Let’s talk about SRC profits. We’ll talk about what they are, why you must have them, and how to generate them.

So let’s get started.

What are SRC Profits?

You see, here’s what I’m seeing.

I’m seeing all of these YouTube videos showing claims like this where someone said, “I made $1,088 in profits day trading.”

Or someone claiming, “I made $1,253 in profits in three minutes.”

Wow, look at this: “32,625 pounds in only 24 hours”

And you know what? I believe that all these guys actually did these trades.

But here’s the deal when you trade, you’re going to have trades that just work out perfectly. Yes, there will be trades where you make a lot of money.

And for me, the question always is, are these SRC profits?

So let’s talk about this here, because if you want to trade for a living, you must be able to generate SRC profits.

So let’s take a few minutes and talk about this.

S — Systematic

So here is what SRC profits are.

First, it’s an acronym and the S stands for systematic.

Now, I don’t know about you, but I want to make my profits in a systematic way.

Yes, of course, you can make money trading Tesla if you’re catching it at the right time.

But you see, how exactly do you decide when to enter, and can you generate these profits again?

You know me, I like to trade what I see and not what I think. I keep a special mug on my desk that reminds me of this.

See, that’s why I use indicators. That’s why I have a trading strategy.

Having a systematic way means that we have a trading strategy that tells me exactly what to trade, when to enter, and exactly when to exit.

Sometimes you exit with a profit and sometimes, you do exit with a loss. Losses are part of our business as a trader.

In short, I have a system. I love to trade based on rules and not based on my gut feeling, because whenever I traded based on what I thought, it only worked for a little bit.

When I switched to trading what I see based on science, based on probabilities, based on rules, that’s when my trading turned around.

R — Repeatable

Let’s move on and let’s talk about the second point, the 2nd letter in SRC profits.

So the second point here is repeatable. Without a system, it will be difficult to repeat the profits. Now, think about it this way.

Let’s talk about Tesla. Let’s say that you caught Tesla when they announced a stock split right here on August 11th:

And let’s say during this run you made 30% in a matter of a few days, or maybe you traded options and you made 1,000% in a few days.

Can you do it again? Well, you see, if you rely on the next stock split then you might have to wait a few years.

Think about it this way, is it better to generate $10,000 on a single trade, or is it better to know how to make $500 every single week?

For me, I’d rather trade a system that’s generating $500 per week consistently than relying on the windfall profits.

Yes, these windfall profits will happen in your trading career we’ve just talked about it. And it’s nice when it happens, but I wouldn’t rely on it.

If you can generate $500 every week times 52 weeks, that’s $26,000. For me, that is better than being able to generate these windfall profits.

This brings me to the next point.

C — Consistent Profit

The next one is consistent profit. I want to make sure that I’m getting consistent profits.

