Bitcoin Weekly Forecast: The worst may be behind us

- Bitcoin price reaches a low of $60,000 on Friday, marking three consecutive weeks of losses exceeding 30%.

- US-spot ETFs record an outflow of $689.22 million through Thursday, pointing to the third consecutive week of withdrawals.

- CryptoQuant’s Coinbase Premium Index spiked positive as BTC slipped toward $60,000, signaling some signs of short-term recovery in the ongoing downward trend.

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%. Institutional demand for BTC continues to weaken, pointing to a third consecutive week of withdrawals.

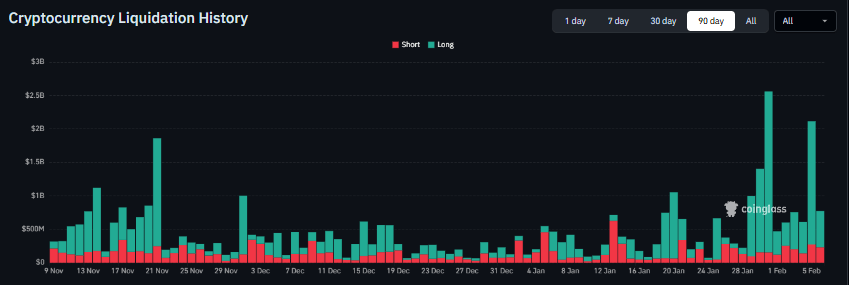

Billions in liquidations

Bitcoin price continued its downward trend, having corrected more than 15% so far this week and reaching a low of $60,000 on Friday. This downward spiral in BTC price triggered a wave of liquidation across the crypto market, wiping out a total of $4.85 billion as of this week, according to the chart below from Coinglass.

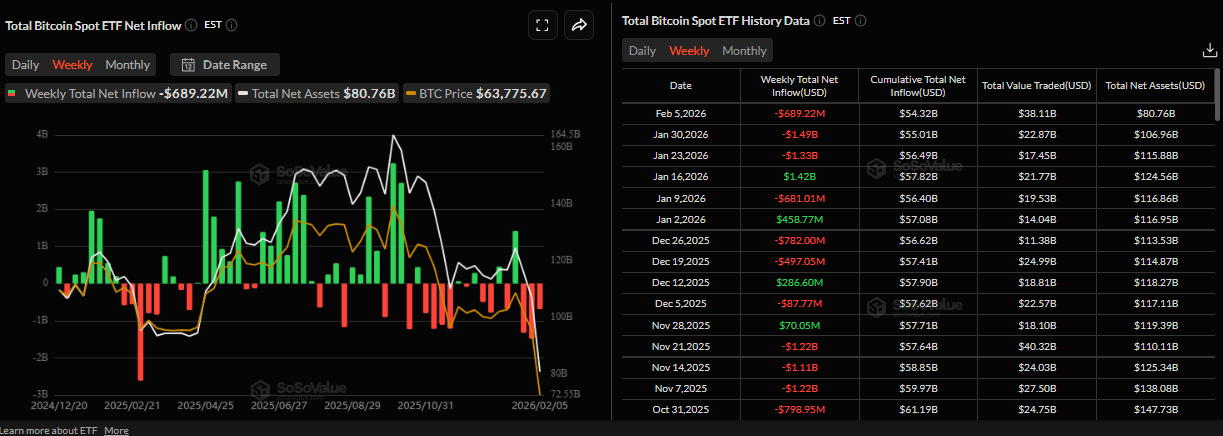

Fading institutional demand

Institutional demand for Bitcoin supported its price correction. The outflows remained robust through Thursday, totalling $689.22 million, according to SoSoValue data. These withdrawals point to the third consecutive weekly outflows since January 23, failing to support BTC prices. If this trend continues, BTC could see further correction in the upcoming weeks.

