Here at Littlefish FX, our whole trading ethos is centered around trying to trade in the same direction as the big fish: the Banks and major financial institutions. Whilst in the past, trading aspirations such as this would have been relatively impossible due to lack of information available to traders outside of these institutions, we now find ourselves at an incredibly interesting and exciting point, with market data, information and analytics creating opportunities for retail traders that have never before been seen.

With that in mind, we have designed what we believe to be some of the most consistent and profitable trading strategies available built around this central theme of using the available market data to trade in line with the big players instead of against them, a trap which many retail traders fall foul of.

These strategies comprise of using the Order Flow Indicators available on the Reuters Eikon trading software platform and our very own COT indicator (to be used on NinjaTrader 7) which automatically displays the information from the weekly Commitment of Traders report in a really effective visual format on your charts.

We have also developed an Order Flow Indicator package which can be used on Metastock Pro which is a professional market data & charting package, the LFX Order Flow Trader, which automatically generates trading signals for you based on a confluent crossover of the Psychology & Order Book Regression indicators.

Here is a quick look at a strategy combining both the COT indicators we built for NinjaTrader and the Order Flow Indicators we use on Eikon.

So first of all we look to our NinjaTrader charts to see if the COT Indicator is giving any clues as to potential moves. As many of you will now be aware, the green lines on the indicator signal the Non-Commercial market participants (the Banks & institutions) and these are the guys we want to be trading in line with.

Looking at this USDCAD Daily chart we can see price beginning to trend higher from the September lows, whilst COT indicators remain to the downside (Green lines below blue). However, as price continues higher through early October, indicators begin to move to the upside and we then see bullish crossovers on Index, Strength, WILLCO & Net Positioning with Momentum moving steadily higher. With these crossovers in place we now have our Bullish trade signal, at which point we move across to our Eikon charts to look for entries using the Order Flow indicators.

_20160324083717-637973707808724631.png)

We can see that on the Bullish candle formed (which marked the final COT crossover on the Index indicator) both Psychology and Order Book Regression indicators crossed to the upside giving us our long trade entry.

Whilst we did see initial bullish crossovers on the COT indicator confirmed by a bullish Pin Bar, we didn’t get the confluent Bullish crossovers on the Order Flow indicators, and as you can see, price moved lower from that Pin Bar before we finally got the entry signals on the Order Flow indicators. This really highlights the value of combining the two indicator sets to clarify entry points once a directional bias has been established.

With COT indicators remaining at highs, keeping the bullish bias intact we can use the order flow indicators on lower timeframes to add to bullish positions.

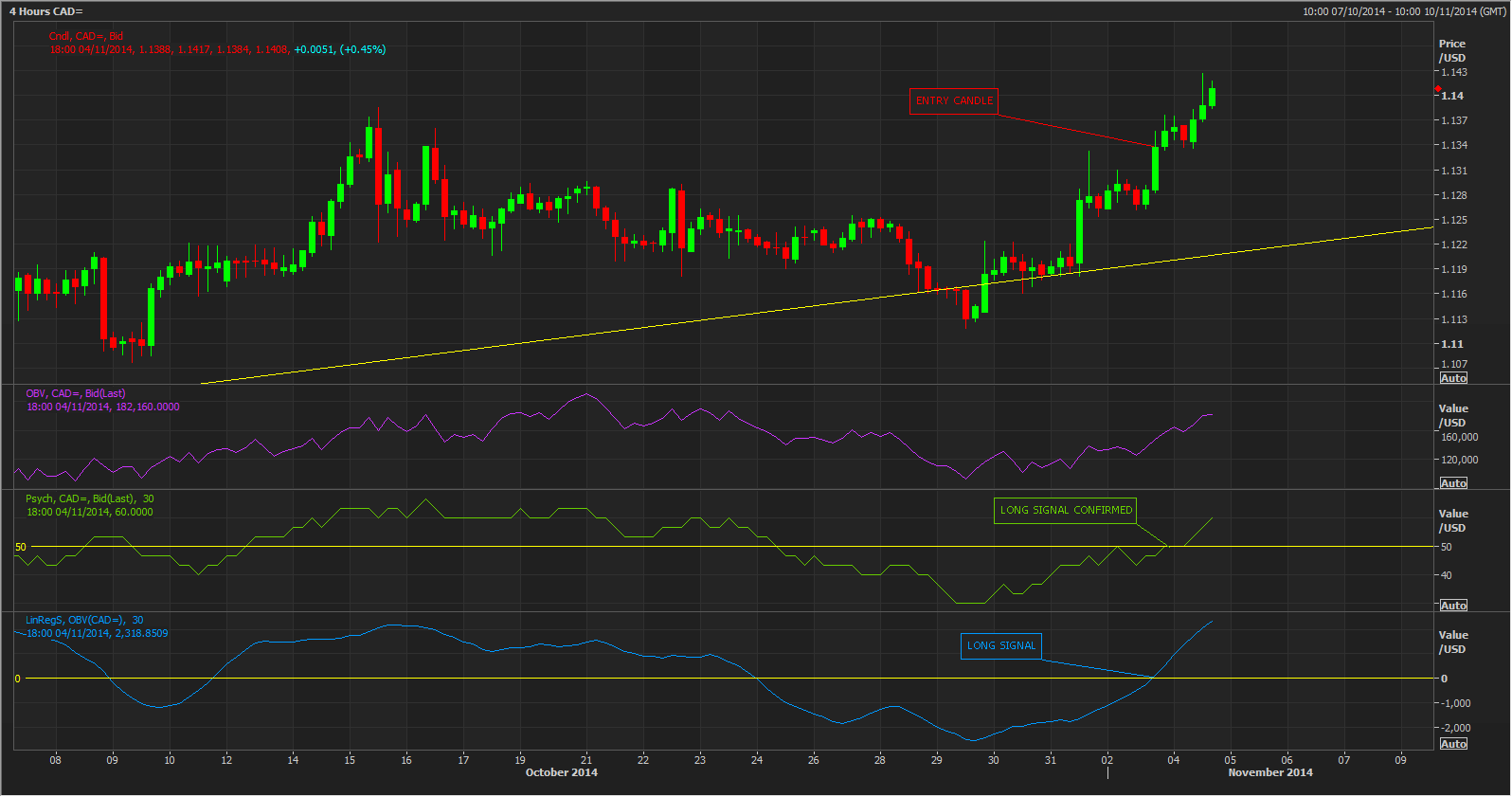

We can see here on the H4 chart that after price consolidated for a period shorty after our initial long position was established we then saw price breaking out to the upside. As this continued bullishness occurred we can see that Psychology & Order Book Regression indicators crossed to the upside giving us a signal to add to our core long position.

This is a very quick look at this combined strategy using both the COT indicators on NinjaTrade7 and the Order Flow indicators on Eikon, but the profitability of combining these tow indicators is evidently clear.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.