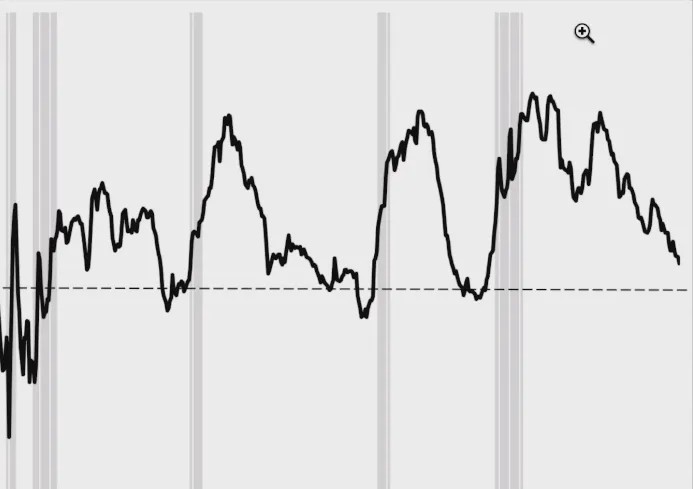

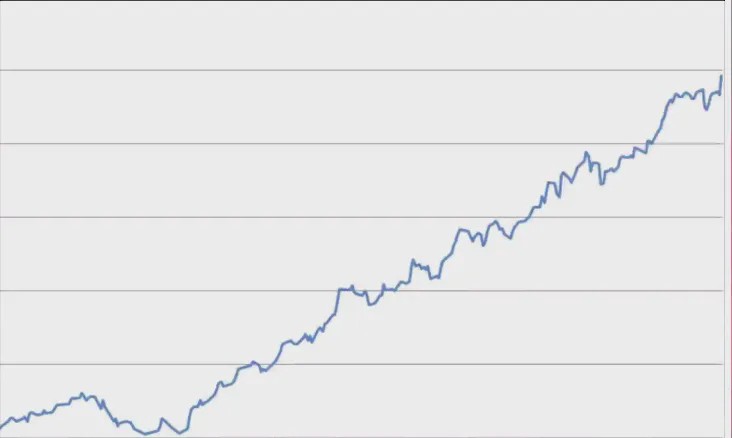

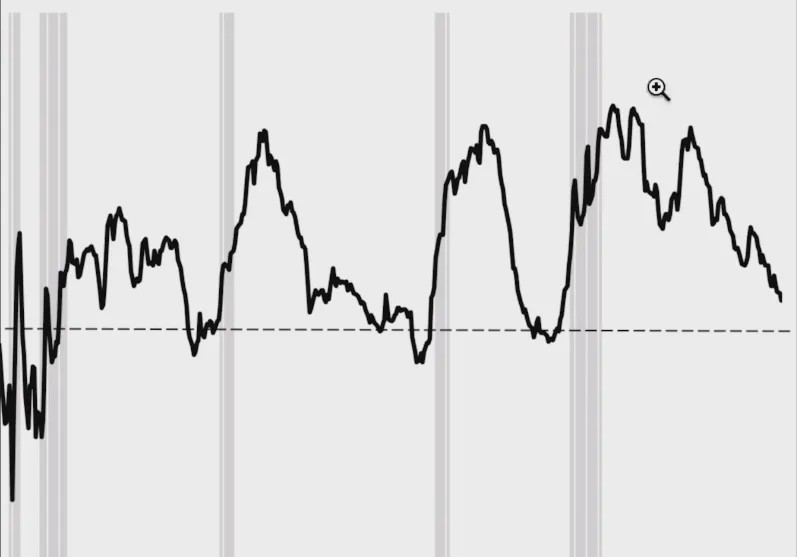

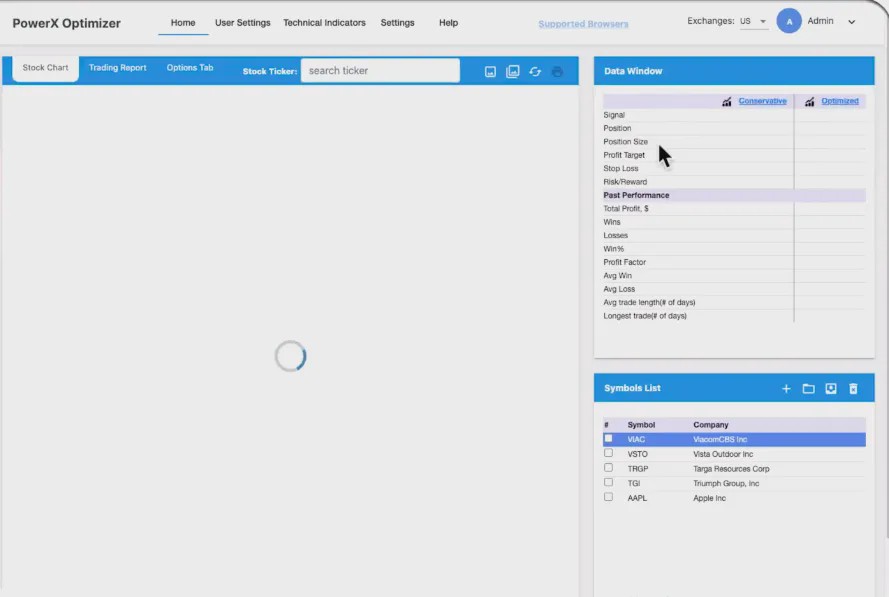

Let me give you an example here. Would you rather have an equity curve like this:

Or like this?

What is an equity curve?

An equity curve is charting your account, of how your account is going. See, both of them are making money.

So this here, you start at the bottom and you end up here:

This one, you start down the bottom and you end up here:

Now, I don’t know about you, but I wouldn’t want to be on this roller coaster. Even if this roller coaster would make me more money I wouldn’t do it.

I would rather make slightly less money but still have my hair instead of pulling it out with that equity.

I’m not a nail biter but if I had this equity curve, this roller coaster, I would probably bite off all my nails. You know that there’s some traders who are doing exactly this.

Now that you know what SRC profits are and why you need them if you want to trade for a living, let’s move on and let’s talk about how you generate these profits.

3 Things You Need To Generate SRC Profits — Number 1

So the first thing that you need is that you need to have a trading strategy or trading strategies.

The strategies that I use are based on indicators and probabilities.

You see, I know exactly what to trade, I know exactly when to enter, I know exactly when to exit. I know my risk, I know my potential profit, and I know my odds of realizing that profit or loss.

If you don’t know my trading strategies yet, let me briefly mention them to you.

So my bread and butter strategy is the PowerX Strategy, and I have written a book about this.

During the pandemic I was trading a strategy called Theta Kings. This was perfect as the markets were crashing, along with the PowerX Strategy.

Now, another trading strategy that I’m trading here right now is a trading strategy called The Wheel. Anyhow, let’s move on.

2. To generate SRC profits you need to have tools

What is the second thing that you need to generate these SRC profits? Well, I am using tools that make my life easier.

You see, I know my odds. I know my probabilities, I know what to expect and I couldn’t do all these calculations in my head.