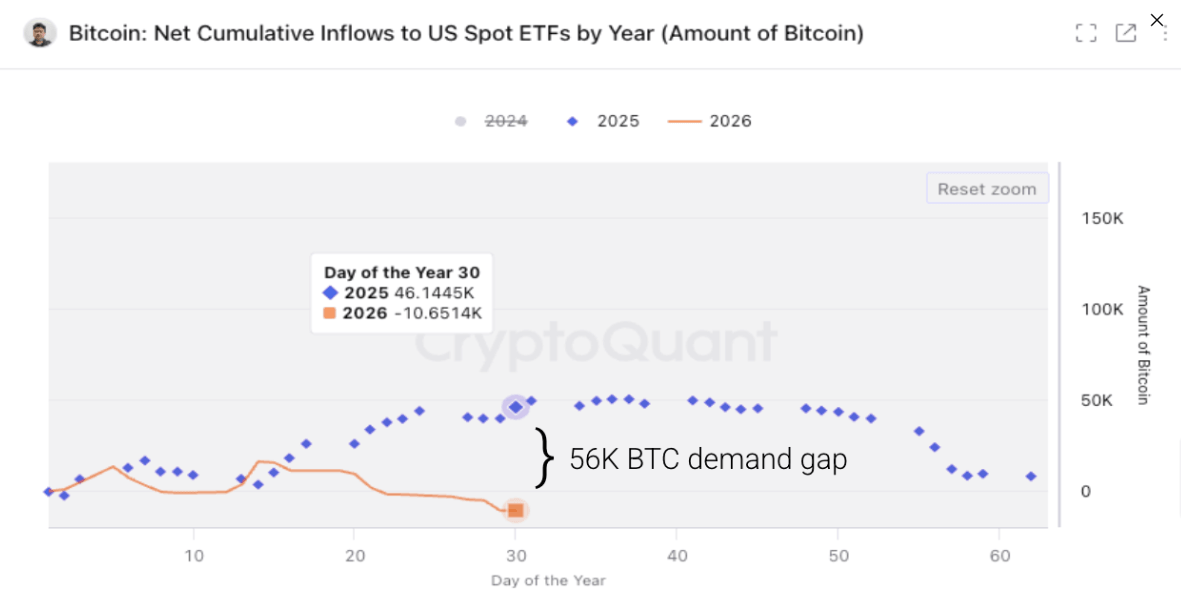

A deeper dive into institutional demand reveals that demand for BTC has reversed materially. The CryptoQuant chart below shows that, compared with the same period last year, these ETFs purchased 46,000 BTC on a net basis, contributing to Bitcoin demand growth. However, ETFs have been net sellers of Bitcoin so far in 2026, reducing their holdings by 10,600 BTC, leaving a 56,000 BTC gap versus last year. This has led to lower demand and greater selling pressure.

Weakness in the US job market fuels BTC correction

On the macroeconomic front, the global risk sentiment weakens, fueling further correction in Bitcoin. Bets on more interest rate cuts by the US Federal Reserve (Fed) in 2026, bolstered by signs of weakness in the US job market, are another factor contributing to Bitcoin’s price correction.

On Wednesday, the US Automatic Data Processing (ADP) Research Institute reported that private-sector employers added 22K new jobs in January. This marked a notable decline from the previous month’s downwardly revised reading of 37K, and missing estimates of a 48K rise.

Furthermore, the US Job Openings and Labor Turnover Survey (JOLTS) data released on Thursday revealed that the number of job openings on December stood at 6.542 million, compared to the previous month’s downwardly revised print of 6.928 million.

Adding to this, the US Department of Labor reported that the number of citizens submitting new applications for unemployment insurance rose to 231K for the week ending January 31 from the previous week’s 209K. The reading was also higher than estimates for a rise to 212K.

Meanwhile, US President Donald Trump nominated Kevin Warsh as the next Federal Reserve chair, which has served as a sell-the-news event.

“Even though Bitcoin reacted negatively to the Warsh nomination, along with the broader macro, the crypto has been underperforming since Oct 2025,” says Deutsche Bank Research analyst.

US aircraft shoots down Iranian drone, tensions escalate

Bitcoin price correction was fueled late Tuesday after reports that the US military shot down an Iranian drone that had “aggressively” approached the USS Abraham Lincoln aircraft carrier in the Arabian Sea.

“The incident occurred as tensions in the Middle East are high, with President Donald Trump weighing potential military strikes against the Islamic Republic,” reported CNBC.

These developments have reduced investors’ risk appetite, despite Trump’s special envoy, Steve Witkoff, is scheduled to meet with Iranian officials on Friday.

Market participants are closely monitoring developments in the US–Iran negotiations, as any signs of rising geopolitical tensions could trigger deeper corrections toward the riskier assets such as BTC.

