I’m Markus Heitkoetter and I’ve been an active trader for over 20 years. I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails. They start trading and realize it doesn’t work this way.

The purpose of these articles is to show you the trading strategies and tools that I personally use to trade my own account so that you can grow your own account systematically. Real money…real trades.

In this article, I want to talk about what to do when you get assigned with a Wheel trade.

Previously, I have shown you the Wheel strategy. It’s a strategy that I’ve been trading for several months and I haven’t had a single losing trade yet, knock on wood.

So I received a lot of comments on my videos asking,

“Yeah. That’s all good. But what do you do when you get assigned with a Wheel trade and the market crashes?”

And that’s exactly what we are going to talk about today.

What To Do When You Get Assigned With A Wheel Trade

I want to show you how to handle getting assigned when the market crashes by using a real trade as an example where this happened to me, and I couldn’t have timed it more perfectly because a little over a month ago, on October 28th, I was recently in such a trade.

The market was down more than 3% and it was a bloodbath. Luckily, this scenario provides me with an opportunity to use it as a template to show you what to do when this happens.

The TQQQ trade I was in at the time works as a perfect example, so let me just show you how things panned out.

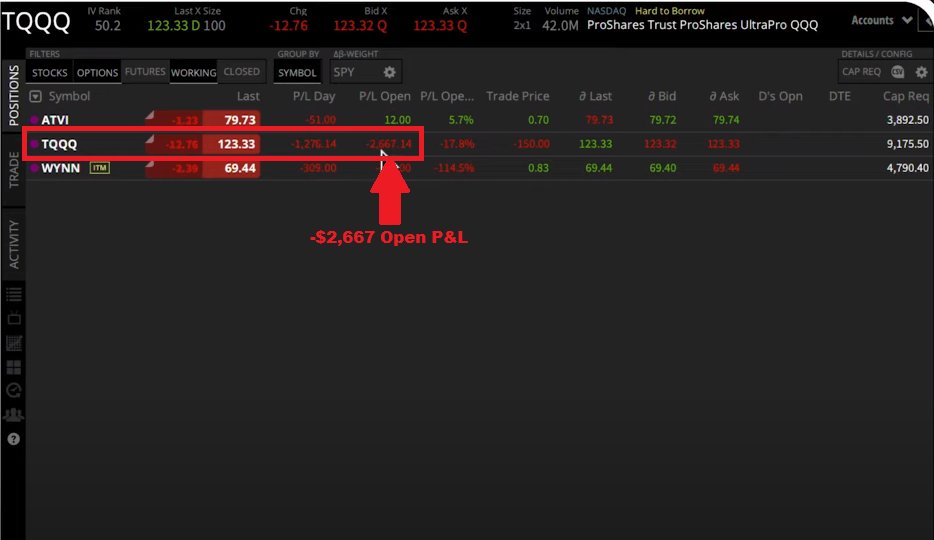

At this time I had three Wheel trades in my account. Something to note, this week I trading a little bit lighter than usual because the elections coming up in just a few days and there’s a lot of uncertainty in the markets.

So with this TQQQ trade, you see right now the open P&L is -$2,667. So what does this mean? Does it mean that we do have a big loss here? No. This is only an unrealized loss, and this is how I handled it.

I simply followed the 5 steps of The Wheel strategy, and the 5 steps are as follows:

Pick a stock that’s going sideways or slightly moving up.

Sell a Put Option, i.e. you have to buy the stock at the strike price.

Collect Premium and buy the Put back when we see 90% of the profits.

If we get assigned, i.e. have to buy the stock, we will sell Covered Callsagainst these shares to try and sell the shares at the strike price.

Collect premium and buy the Call back when we see 90% of the profits.

