Before he was Han Solo or Indiana Jones, in 1964 Harrison Ford moved to Hollywood to become an actor.

"But I arrived on a metaphoric bus full of people who had the same ambition" he said. What happened next?

Spending time around other aspiring actors he noticed common traits among the people he was competing against.

- They needed validation quickly.

- They wanted success early.

- They were in a hurry to 'make it'.

So what did Harrison Ford do? Tell you in a minute. But first:

When it comes to trading what first comes to mind? Errr. Better put on a trade. Right?

Even though most people:

- Have had some success but didn't last, or

- Still need to reach consistency, or

- Aren't making money. Agree?

And just like the hypnotic spell of coins cascading into a voracious pokie machine, money relentlessly pours from most people into the coffers of the few experienced and skilled people. Correct?

But why?

No different to what Harrison Ford observed of his peers - when it comes to markets - people are in a hurry.

- I'm not making money if I'm not in a trade.

- I'm not trading if I'm not in a trade.

- Can't call myself a trader if I'm not trading.

- I've set aside this time to TRADE so I better TRADE.

Recognising most of his peers were in a hurry to succeed, Harrison Ford extended his timeline. He took up carpentry as a secondary source of income allowing him to outlast his competition.

Outlasting the competition was central to Friday's trading. But first:

Being in a hurry to trade makes you vulnerable. Which is how influential market people pummel you into submission. Preying on your need to enter a position. Preying on your need to make a profitable trade.

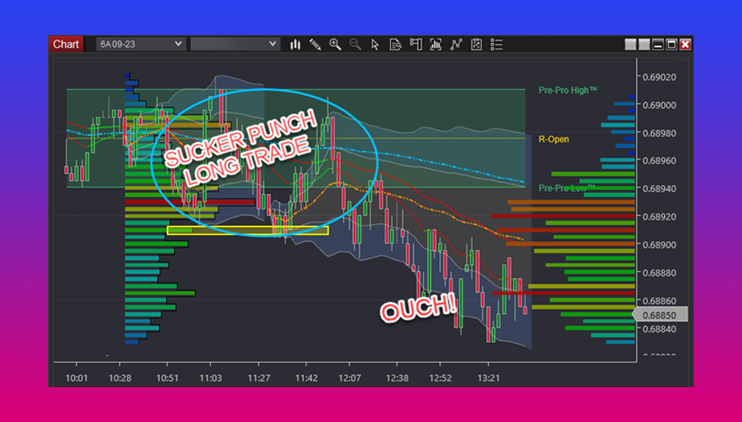

From Friday's trading game plan. Notice the focus is on people in a hurry?

For context see the accompanying chart:

Over the years Harrison Ford built up his Hollywood connections through his carpentry gaining a reputation as the "carpenter to the stars". Meanwhile, many aspiring actors dropped out of competition.

People who bought in a hurry dropped out too. In-a-hurry buying turns to losers. Some losers reverse and go short. See what happens next in a minute:

Harrison Ford worked as a carpenter for prominent figures like Francis Ford Coppola, James Caan, Richard Dreyfuss, and Joan Didion.

During his work at Coppola's offices Harrison Ford was unexpectedly asked to read lines with other actors for Star Wars.

Despite initially not being considered for a role, Ford's performance led to him being offered the iconic role of Han Solo.

In the game plan above it was always the intention to go long. But when?

Know when it's safe to enter: 3 resources tieing it all altogether

1. The playing field

Themes are working in the market that transcends what's occurring in the bars of various charts. These include relative value, hedging, market making, positioning. Watch the 4 minute video to see how:

2. Human behaviours the market exploits

Scientific research shows how you're manipulated to make trading decisions that hurt you.

Most people do this in their trading – Make it your competitive advantage

3. A process that protects you

Safely navigating the otherwise treacherous minefield that is market movement requires playbook trades.

What exactly are playbook trades and why do the best traders swear by them?

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

US Dollar struggles as Trump tariff uncertainty grows

The US Dollar struggles to stay resilient against its rivals to start the new week as investors assess the headlines surrounding the US trade regime. After the Supreme Court ruled against US President Trump's tariffs, Trump announced that he will hike global tariff rates to 15%.

Gold advances to four-week highs, focus is on $5,200

Gold is holding onto its bullish tone on Monday, hovering near monthly highs well above the $5,100 mark per troy ounce. Fresh trade-war concerns, coupled with rising geopolitical tensions in the Middle East, are keeping demand for the yellow metal well on the rise.

EUR/USD regains balance, targets 1.1800

EUR/USD has lost a bit of momentum after its earlier push higher and is now attempting to reclaim the key 1.1800 barrier on Monday. In the meantime, investors remain focused on the evolving US–EU trade relationship after President Trump’s announcement of sweeping global tariff hikes.

Crypto Today: Bitcoin, Ethereum, XRP intensify sell-off as tariff uncertainty weighs

Bitcoin, Ethereum and Ripple are trading amid increasing selling pressure at the time of writing on Monday, as investors react to fresh trade uncertainty over US President Donald Trump’s push for more tariffs.

Supreme Court nixes tariffs, Trump teases 15% global tariff

On February 20th, the Supreme Court ruled that Trump’s global tariffs under IEEPA authority were unconstitutional, effectively nullifying the framework. However, the relief was short-lived. Within hours, Trump floated a 15% blanket tariff under an alternative legal authority.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.