If asked to describe financial markets to someone who's never heard of them, you'd use terms like chaotic, random, volatile, unpredictable, wild, and never constant.

As a serious trader, your first step is to chunk down until you have a framework that brings order to your trading. Think of it like a playing field in sports. Within the field of play is when you can trade, and out-of-bounds is when you don't trade. But it's not only about being in the field of play. In team sports, players have unique roles and only engage in certain cases. Trading is no different.

A trading playbook refers to a catalogue of strategies deployed in certain cases. And as a result, they produce positive results over the long-term. It means they make money over x number of trades despite in trading where nothing is 100%. Traders refer to this as edge. When the market presents an opportunity to combine several playbook trades simultaneously, it can be satisfying and rewarding.

We're in the odds business, but confidence plays a role in everything we do, including trading. Has your trading confidence taken a hit? How would you feel knowing you are stacking known positive expectancy trades on top of each other? You'd feel full of confidence and not hesitate to act on your trade. Right? Hence why, the best traders swear by a trading playbook.

Your only tasks when live trading are:

-

Recognise when the market behaviour matches a playbook trade.

-

Execute the trade.

You're going to see a recent short and long trade. But before that, it's important to understand why there are always reports of high failure percentage of traders outside of professional trading. It's because these traders don't have an edge. i.e. no catalogue of trades that produce positive results over the long term. It takes years of knowledge and forward testing to evolve a trading playbook. If you go it alone, you'll likely never get there.

But the good scoop is you have a choice. You can learn playbook trades when you trade at a professional trading firm or work with a mentor who can teach you their extensive playbook. It's a legitimate shortcut to developing profitable trading. If you love trading, but poor results and little progress are painful, either option will get you past this.

Now, the examples are shared to show you:

-

Order and form can exist in what is an otherwise chaotic and random environment.

-

You can play the game on your terms, building your trust and confidence in trading.

-

It's how serious traders can operate a trading business that has long-term positive performance.

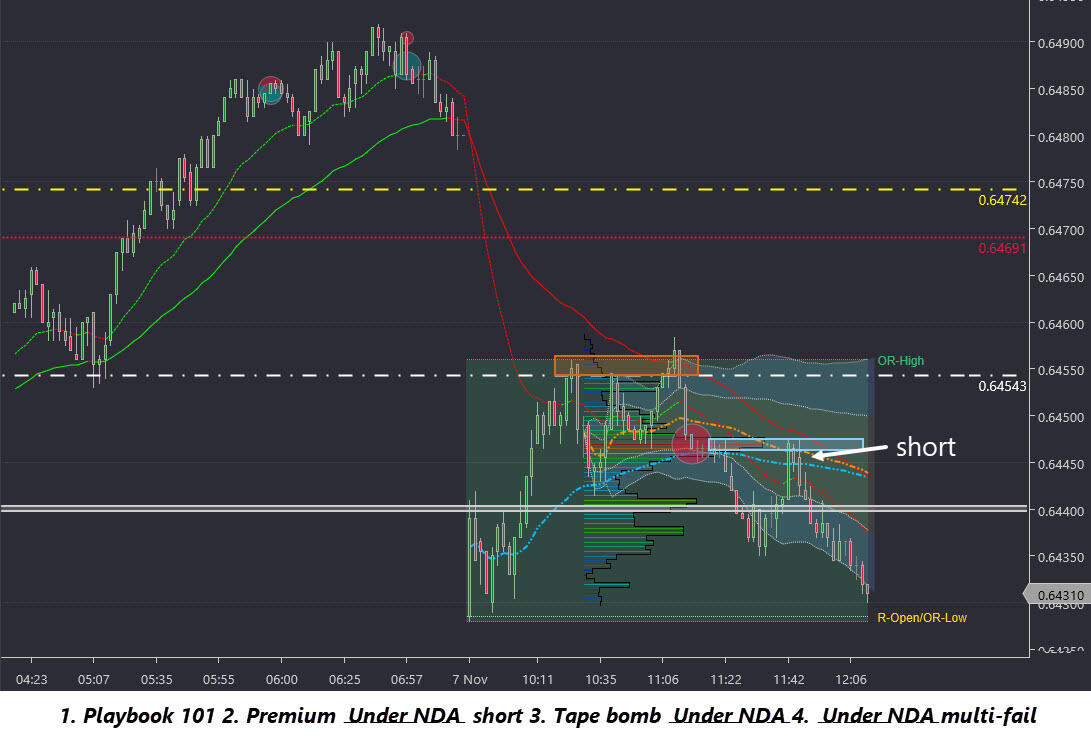

The short trade is taken when four playbook trades occur at the same time.

