This is the first Strategic Investing article for the year 2020. Will this decade be another iteration of the Roaring 20’s from a century ago, or something completely different?

No one knows.

No one ever knows. And that is why as Strategic Investors we must be ready for anything at all times.

Historical Returns on Various Asset Classes

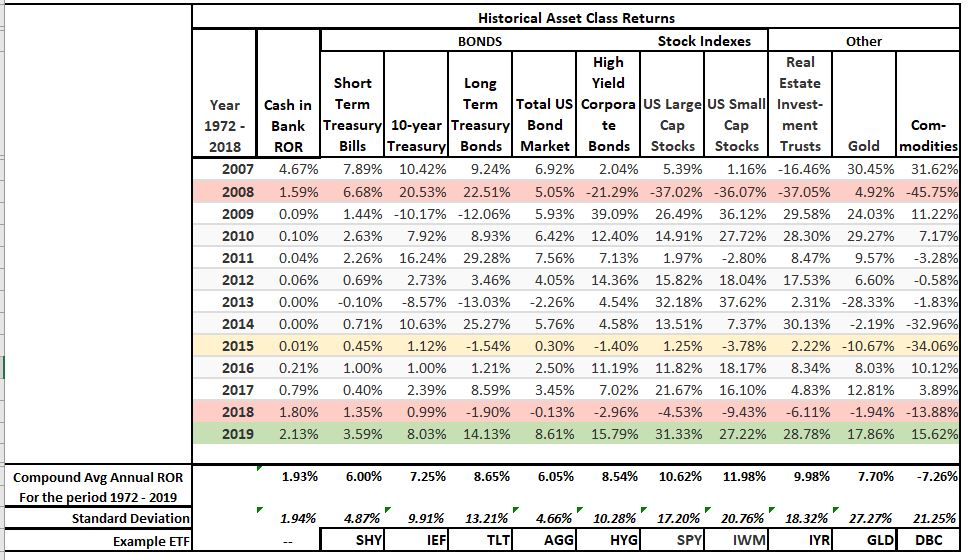

To illustrate what I mean, here’s a table of certain major asset classes with their total returns for the last few years. Total return includes both price change and cash flow in the form of dividends or interest. For assets where total return is negative, the drop in price during the year more than offset any cash flow, resulting in a net loss.

The Compound Annual Growth Rate (CAGR) is the best reflection of long-term average performance. At the bottom of the above table I have noted the average CAGR for each asset class for the period 1972 through 2019. I’ve also noted the Standard Deviation, which is a measure of how variable returns are from one year to another, for each asset.

SPY, for example, had a CAGR of 10.62% and the Standard Deviation was 17.2%. This means that, based on past performance, about 68% of the time we could expect SPY to range from a 6.58% net loss to a 27.82% gain.

The year 2019 (highlighted above in green) was an extraordinarily good year for all of the major investment asset classes. In 2019, every single asset class except treasury bills performed above its long-term average. So, the only way not to make good money on your investments in 2019 was to try to keep it safe in treasury bills. Stocks, bonds, gold, commodities, real estate – wherever you looked, there was money to be made.

This was, as I said, an extraordinarily good year, and the kind of year not seen very often. We have had other great years in the stock market -2009 and 2013, for example, but in those years, bonds and/or gold had losses for the year.

Some years are the exact opposite of 2019. 2015, for example (highlighted in the chart in yellow), was called The year that nothing worked. All asset classes had negligible to negative returns in that year. Other rotten years included 2008 and 2018 (highlighted n red on the chart).

I make these points to remind us that there is a good reason for the phrase past performance does not necessarily indicate future results. The only thing that is certain about financial markets is that they will change.

Well, there is one other thing that is certain – and that is that predictions will mostly be wrong. Each year there are a number of articles in the financial press comparing the predictions from the leading economists and market analysts at the beginning of the year to actual results. Uniformly, almost everyone will have gotten it wrong.

This known unpredictability – the fact that we know that we don’t know anything – is what must guide our investment strategy.

How?

Strategic Investing principles, as taught in our Strategic Investor course, stress creating a diversified portfolio that is unlikely to be decimated by one terrible market, or even seriously hurt in a nothing worked year.

A strategic investor uses not just a single strategy, but a combination of strategies that allow him or her to take advantage of great years in the stock market, or in bonds, gold, real estate or others, while keeping capital safe and generating cash flow.

In a few words, Strategic Investing principles boil down to these:

-

Identify a target rate of return that fits your circumstances

-

Diversify investments among several different asset classes and strategies, selected individually for your unique combination of needs for safety, growth and cash flow

-

Manage each separate investment according to structured strategy rules that optimize returns while controlling risk

Of course, there is a lot more to each of these three points than these few words. To find out more, contact your local center about our Strategic Investor program.

Here’s hoping for another prosperous year to ring in the Roaring ‘20s!

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.