Experts are bearish as BTC correction deepens

Bitcoin’s sharp correction – nearly 15% this week, 25% year-to-date, and 50% from its all-time high of $126,199 – it has turned many market experts increasingly bearish on BTC.

Veteran trader Peter Brandt explained in an X post that Bitcoin’s recent decline, marked by eight consecutive days of lower highs and lower lows, bears the hallmarks of “campaign selling” rather than retail-driven liquidation. Brandt added that he has “seen this pattern hundreds of times over the decades,” cautioning that the timing of when such selling pressure exhausts itself remains uncertain.

In addition, Stifel, an independent investment bank, says Bitcoin could fall to $38,000 based on past cycles, citing tighter Federal Reserve (Fed) monetary policy, slowing US crypto regulation, shrinking liquidity, and heavy ETF outflows.

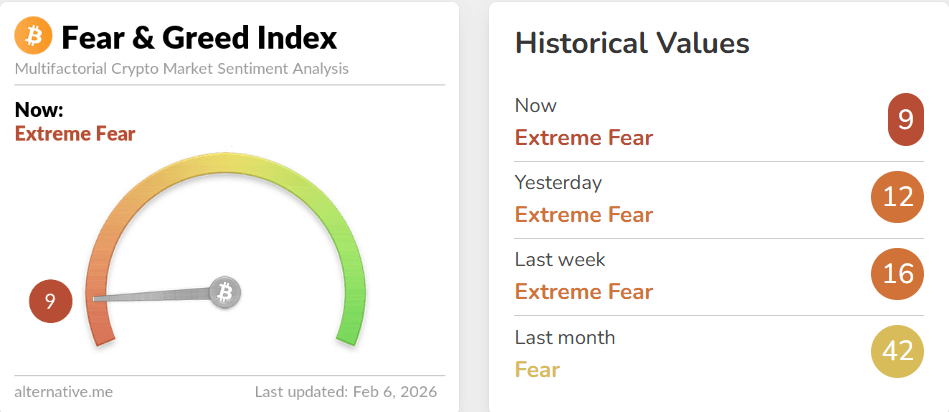

The sentiment chart shown below has declined to “extreme fear,” indicating waning institutional and retail interest.

