Over the last few weeks of teaching on location classes, delivering XLT sessions and the initial Market Timing Orientation programs, I have noticed much confusion in the air regarding the state of the current financial markets; and with so much political and economical news in the air, it’s far from surprising to hear the questions coming.

Anyone with a little experience in the world of currency trading is familiar with the impact that Central Bank Interest rates have on currency prices, and we are told to pay as much attention to this as possible so as to keep informed on all factors shaping exchange rates across the board. When reading about anything to do with FX and interest rates, you will find commentary on one aspect called the Carry Trade which is something I have been getting many questions about lately. It is a very important aspect of Forex and can be hugely helpful in analysis if you know what to look for, so let’s take a deeper dive into it.

The Carry Trade has typically been a trading strategy used by major investors and institutions to greatly increase the rate of return or yield which they are getting on their money. As we know, Central Banks around the globe have the power to change their interest rates regularly through economic policy. The higher the rate are, the more attractive the currency is to the outside investors. The lower those rates are, the less likely people are to hold their money in that currency. The difference between worldwide rates is dependent on the policies of the Central Banks themselves and varies from nation to nation, with some being much higher or lower than others at any given time. So how would an investor take advantage of this?

A good example would be to focus on a currency like the Japanese Yen. Traditionally, the Yen has held lower rates than most other currencies, mainly since the Japanese Bank wants to maintain a cheaper currency which in turn means that it is more affordable for other nations to buy Japanese exports. As we know, Japan is built on exports so a weaker Yen works nicely in their favor. Due to these factors, the Carry Trade evolved into a strategy where investors could borrow one currency with a low rate attached to it, like the Yen and then sell to buy or invest in another higher yielding currency like the British Pound, Euro and even the USD itself.

