Three scenarios for Japanese Yen ahead of snap election

- The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election.

- The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

- A lower-than-expected result or a turnout surprise could trigger a fast unwind of bearish Japanese Yen positions.

The Japanese Yen (JPY) trades in an environment where the country's politics has once again become a direct driver of the currency. Two days ahead of the snap election on February 8, polls are not just about forecasting a winner but shaping how markets paint different scenarios, and therefore the risk premium embedded in the Japanese Yen.

What the polls show and why markets are considering them

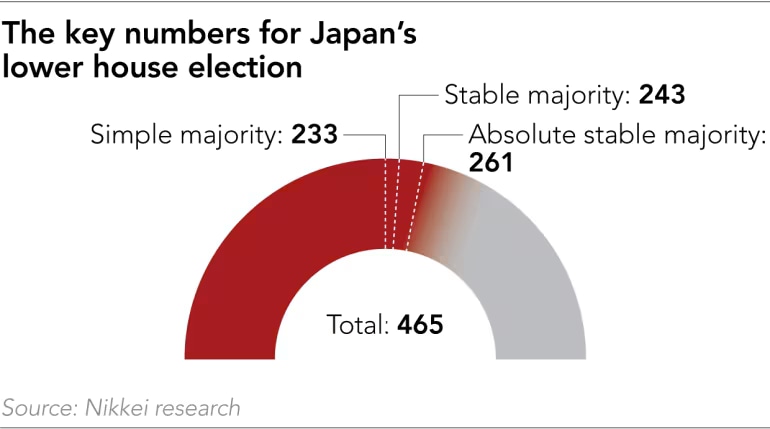

Several major surveys broadly converge on the same message, suggesting that the coalition led by Japan's Prime Minister Sanae Takaichi is in a strong position. A Nikkei poll conducted earlier this week projects that the Liberal Democratic Party (LDP) and its coalition partner, the Japan Innovation Party (JIP/Ishin), could clear 300 seats out of 465 in the Lower House. A similar projection has also been flagged by the Japanese newspaper Asahi Shimbun, while separate polling attributed to Kyodo News suggests the LDP could even secure a single-party simple majority above 233 seats on its own.

In Japan’s parliamentary mechanics, these numbers matter more than the binary question of who wins. With 233 seats, the ruling camp controls the Lower House. Above 261, it strengthens its grip on committees and chair positions, enabling smoother agenda-setting and faster lawmaking. And if the bloc moves close to a two-thirds threshold, institutional frictions diminish further, because the Lower House gains greater ability to push legislation through even when the Upper House is uncooperative.

In short, the more polls point to a large win, the more the market prices in the possibility of rapid execution of the government’s economic platform.

One factor adding international attention is the public support expressed by US President Donald Trump to Takaichi, alongside prospects of meeting in March. For Forex markets, this is not a fundamental driver, but it can amplify media focus, harden narratives and accelerate short-term positioning.

Why a victory of the ruling bloc can be negative for the Japanese Yen

The current paradox is that an election win of the ruling bloc, which would be normally associated with political stability, can become negative for the currency if it is linked to a fiscal path seen as too expansionary. Markets are not punishing stability, but they are pricing the risk that stability translates into a policy blank cheque.

The most tradable campaign pledge remains a temporary suspension of the consumption tax applied to food. For households, it is simple. For investors, it is immediately a funding question, as the revenue hole must be offset through spending cuts, other tax measures, or increased Japanese government Bond issuance.

In a country that is slowly leaving decades of near-zero interest rates behind, that sensitivity matters. As yields rise, debt-servicing costs become more rate-sensitive, and the ultra-long end becomes a confidence gauge. This is why a fiscal-driven sell-off can weigh on JPY even though, in theory, higher Japanese yields might support the currency through narrower rate differentials. If yields rise because investors demand more term premium for fiscal and credibility risk, that move can be Yen-negative rather than Yen-positive.

Three scenarios for the Japanese Yen

Polls do not reduce the event to just a final result. They mainly skew the distribution toward “strong mandate” outcomes. Markets, therefore, tend to frame the vote in three broad buckets.