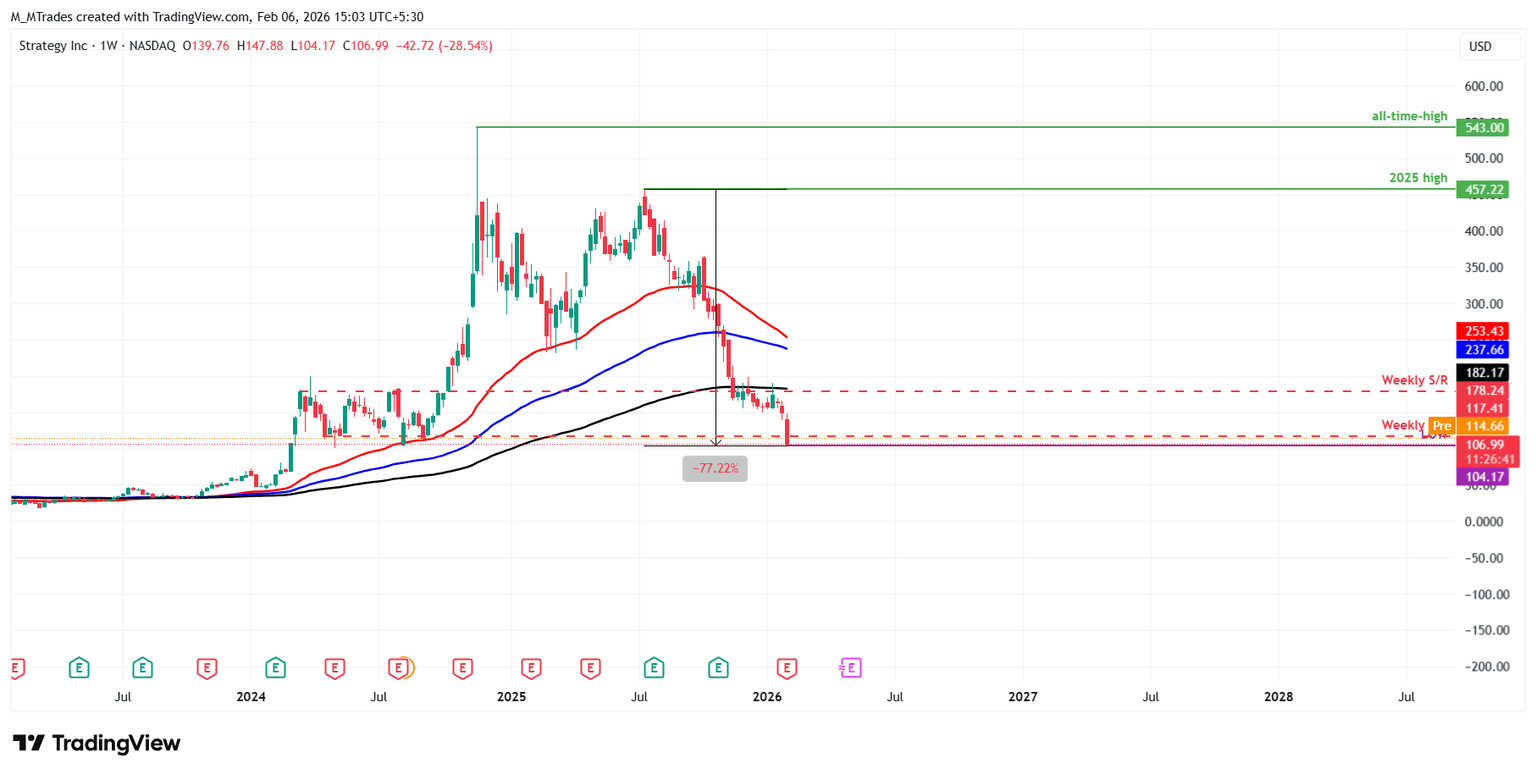

Strategy confirms net loss of $12.4 billion in Q4

Strategy, the largest corporate holder of Bitcoin, with 713,502 BTC in its reserves, announced its Q4 earnings on Thursday. The firm confirmed a net loss of $12.4 billion for the fourth quarter.

The pain has deepened this week, with BTC hitting a low of $60,000 on Friday, while MSTR stock prices closed down by more than 17% after Thursday’s announcement. MSTR has erased post-election gains, with the stock price nosediving by more than 77% from its 2025 high of $457.22, reaching a low of $104.17 on Thursday, levels not seen since August 2024.

Michael Saylor, founder of Stragegy, has said the company faces no margin calls and has $2.25 billion in cash, enough to cover interest and distributions for more than two years. However, Bitcoin trading below the firm’s average purchase price of $76,052 adds further pressure.

Famous Wall Street trader Michael Burry, who bet on the 2008 housing market crash, warned that Bitcoin’s ongoing decline could destroy significant value, especially for companies holding large BTC reserves.

Burry added that Bitcoin’s drop could trigger a “death spiral” among corporate holders and leave Saylor’s firm billions underwater.

“His remarks revived a long-running critique echoed by short-sellers like Jim Chanos, who flagged Strategy’s reliance on non-earning assets and speculative leverage well before the recent breakdown,” noted a Bloomberg report.

Some signs of optimism

CryptoQuant founder Ki Young posted on X on Friday that “plunge protection team just arrived.”

Young showed that CryptoQuant’s Coinbase Premium Index spiked positive as BTC slipped toward $60,000 during early Friday. This positive spike indicates that large-wallet investors (whales) have accumulated BTC during this dip, which could signal a short-term recovery within the ongoing downward trend.

Sandra Brekalo from Crypto Finance Group said in a research note that Bitcoin's recent sharp fall increasingly resembles a positioning and leverage reset rather than the early stages of a deeper structural unwind. Still, she added that the crypto market needs a fresh catalyst to reignite upside momentum. "Until such a narrative emerges, price action is likely to remain volatile and range-bound, even as underlying positioning improves," she said.

Where is the bottom?