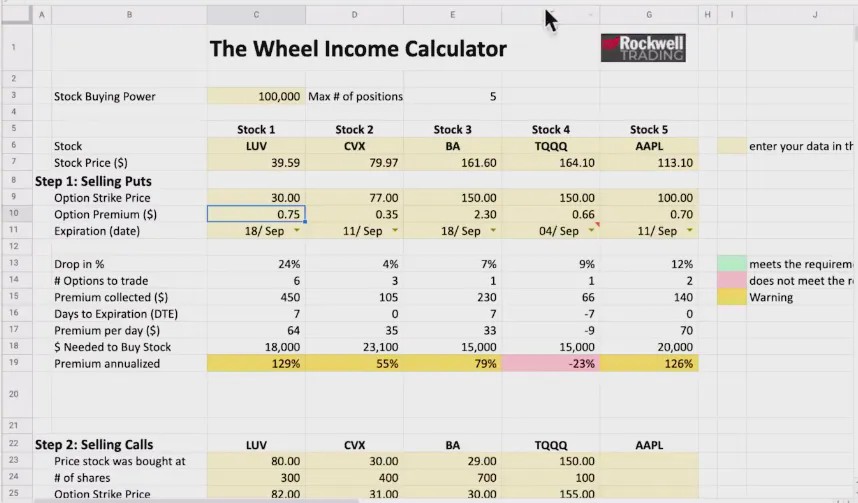

This is why I’m using tools like the PowerX Optimizer that helps me to find the best stocks and options to trade.

So here is the PowerX Optimizer.

It shows me for any given stock the signal, the position size, how much I should trade, how much money I can potentially make, and how long I’m in a trade.

All of this is important to me so this is why I love to have tools.

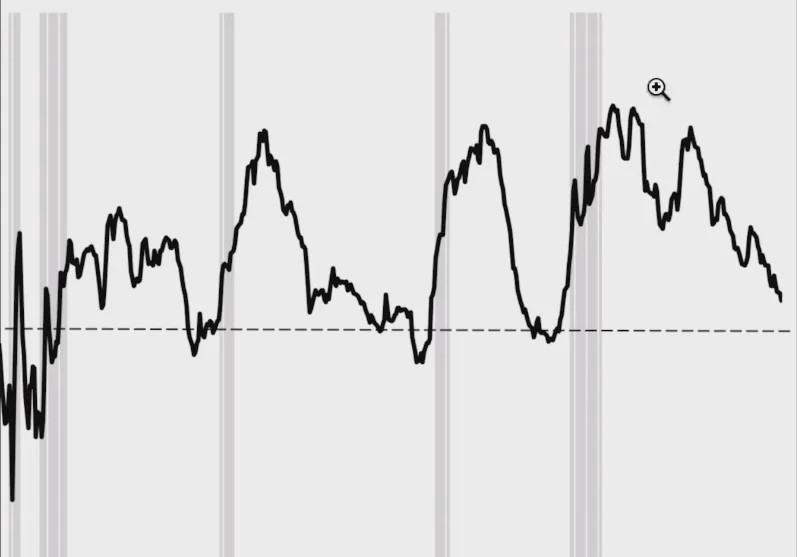

And for The Wheel strategy, for example, I use the wheel income calculator. Let me show this to you.

So this is my income calculator that I’m using for picking the best stocks and options for The Wheel.

You see, I need to make sure that I’m getting the very best trades for my trading. I personally would never trade without the right tools. It’s like trying to compete in a Formula One race with a Toyota Prius.

I mean, nothing against a Prius, but you won’t win a Formula One race with it. And when trading your trading against some of the smartest minds in the world. Don’t bring a knife to a gunfight, have the right tools.

3. You need to have the right mindset

So finally, number three, what is the third thing that you need here? It is the right mindset.

What do I mean by this? You see, when trading there will be losses and you need to know how to limit your loss because otherwise these losses will be devastating.

Who knows what I’m talking about? You see, you need to know how to control your risk. Take care of your losses. The winners, they can take care of themselves.

Summary

Now, here’s something to remember that is super, super important. Trading is a marathon, not a sprint.

So super important and here’s why.

Good for you if you made a $1,088 in profits in day trading, or if you made $1,253 profits in three minutes. And you know what? Good for you if you made $32,625 during the coronavirus in 24 hours.

But let me ask you this, how much money did you lose before that? How much money did you lose right after you made these profits? Did you give it right back?

You see, I see too many traders being blinded by these windfall profits, by these, “Hey, look at me. Look at what I did” stories and they don’t see the full story.

This is why I’m doing this here to show you the full story.

When traders don’t see this full story, when they just see this “look at me” stuff, they start chasing these dreams and they lose a lot of money along the way.

You see, for me personally, I prefer SRC profits. Trading is a marathon, not a sprint.

If you enjoyed this article, feel free to leave a comment below and share it with anyone you think may find this helpful.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.