- Dr. Stefan Friedrichowski is physicist and full-time trader and manages the scientific work and the development of trading strategies and Christian Stern is full-time trader and heads the treasury and the education department at Trading Stars.

Traders always search for volatility – there is even a dependency of it, because without market movements you will not earn profits. Around the time of the publication of important economic news the stock markets often show erratic movements in many underlyings. We show you how to use these movements successfully with an example of EUR/USD.

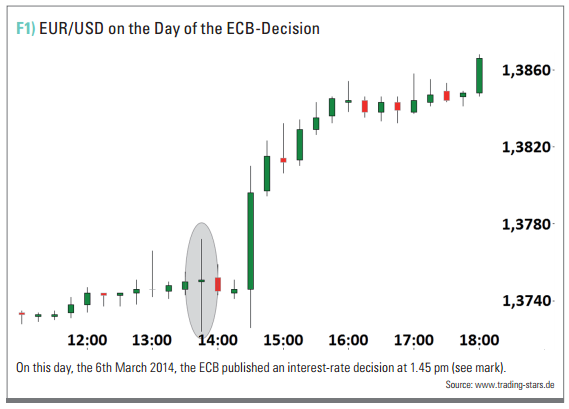

The Trading Idea There are days when prices only move in slow-motion – there are only sideways phases and many false breakouts. But then there are days where everything changes: dynamic breakouts up or down, sometimes even to both sides within minutes. These events can take place completely unplanned (for example because of attacks, riots, natural disasters) or predictably at big news-events like the publication of the gross domestic product (GDP) or the NFP-data (non-farm payrolls) or a press conference of the Fed. Dynamic price movements take place, but you know the date and time in advance. We want to introduce a trading idea based on the monthly ECB-interest rate decision and we want to show that we can recognise a mathematical probability advantage and use it for a real profit.

An old saying goes: “Close your trades prior to important news or at least protect them with a stop-loss.”

This is absolutely true. There may be some insiders who know in advance what will be published, but the reaction of the market is hard to predict. For example nonfarm payroll data is published and they are better than expected, which should mean a bullish move. But maybe because of this the market fears that the monetary measures will be reduced and therefore the DAX drops 100 points. In hindsight we can always explain the “Why”. But to be honest, this could be an explanation for the contrary as well. The consequence is clear: Stay still and close open positions – unless you want to trade the news systematically.

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.