The path to financial freedom is paved with challenges, and for traders and investors, choosing the right proprietary trading firm can make all the difference. The focus falls on three notable names in the industry: Top Step, FTMO, and the up-and-coming Accelerated Prop Group (APG). Each offers a unique approach to helping you unlock the door to the next generation of prop trading.

But What are the Benefits of Prop Trading?

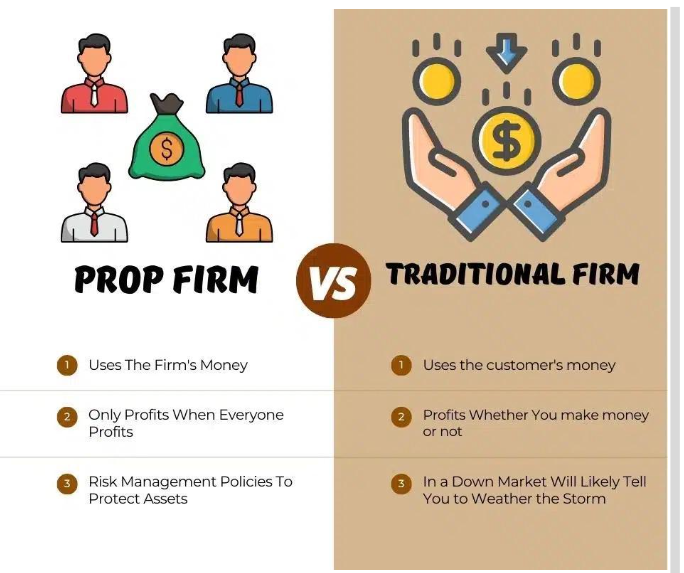

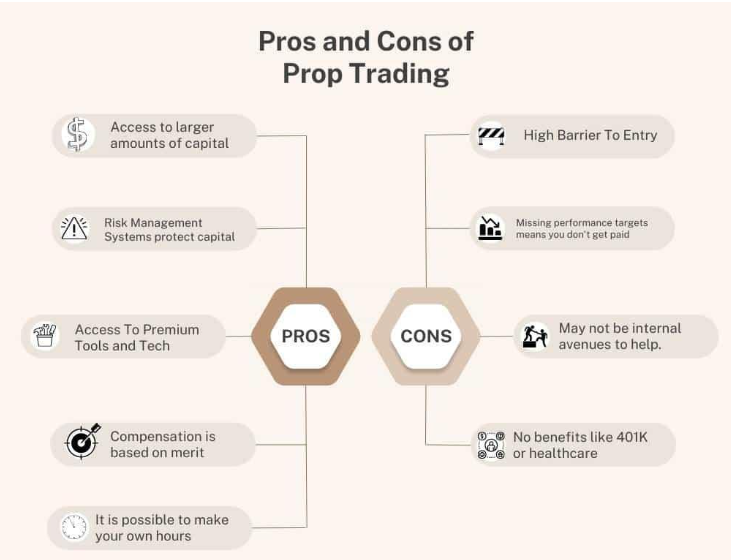

Prop firms are not only more collaborative but also offer better risk management than traditional firms. As well as this, prop traders have access to larger amounts with which to trade.

APG’s low barrier to entry and 24/7 internal support network are helping to make prop trading a safer and more profitable place. Read on to find out more!

APG: The Next Generation Prop Trading Firm

APG is the new kid on the block, but it's quickly turning heads with its innovative features and market-leading methods. They've crafted a two-step Evaluation Process that sets them apart from the competition. Most prop firms impose a 30-day time limit to pass evaluations, but not APG. This flexibility is a breath of fresh air for traders. With APG, the old saying ‘time is money’ takes on a new meaning.

Additionally, APG offers little to no spreads, ensuring minimal interference in your trades. In what is a huge feature, APG provides quicker access to your profits by offering bi-weekly payments. No more waiting 30 days for your money!

The leverage is another winning point; APG offers 1:100 leverage, higher than the 1:60 typically offered by other firms. Plus, their pricing is more affordable, giving you better value for your money.

Finally, APG University offers comprehensive training and courses for those who are new to the prop trading world. Tailored mentorships offer tips on trading psychology and risk management to name a few…

Explore APG’s Proprietary Trading Courses and Take the First Step towards Success here.

Top Step: The Path to a Better Lifestyle

Top Step's vision and mission focus on transforming traders into better traders with healthier habits. They've funded thousands of traders globally, paying out millions in withdrawals. Their accolades, including being on the Inc. 5000 list and recognized by Crain's as one of the best places to work in Chicago, speak to their success.

Top Step's approach involves the Trading Combine, an experiential learning and evaluation program for futures traders. However, it's essential to note that their Maximum Loss Limit (MLL) calculation differs from APG.

While other prop firms often calculate MLL based on unrealized profits intraday (high water mark), Top Step calculates it based on your end-of-day balance, offering more trading room. The Trading Combine encourages discipline and skills growth in simulated markets.

FTMO: Learning by Doing

FTMO is another established name in the prop trading world. Their 2-step Evaluation Process involves the FTMO Challenge and Verification stages, which traders must pass to access an FTMO Account. Once qualified, traders can earn up to 90% of their profits, a tempting proposition, and one that is matched by APG but not Top Step.

The Path to Financial Freedom

As traders look to the next generation of proprietary trading, they are presented with various choices. APG stands out with its flexible evaluation process, more frequent payouts, and enhanced leverage and pricing, making it perhaps the most enticing option for those wishing to get into proprietary trading.

Top Step focuses on nurturing improved trading practices, emphasizing healthy habits. Meanwhile, FTMO offers a comprehensive 2-step evaluation process, coupled with significant profit-sharing potential.

Each of these three firms boasts unique strengths tailored to different trader preferences and objectives. It's essential to consider one's individual trading style, goals, and priorities when selecting the most suitable prop trading firm. Ultimately, the road to financial freedom is a personal voyage, and these firms could be the key that unlocks the door.

For more information: Visit APG's website

This article is sponsored content

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.