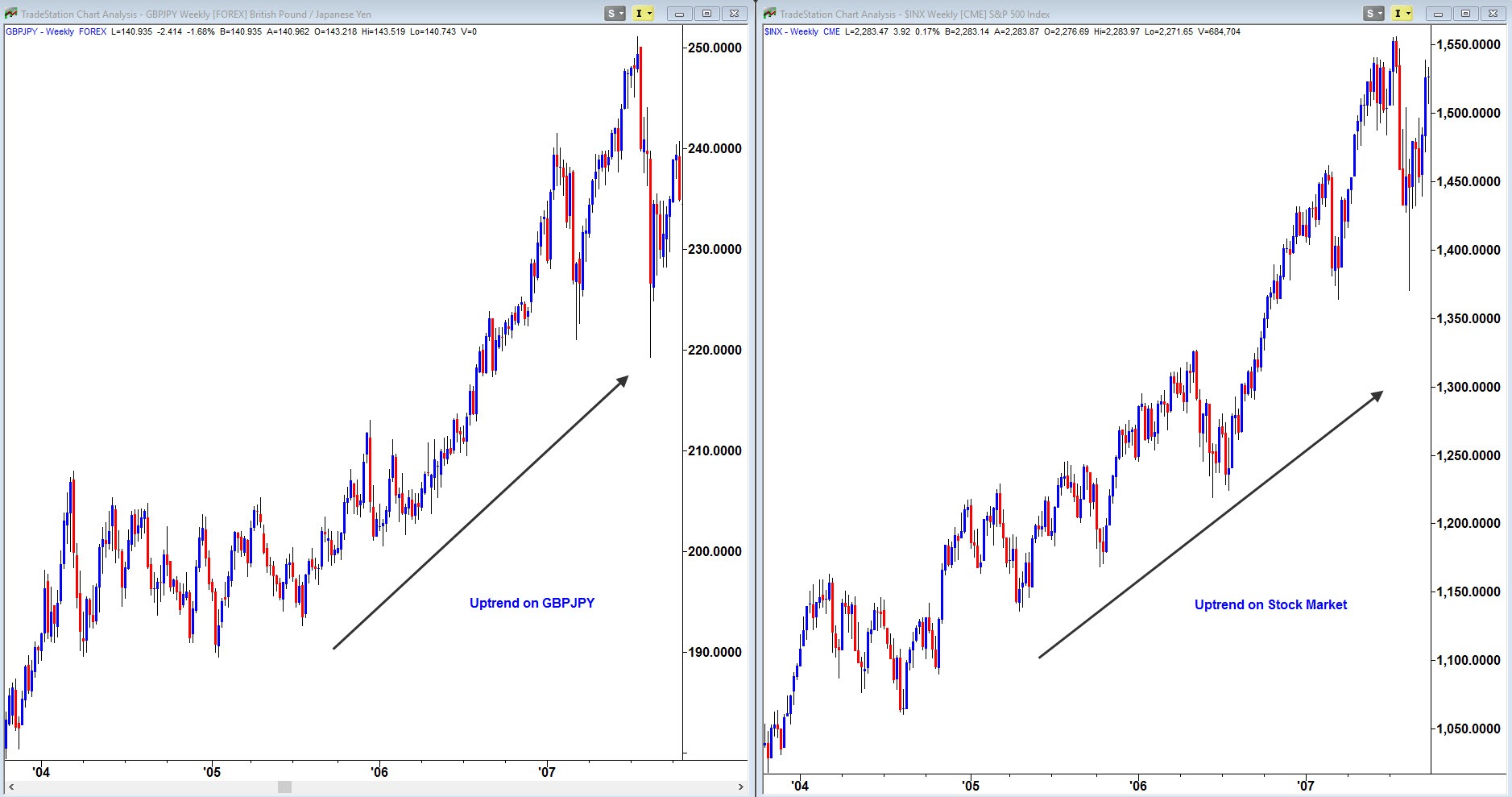

As a result of the carry, we would see long term trends develop over the years as more people would borrow and sell Yen to buy stronger currencies and get paid what we call the rate differential. As well as recovering this differential, the investor would also gain from the change in rates. Here is an example of the carry trade in full working order on the GBPJPY between 2004 and late 2007:

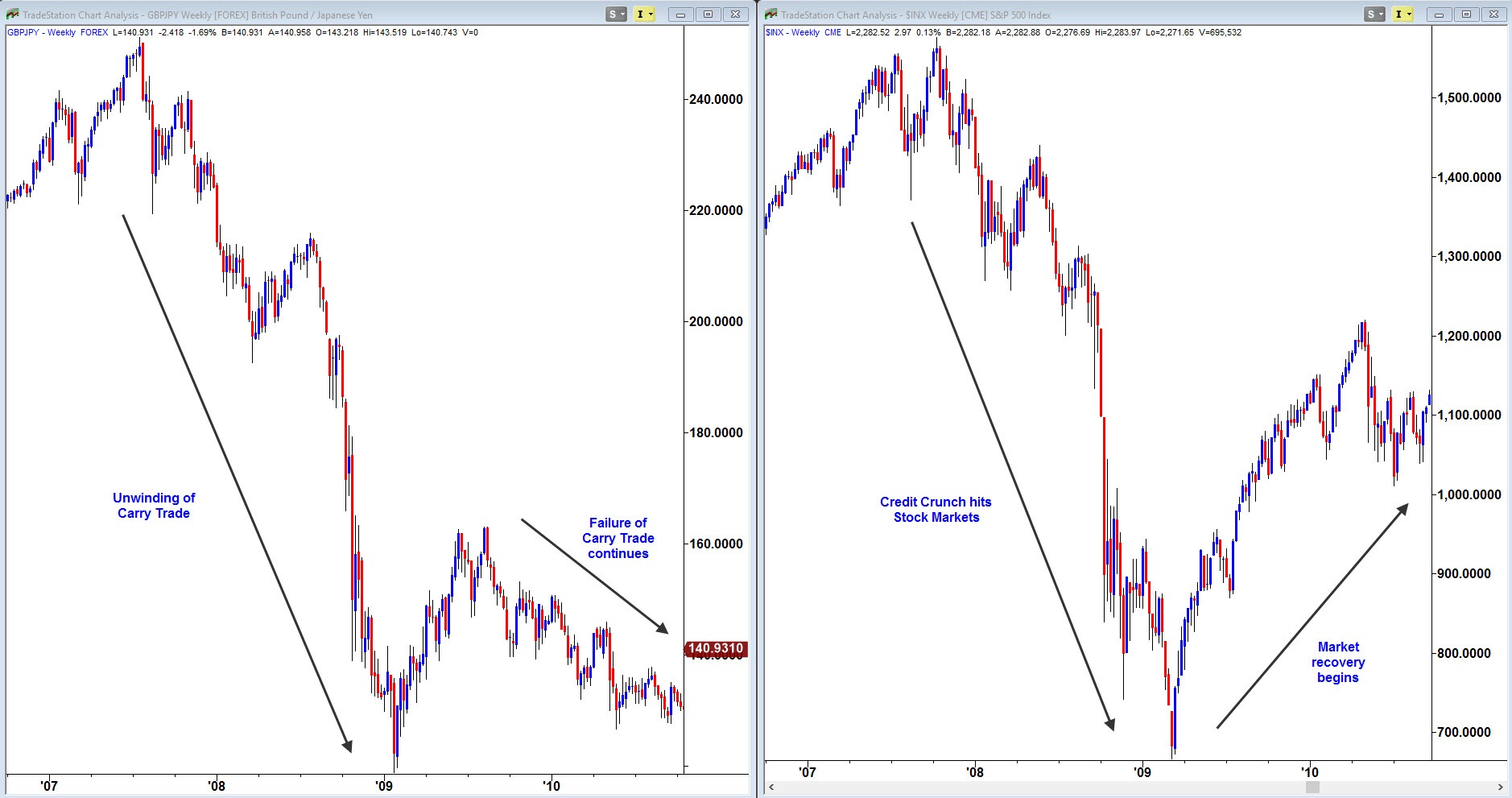

Do you notice how the trend of GBPJPY is in the same direction as the S&P 500 Index? When things are doing well in global markets, investors tend to build up a higher appetite for risk and are happy to use their profits to attempt strategies like the carry trade. At the time, rates in the UK were above 6%, way more than in Japan where they were below 1%. That is a free 5% you would have been receiving, along with the major gain in pips. However, as we saw when the Credit Crunch reared its ugly head in 2008, all good things come to an end and the carry trade unwound in spectacular fashion:

Up until 2009, both charts are practically in perfect sync, but the “flight to quality” by nervous traders and investor who were closing their positons and going back to cash caused a shift and we see the collapse in both Stocks and the GBPJPY. As you can see, overall market sentiment will change very quickly, sharply adjusting the supply and demand for markets in the blink of an eye.

A keen eye will notice a unique change in the dynamic of the carry trade when looking at the charts above. While both markets enjoyed a dual recovery in 2009, things tailed off by 2010 for the GBPJPY which continued its downward descent, yet the Stock Markets continued to rally without pause. The reason why is simple: in reaction to the financial crisis, Central Banks across the board lowered rates thus eradicating the carry trade dynamic completely, so when things bounced back in stocks, investors didn’t see the same opportunities in FX.