1. A large ruling bloc win of around 300 seats, without a credibility shock

This is the scenario where consensus projections broadly materialize with a comfortable mandate, smoother execution, and a FY2026 budget that passes on time or with manageable delays.

In this setup, the market may initially keep pressure on the Japanese Yen because the probability of a larger fiscal package rises. But the key is the quality of post-election messaging. If the government emphasizes phasing, temporary design, and issuance plans that avoid saturating the ultra-long sector, the risk premium can stabilize.

This scenario is consistent with a choppy Japanese Yen rather than a one-way moving currency. Markets may “sell the headline” on fiscal optics, then gradually re-price more traditional drivers such as the Bank of Japan (BoJ) and US yields.

2. An overwhelming victory of LDP and allies that implies near-total legislative dominance

If the result significantly beats expectations, the market interpretation becomes more aggressive with faster execution, fewer compromises, and therefore a higher probability that costly pledges pass in a less diluted form. In that case, the Japanese curve could steepen further and pressure on JPY could intensify in the near term.

This is also the scenario where intervention risk rises sharply. Markets tend to focus less on a precise level than on a move that becomes too rapid and too one-directional. The faster USD/JPY climbs, the more incentive the Ministry of Finance has to break momentum, especially if the Japanese Yen weakness risks feeding imported inflation just as the government is promising cost-of-living relief. Intervention can trigger sharp pullbacks, but durability still depends on the US rate backdrop and the the Bank of Japan's monetary policy stance.

3. An election surprise, weak turnout, or a less decisive LDP coalition win than polls suggest

Even if polls dominate the narrative, they carry a classic risk of lower turnout among Takaichi-leaning voters or resistance in certain urban districts. If the outcome is less impressive than the average projection, markets could quickly unwind the “Takaichi trade” with the result that yields ease, the risk premium compresses and the JPY strengthens.

But this scenario is not automatically positive over the medium term. A weaker mandate can reopen the door to messy, expensive compromises needed to pass legislation and budgets. That mix often produces the least comfortable currency profile with less visibility, more noise, and a harder path to locking in the FY2026 budget.

The Bank of Japan’s role and the Yen’s real equilibrium

Across all scenarios, the Bank of Japan remains the indirect arbiter. It does not react to election results per se, but to their consequences for inflation, financial conditions and the exchange rate. If fiscal policy keeps inflation stickier or Japanese Yen weakness lifts imported inflation, the case for faster monetary normalization strengthens at the margin. If yields become disorderly and tighten conditions too abruptly, the BoJ may prefer caution to avoid destabilizing growth.

Ultimately, the February 8 vote is less a political event than a “mandate versus credibility” test. Polls point to a strong win. The Japanese Yen’s direction will hinge on whether that win is used to accelerate costly promises or instead to secure enough political capital to phase, fund and calibrate measures in a way that avoids reigniting stress in the Japanese Bond curve.

USD/JPY technical analysis: Bullish momentum holds above key moving-averages

USD/JPY 4-hour chart. Source: FXStreet

The USD/JPY pair trades at 157.10 at the time of writing on Friday on the 4-hour chart. The 100-period Simple Moving Average (SMA) extends its slide below the 200-period SMA, maintaining a bearish alignment, while the longer average edges higher. Price holds above both references, with the 200-period SMA at 156.60 offering nearby dynamic support. The Relative Strength Index (RSI) prints at 67, signaling firm bullish momentum but without reaching overbought conditions.

Measured from the 159.45 high to the 152.10 low, the 78.6% Fibonacci retracement level at 157.88 caps the topside. Immediate resistance aligns at 157.34. Next cushions are seen at the 61.8% retracement at 156.64, and then at the 200-period SMA at 156.60, keeping the near-term bias supported while momentum stays firm.

(The technical analysis of this story was written with the help of an AI tool.)

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ghiles Guezout

FXStreet

Ghiles Guezout is a Market Analyst with a strong background in stock market investments, trading, and cryptocurrencies. He combines fundamental and technical analysis skills to identify market opportunities.