The forex landscape is constantly growing, and for brokers, it’s important to continue evolving your reporting services for clients to continue to stand out ahead of your market competitors.

With global turnover in foreign exchange (FX) markets reaching a total of $7.5 trillion per day, currency trading has surpassed global gross domestic product by as much as 30 times. The key strength of the market comes from its accessibility and leading brokerages can enjoy a significant portion of user traffic and the financial rewards that come with it.

Significant volumes of turnover invariably mean that FX has become a fiercely competitive ecosystem for brokers, and this has left different firms seeking to win more clients by out-innovating their rivals.

In a marketplace densely populated by approximately 7,000 FX brokers globally, no firms can afford to rest on their laurels.

For ambitious brokers, it’s essential to explore how to optimize your suite of services in a way that helps your target audience enjoy a seamless experience in a way that fosters brand loyalty and satisfaction.

Fortunately, there are plenty of technologies that have the power to help you win more clients and are rightly positioned as a leading resource to support their trading activity. Let’s explore some of your more actionable options for boosting operations to position your brokerage ahead of your competitors:

Optimizing Your Reports Structure

In the vast majority of competitive industries, it’s imperative for brands to provide a stronger customer experience than their competitors. This can often become a leading factor in helping clients to achieve their FX goals in a frictionless manner.

This is perhaps more true in the world of FX than in any other industry due to the difficulty that many investors have in reaching their goals. While retail investors don’t have a particularly large stake in the overall FX market, accounting for around 5.5% of all traders, statistics suggest that the majority of these investors run up significant losses on their trades on average.

In an industry that’s unforgiving to many retail investors, it’s essential that brokers work to achieve a level of agility and insight that can help to provide all clients with the best possible market opportunities–regardless of whether they’re retail or institutional investors.

Offering stronger reporting tools is vital in helping clients to ramp up the quality of their trades and to improve their market decisions. Factors that can help traders understand how their most successful trades were discovered, what mistakes are continually being made, and where their profits are really coming from.

Better reporting tools can also pave the way for ambitious brokers to become a better trading resource than their rivals, helping clients steer clear of third-party tools that add another point of friction to their existing processes.

Removing the barriers between traders and their insights in imperative for all forex brokers, and booting the quality of your reporting insights is the best way to build on a positive user experience for traders of all competencies.