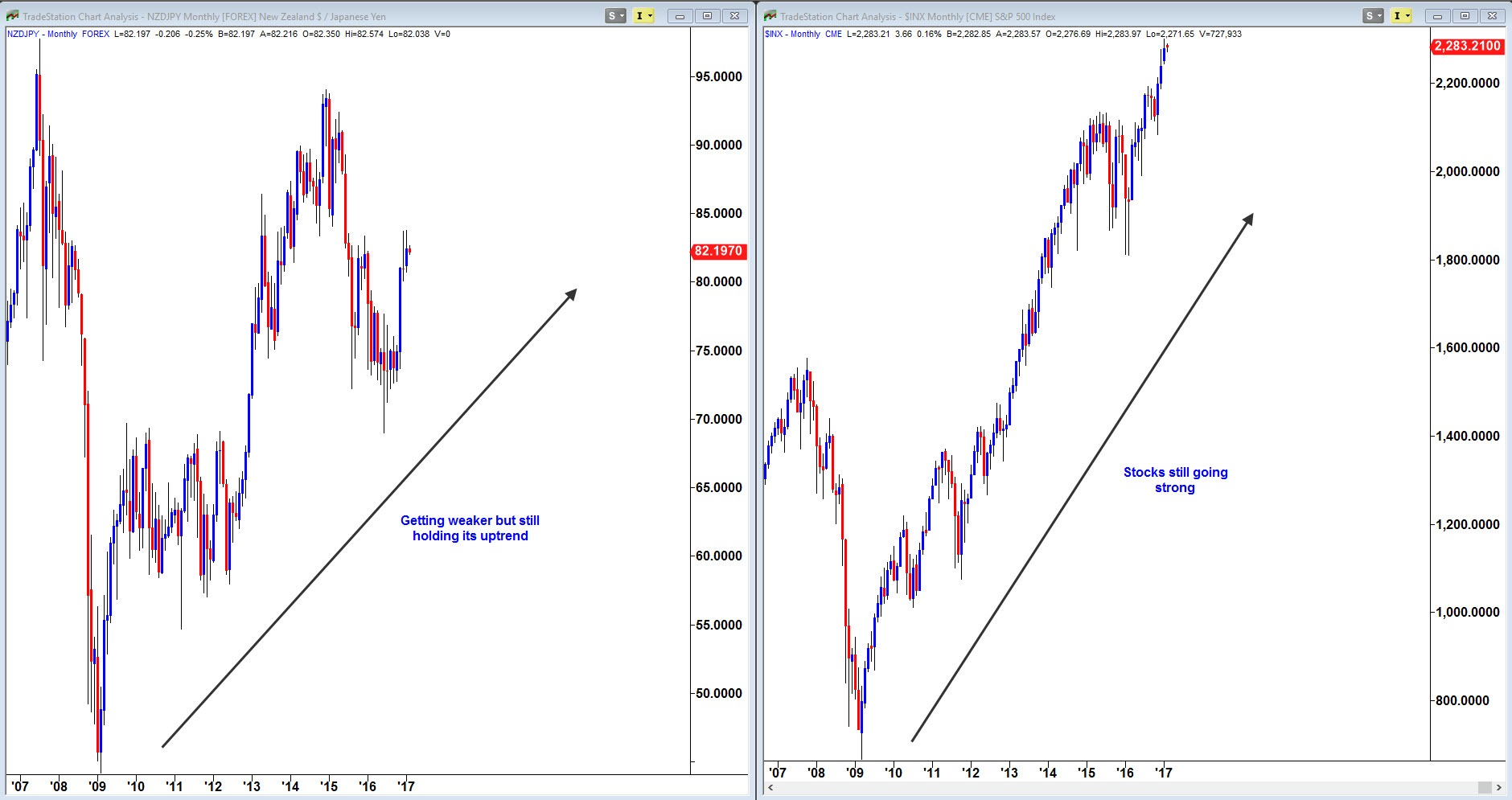

However, there was still a bit of room for the carry trade to work but to a lesser degree, this time with the rare few nations who did raise rates over the last few years, namely Australia and New Zealand. Looking at the time of writing this article, New Zealand has the highest rates of the major currencies at 1.75% though it was a little higher than that over the last few years with highs of 3.5% in 2014-2015 and lowering consistently since then.

What does this look like on a chart then? It seems the Carry Trade was not completely dead and buried after all when looking at NZDJPY:

Now, while I would agree that the correlation of the two markets is not as strong as it was with GBPJPY, it is still there. What has my attention for the long-term perspective is that the S&P 500 is still grinding higher, yet the NZDJPY is struggling to maintain the momentum. Maybe a sign that the smart money is not as trusting of the new equity market highs as much of the media is? All I know is that I will personally be keeping an eye on this currency pair in the coming months as I would expect much available downside opportunity if or when stocks do decide to correct. There is still a Carry Trade out there guys, you just have to look a little harder to find it these days.

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.