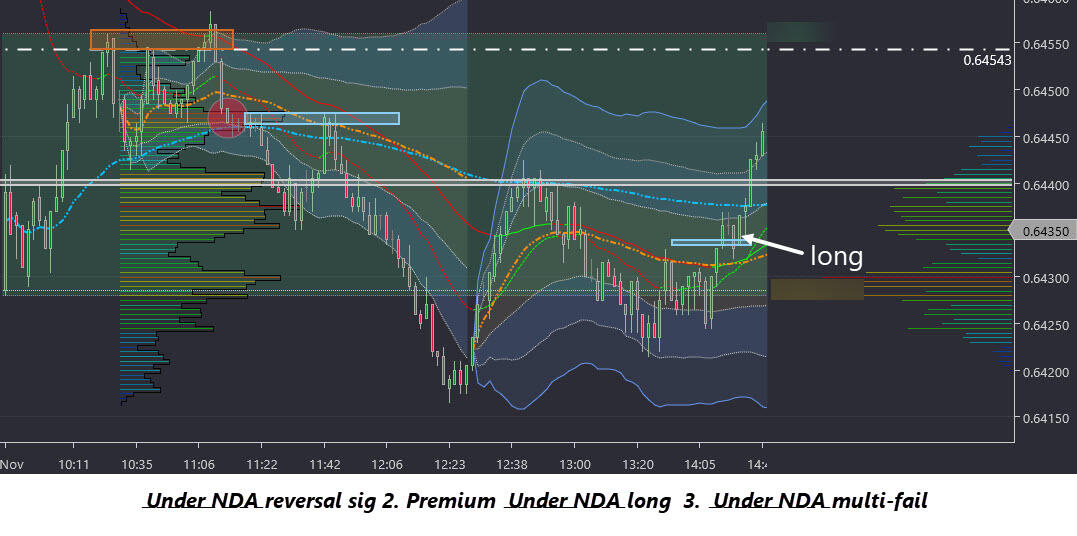

The long trade is taken when three playbook trades occur at the same time.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

US Dollar struggles as Trump tariff uncertainty grows

The US Dollar struggles to stay resilient against its rivals to start the new week as investors assess the headlines surrounding the US trade regime. After the Supreme Court ruled against US President Trump's tariffs, Trump announced that he will hike global tariff rates to 15%.

Gold pops above $5,200, four-week highs

Gold is holding onto its bullish tone on Monday, reaching new multi-week highs just past the $5,200 mark per troy ounce. Fresh trade-war concerns, coupled with rising geopolitical tensions in the Middle East, are keeping demand for the yellow metal well on the rise.

EUR/USD keeps the bid bias just over 1.1800

EUR/USD has started the week on a positive foot, hovering around the 1.1800 region in the latter part of Monday’s session. The pair’s recovery comes on the back of a decent decline in the US Dollar, as investors keep their attention on the evolving US–EU trade relationship after President Trump’s announcement of sweeping global tariff hikes.

Crypto Today: Bitcoin, Ethereum, XRP intensify sell-off as tariff uncertainty weighs

Bitcoin, Ethereum and Ripple are trading amid increasing selling pressure at the time of writing on Monday, as investors react to fresh trade uncertainty over US President Donald Trump’s push for more tariffs.

Supreme Court nixes tariffs, Trump teases 15% global tariff

On February 20th, the Supreme Court ruled that Trump’s global tariffs under IEEPA authority were unconstitutional, effectively nullifying the framework. However, the relief was short-lived. Within hours, Trump floated a 15% blanket tariff under an alternative legal authority.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.