Out-Innovating Your Rivals

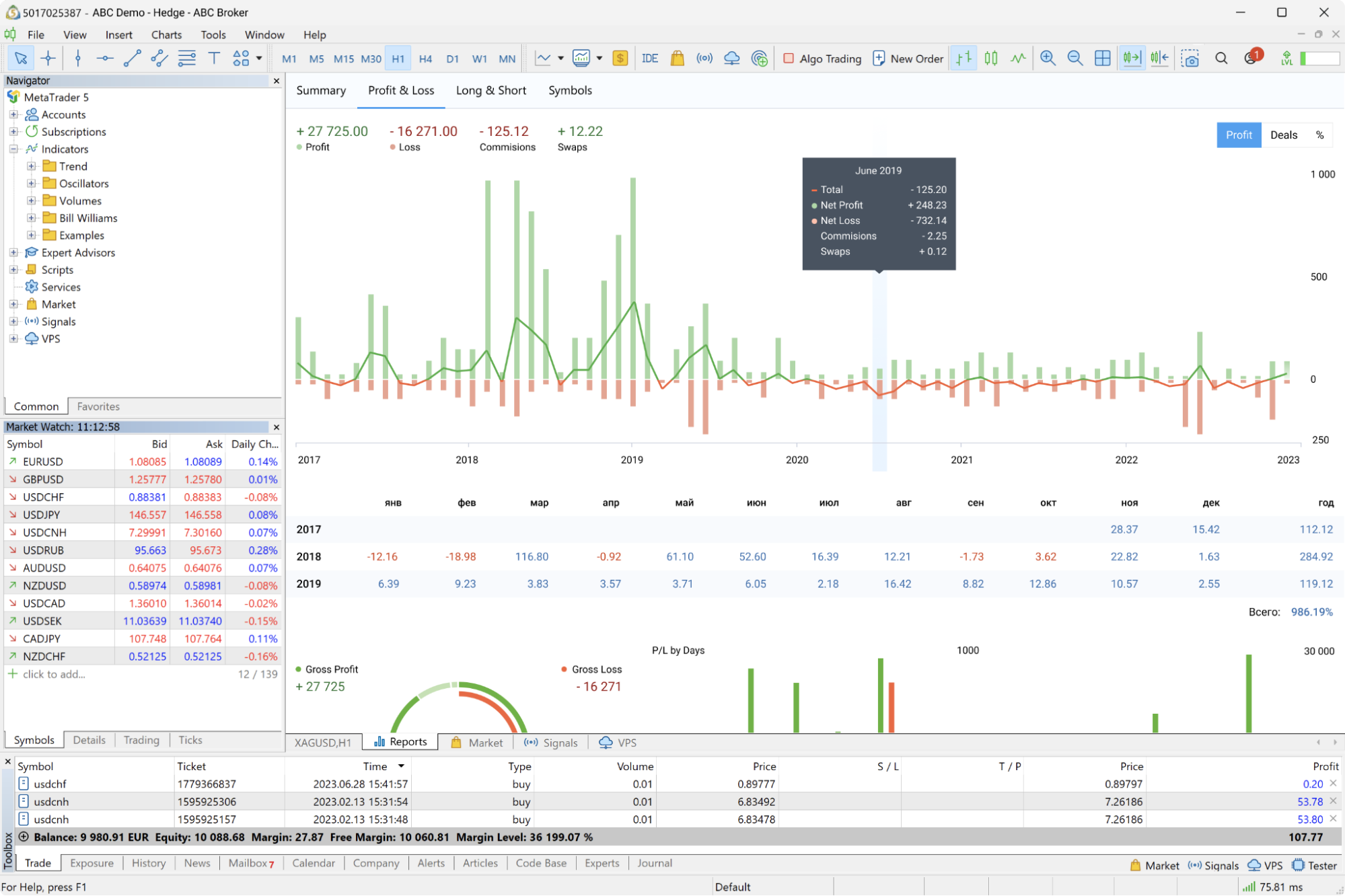

MetaQuotes have sought to introduce powerful new trading tools for brokers around the world. In a recent update to the reporting tools available for its MetaTrader 5 platform, brokers can now benefit from a far more extensive range of insights.

The update has helped to pave the way for a fresh statistics platform within its MetaTrader 5 terminal, and traders will be able to benefit from bespoke reporting and analytical tools that can shape their approach and pave the way for improved processes–all without the need for leaving their broker’s platform to gain third party advice.

Packed with incisive features like a dedicated Summary page, Profit & Loss insights, and an emphasis on historical data that can help to identify key patterns across different areas of a client’s trading history, the new update can help to foster more successful trading patterns for all users.

With more powerful insights, clients can analyze their performance on a more forensic level and make improvements on different areas of their trading strategy, whether they’re lagging in terms of copy trading, algorithmic trading, or manual trading, these insights can help to get to the bottom of their performance and make measured adjustments to generate stronger results.

The new reporting insights mean that different trading patterns can be broken down by the type of trade, various performances based on different symbols, and how certain trading pairs are performing in comparison to others.

Given that the high volume of FX trader losses are well documented throughout the industry, the availability of powerful reporting tools is a major draw for users who are conscious of maximizing their potential to turn a profit.

The availability of end-to-end filters can also help traders zoom in on certain areas of their performance across tabs. This means that a client can adopt a holistic view of their JPY/USD trades and contrast them with CHF/USD to better understand their decision processes.

Winning New Client Appeal

The adoption of new reporting tools can bring countless benefits to brokers as well as their respective client bases. The ability to utilize data-driven reports for a free and valuable source of trading insight may pay dividends to users who are eager to continue learning and improving the quality of their decisions.

Effective reporting insights can help brokers ramp up their client-focused offerings and provide clients with a means of accessing the information they need without having to rely on potentially harmful third parties for a cutting-edge perspective.

As the technology to support reporting tools continues to grow, brokers have more opportunities to provide their users with the chance to buck trends in an industry that’s notoriously difficult to crack. By accommodating better reporting within your platform, you can pave the way for stronger client satisfaction while providing them with a better chance for success.

All views and opinions expressed in this article are the opinions of the author and not FXStreet. Trading cryptocurrencies or related products involves risk. This is not an endorsement to invest in or trade any of the cryptocurrencies, stocks or companies mentioned in this article.

Editors’ Picks

EUR/USD climbs to daily highs on US CPI

EUR/USD now accelerates it rebound and flirts with the 1.1880 zone on Friday, or daily highs, all in response to renewed selling pressure on the US Dollar. In the meantime, US inflation figures showed the headline CPI rose less than expected in January, removing some tailwinds from the Greenback’s momentum.

GBP/USD clings to gains above 1.3600

GBP/USD reverses three consecutive daily pullbacks on Friday, hovering around the low-1.3600s on the back of the vacillating performance of the Greenback in the wake of the release of US CPI prints in January. Earlier in the day, the BoE’s Pill suggested that UK inflation could settle around 2.5%, above the bank’s goal.

Gold: Upside remains capped by $5,000

Gold is reclaiming part of the ground lost on Wednesday’s marked retracement, as bargain-hunters seem to have stepped in. The precious metal’s upside, however, appears limited amid the slightly better tone in the US Dollar after US inflation data saw the CPI rise less than estimated at the beginning of the year.

Crypto Today: Bitcoin, Ethereum, XRP in choppy price action, weighed down by falling institutional interest

Bitcoin's upside remains largely constrained amid weak technicals and declining institutional interest. Ethereum trades sideways above $1,900 support with the upside capped below $2,000 amid ETF outflows.

The weekender: When software turns the blade on itself

Autonomous AI does not just threaten trucking companies and call centers. It challenges the cognitive toll booths that legacy software has charged for decades. This is not a forecast. No one truly knows the end state of AI.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.