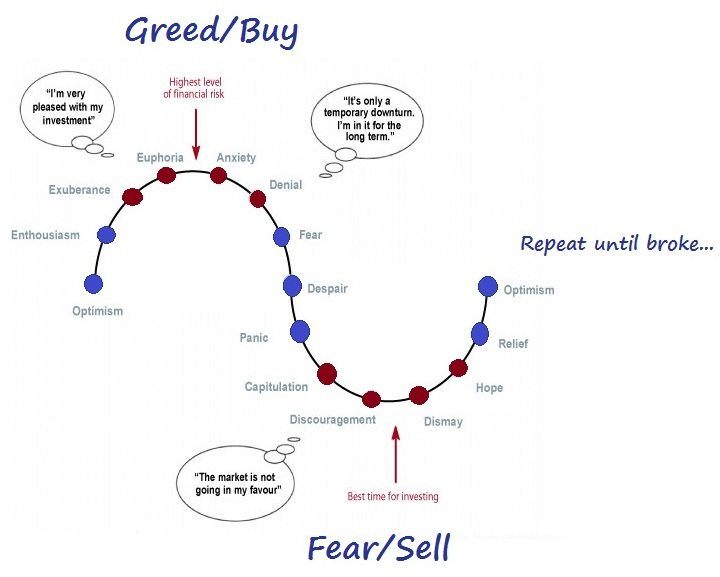

The continuous market cycles that occur produce different psychological effects on those that participate. For example, at the peak of the investment cycle traders and investors feel sanguine about the returns they’ve realized up to that point in the market cycle. This is usually followed by a sense of dread when they see those returns begin to gradually dwindle and eventually turn into losses.

Unfortunately, most traders and investors experience these fear and greed cycles time and again. This is due to the simple fact that most traders and investors don’t have a plan to properly manage risk and reward. Furthermore, they don’t possess a clear understanding of probabilities as it relates to making trading decisions. These deficits subject traders to making decisions based on their emotions of fear and greed. In order to mitigate these emotions, traders need to have a strategy that can help them buy low and sell high. Easier said than done, as you might imagine. But without a strategy, trading and investing can be extremely challenging

In order to deal with some of these challenges, a trader/investor must understand the various stages of the collective psychology of traders and investors. These market cycles can occur over many years, but smaller episodes happen almost daily.

The emotion that accompanies the first phase of the market cycle is optimism. This happens when the market has been in a sustained uptrend for many months, perhaps years. In this environment, the prospects for earnings and for the economy look rosy. Traders are feeling comfortable buying, as they perceive little risk in putting money into the stock market. As the market continues higher, optimism turns into excitement as the early buyers are starting to garner hefty profits and every pullback is seen as another buying opportunity. This perception is there because buyers are being rewarded for purchasing every retracement.

As the market cycle continues to accelerates to the upside, the thrill phase begins as profits increase substantially and investor confidence is through the roof. Then comes the euphoria phase which is when profits come so easy that most traders and investors feel that they must take on leverage and begin to ignore simple risk management principles. Although on the surface it seems like nothing can go wrong, the reality is that this is the point of maximum risk in the cycle, but everyone is too blinded by greed to come to this realization. This phase is where institutional investors have tons of liquidity to unload millions of shares of stock as there are huge numbers of willing buyers. This is the distribution phase.

As the new pool of buyers begins to diminish, the market starts to rollover. Initially it looks like another garden-variety pullback; that is, until the market fails to take out the prior high watermark and the prior lows are breached. This kicks off the anxiety phase of the cycle as some of those easy profits begin to not be so easy anymore. In addition, some of the earlier gains begin to slowly evaporate.

The denial phase begins as investors start to rationalize their decisions for holding on to losing trades as good long-term opportunities. The logic is that those positions will eventually come back and make them whole. As the market continues to go lower and the losses continue to mount, denial turns into fear that causes paralysis and confuses traders and investors into doing nothing (like a deer in the headlights).

The persistent selling provokes a sense of desperation and dread among traders and investors as their resolve to hold on for the long term begins to crack. At this point, it doesn’t take much for panic to set in as the terrible reality of what the losses mean is too much to bear. This is the most emotional phase of all the market cycles.

With the selling intensifying, investors reach their breaking point. This is referred to as the capitulation or give-up phase in which investors have to sell simply to relieve themselves of the excruciating pain they’re experiencing. This is the point in the market cycle of maximum financial opportunity as the institutions are accumulating shares and buying futures contracts for the recovery that most likely is forthcoming.

Invariably, the market recovers soon after the masses have given up. As the recovery begins, investors become depressed as they realize that they have made a terrible mistake in selling near the lows. This phase is where many question whether they should be traders, or in the markets at all.

Finally, as the market slowly recovers, investors slowly become hopeful again and begin dipping their toes into the water, so to speak. This happens only after a sustained rally is underway, of course, and the cycle begins again.

If we succumb to the emotional roller coaster of investing and trading as pictured in the illustration, we will eventually end up financially and emotionally bankrupt. Instead, learn to implement a low-risk, high probability strategy that allows you to time the market and navigate through this emotional market cycle, without the emotional turmoil. Or… well, you already know the alternative.

Until next time I hope everyone has a great week.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD extends slide toward 1.1800 on renewed USD strength

EUR/USD extends its daily slide and trades at a fresh weekly low below 1.1850 in the second half of the day on Tuesday. Renewed US Dollar strength, combined with a softer risk tone keep the pair undermined alongside downbeat German ZEW sentiment readings for February.

GBP/USD falls below 1.3550, pressured by weak UK jobs report

GBP/USD remains under heavy bearish pressure and falls toward 1.3500 on Tuesday. The UK employment data highlighted worsening labor market conditions, bolstering bets for a BoE interest rate cut next month and making it difficult for Pound Sterling to stay resilient against its peers.

Gold recovers modestly, stays deep in red below $4,950

Gold (XAU/USD) stages a rebound but remains deep in negative territory below $4,950 after touching its weakest level in over a week near $4,850 earlier in the day. Renewed US Dollar strength makes it difficult for XAU/USD to gather recovery momentum despite the risk-averse market atmosphere.

Crypto Today: Bitcoin, Ethereum, XRP upside looks limited amid deteriorating retail demand

The cryptocurrency market extends weakness with major coins including Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) trading in sideways price action at the time of writing on Tuesday.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.