One of the most common questions I have asked of me is where a trader should place their stops for maximum effectiveness and still not be stopped out too soon by normal market fluctuations. A specific question posed to me was:

Q: My biggest problem is that I do not know where to set up my stop losses without being taking out too early or too late. Is it true that a Market Maker can see all of the stop losses in their computer and move the price around that to benefit them?

A: To answer the second part of your question, yes and no. The market makers can only see stops that are placed on their own system from their clients. So ScottTrade’s market makers know where all of ScottTrade’s clients are placing their orders. This is one reason why Online Trading Academy teaches trading through Direct Access brokerages. If you place a stop order on a direct access trading platform, the order is usually held in the brokerage’s server and is not seen by the market or the other market makers until it is activated. You must know your broker’s stop policies however. There is a different type of stop order routing that is used by some direct access brokerages. This stop order is routed to an ECN and held at the ECN server until activated. This type of order may be seen by all who subscribe to that particular ECN. The ECN, AUTO is one such ECN that will house orders.

Remember that market makers are smart. They do know that most people will place stops around whole, decade, or century numbers and will “run” the stops to shake you out. You should also place stops NEAR supply and demand, not AT supply and demand for the same reason.

Setting proper stops can be tricky. You should always maintain the 3:1 Reward to Risk ratio or do not take the trade. Identify your entry point, your exit point, and calculate your potential profit for the trade. Divide that number by three and that should be your minimum stop loss. You can also refer to the AverageTrueRange to see if your stop is too tight for the time frame you are trading.

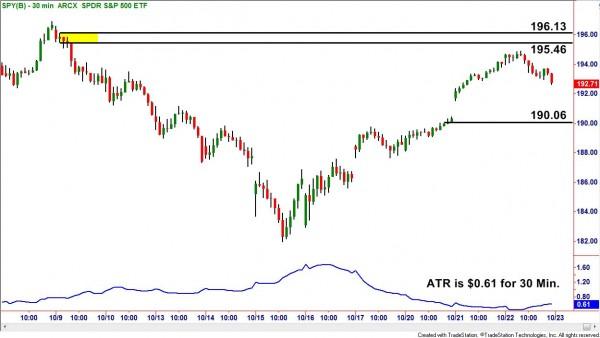

For example, the potential trade in the chart below shows a possible short with a profit of $5.40 (Short entry at about $195.46 and exit near $190.06).

The ATR for SPY every 30 minutes is only $0.61. We could take the short with a stop of about $1.80 and not fear getting stopped out by the volatility of the ETF.

For swing trades, I use similar criteria. A trade with a $3.00 potential profit and a $1.00 stop may get stopped out too early if the ATR is $1.75, but may be ok if the ATR is $1.25 or less. I also look at doubling the ATR and using the smaller of the ATR x 2 or 1/3 of my potential profit.

Another type of stop is the Chandelier exit which was featured in Technical Analysis of Stocks and Commodities magazine a while ago. It involves multiplying the ATR by three and subtracting that number from the most recent high (or low if you are short). Just remember to maintain proper risk vs reward ratios (3:1). This type of stop works best in trending markets.

Here we see SPY pulling back to demand on the daily chart. When we go long at demand, we set our initial stop below demand.

Changing the stop can prove challenging as well. Once you clear breakeven, you may choose to move your stop high enough to cover exit with no loss, even covering commissions! If another swing high presents itself, I usually move up my stop to protect any profit.

In the above chart we had a pullback from a new high of $92.98. A check of the ATR at that time shows $0.71 Daily ATR. We multiply that by three and hang it from the high. This gives us a stop of $90.85 which locks in a gain even if prices move against us. Every time price makes a new high and starts to correct, we can repeat the process. Doing this creates more profitable trades in the trend.

These stop guidelines would work on any type of security. We can use them in trading currency, futures, commodities, and of course stocks. I hope this answers some of your questions about stops.

In our courses at Online Trading Academy, we teach traders and investors the proper methods for placing stops and protecting their money. Stop into your local office to learn more.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.