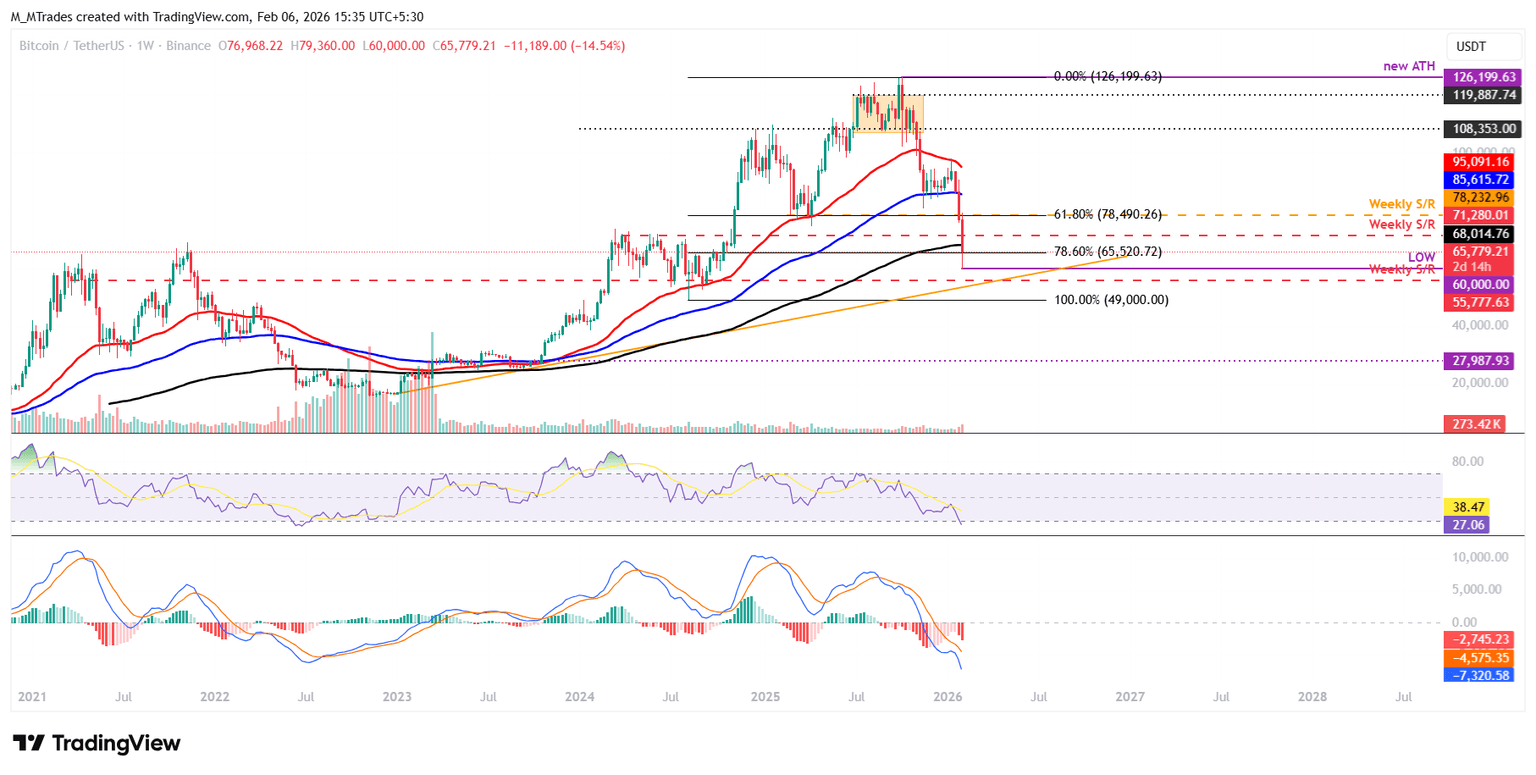

Bitcoin’s weekly chart slipped below the 200-week Exponential Moving Average (EMA) at $68,014, reaching a low of $60,000 on Friday. However, BTC has rebounded slightly, trading at $65,700 after retesting this key psychological level.

If BTC closes below the 78.6% Fibonacci retracement level (drawn from the August 2024 low of $49,000 to the October 2025 all-time high of $126,199) at $65,520 on a weekly basis, it could extend the decline toward the next weekly support at $55,777, which roughly coincides with the ascending trendline (drawn by joining multiple lows since December 2022).

The Relative Strength Index (RSI) reads 27 on the weekly chart, an oversold condition, indicating strong bearish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator on the same chart also showed a bearish crossover in mid-August, which remains intact, further supporting the negative outlook.

