What Is a Futures Contract Rollover?

In the futures market, the transition from an expiring futures contract to a new futures contract is called a rollover. Since futures are derivatives contracts that control an underlying asset they, like many contracts, have a start and finish date. Because there is a shelf life to futures markets, traders must close their existing positions in the contracts that are close to expiring. If they elect to continue trading that asset, before the contract expires they will rollover their position (close the expiring position and open a new position) which will trade until the next cycle of expiration, usually several months into the future.

Timing of Futures Contract Expirations

To someone new to trading futures, futures contract expirations and, more importantly, knowing when to rollover could be confusing. That’s because all types of futures contracts do not expire in the same months or at the same time during the month.

Financials

Every quarter (March, June, September and December) the futures contracts that track interest rates, currencies, and the stock index futures come to the end of their contract life and expire. This necessitates the need for traders engaged in these markets to exit these contracts and, if desired, roll them over to the next quarterly month. However, the contracts don’t all expire on the same day, so the Futures Rollover event is happening throughout the month across most futures contracts. Futures traders must pay attention to the expiration date and futures rollover deadline for the contract they are trading.

Non-financials

The fact that financials all carry quarterly expiration makes it is easier for traders to remember when to rollover. In contrast, all of the traditional commodities such as oil, gold, wheat and the like, rollover more frequently because many producers use these contracts as a way to hedge against their cash crops and businesses use them to hedge against rising costs of buying the underlying commodities. Since these futures contract expiration dates vary, it is even more important for traders to pay attention to the futures rollover deadlines affecting their positions.

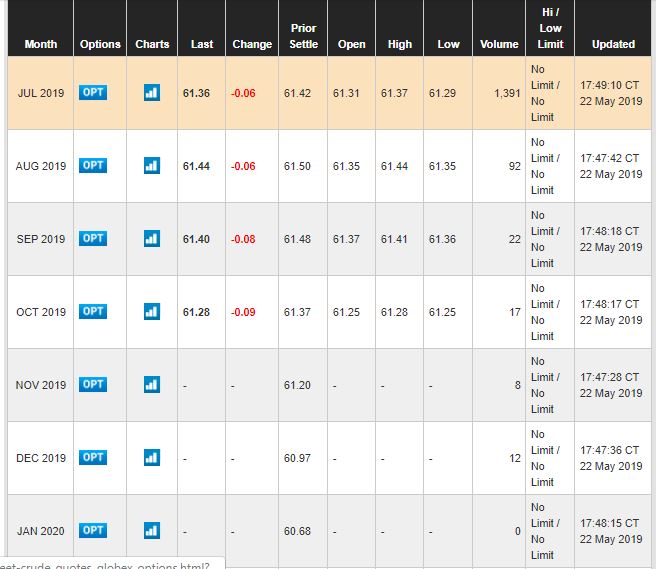

As an example, below is a calendar of all the pertinent dates for Crude Oil. In it, we see that Crude has a contract for every month of the year. This is unique for the energy complex as it is used by many businesses to hedge a possible increase in the price of Crude oil.

What Happens If a Futures Contract Doesn’t Rollover or Close Before Expiration?

One of two things can result from failure to rollover or close, meaning that a trader finds himself still in position on the day the futures contract expires: forced liquidation and slippage.

If a trader holds on to an expiring contract after the first notice date (the date in which a trader may be required to accept delivery) it could cause all sorts of headaches for the broker, not to mention the trader himself. To minimize the headaches the broker may force liquidate the position and will likely do so without regard to price which could result in losses. Also, the broker will likely deem the trader negligent for missing the rollover date and suspend the account for a given period.

Losses are especially likely since liquidity in the expiring contract starts to dry up immediately after rollover day. As liquidity dries up, spreads become wider which could lead to trades becoming more prone to slippage.

Futures Contract Settlement Date

The most important date for traders is the settlement date, which is the last day the contract will trade and, therefore, the last day to close out or rollover a futures contract. A trader will have to rollover the expiring futures contract on or before the settlement date which occurs just before the contract expiration date.

The CME maintains a futures expiration calendar and an explanation for all the terms. The products are grouped by sector. To get to the calendar, simply find the specific futures contract and click on the product name link which will take you to the contract specifications page in which you will see the calendar tab.

Take note that futures rollover day differs depending on the type of futures contract being traded. In other words, the number of days before expiration when a trader needs to exit one contract for another varies. Below is a list of the sectors and days prior to expiration when rollover occurs:

-

Equity indexes – 7 days

-

Currencies – 3 days

-

Interest Rates – 14 days

-

Metals – 20 days

-

Grains – 10 days

-

Energy – 3 days

With this information, you simply check the product calendar at the beginning of every month and prepare to make the switch (close out the expiring month) from one contract and open (or rollover) a contract from the next month which will have increased volume. This is done according to the rollover days I’ve spelled out above. It’s as simple as that and just an extra, albeit necessary, step when you’re trading Futures contracts.

Read the original article here - Futures Contract Rollover Explained

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.