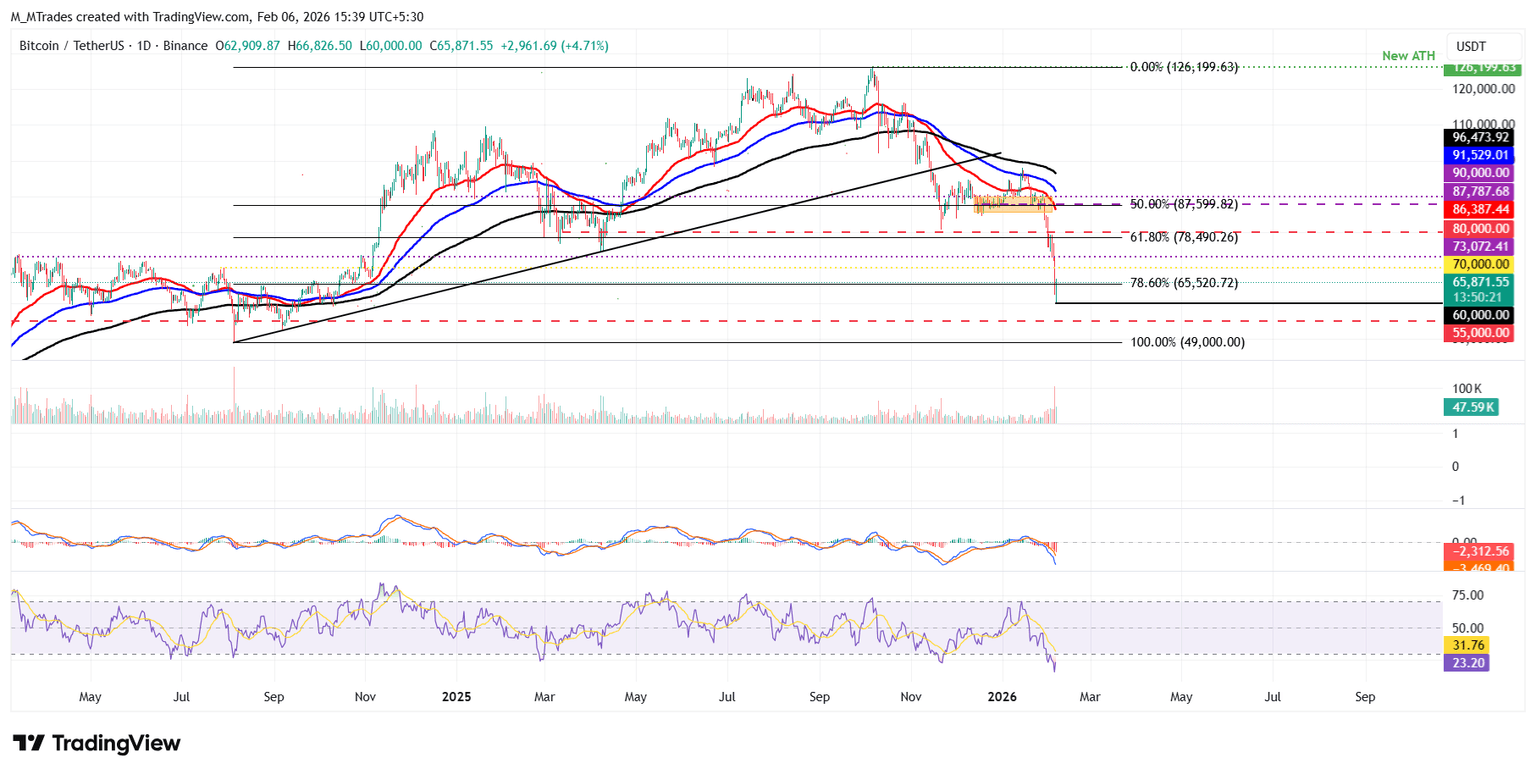

On the daily chart, Bitcoin’s price has crashed by more than 15% so far this week, after correcting by 11% the previous week. As of writing on Friday, BTC has reached a low of $60,000, a level last seen in mid-October 2024.

If BTC continues its correction, it could extend the decline toward the next psychological support at $55,000.

The RSI reads 23 on the daily chart, an oversold condition, indicating strong bearish momentum. Additionally, the MACD indicator showed a bearish crossover on January 20, which remains intact with rising red histogram bars below the neutral level, further supporting the negative outlook.

However, after such a massive correction, the chances of price consolidation remain high rather than a sharp recovery. If BTC consolidates, it could do so between $60,000 and $70,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.