Selling Puts

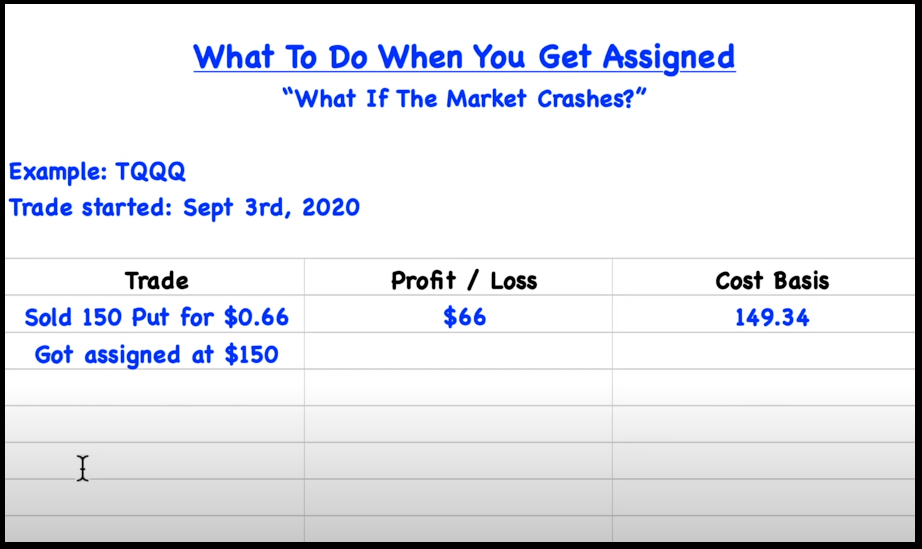

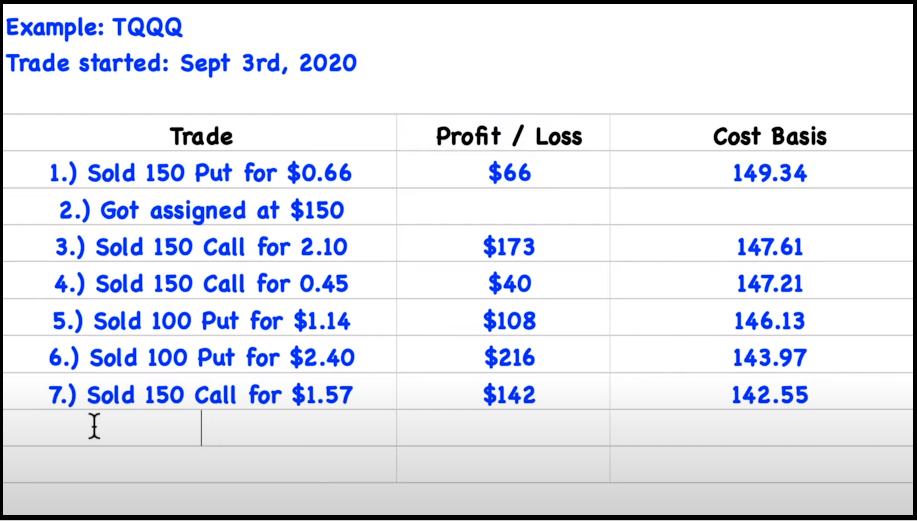

The trade initially started on September 3rd, so let’s backtrack a little bit to really dissect it step by step. TQQQ met all my criteria, and on September 3rd is when I first trading this.

September 3th, when I started trading this, I sold 150 put for $0.66, which is $66 because I traded one contract, and one contract represents 100 shares.

The next day I got assigned. I got assigned because when you’re selling puts it means that if the stock goes below the strike price at expiration, 150 in this case, I would get assigned. This is exactly what happened a day later when the option expired.

So I made $66 by collecting premium, even though I got assigned 100 shares at $150/share, but here’s the deal. Since I sold the put for $0.66 this means that my cost basis, since I keep that premium regardless of whether I am assigned or not, gets lower.

So this means that the $150 a share I paid minus the $0.66 I collected per share, brings my cost basis down to $149.34.

Now doesn’t sound a lot, but it basically means that the stock now does not have to go above $150 anymore. As soon as TQQQ goes up to $149.34 I’m breaking even. Now if it goes above this, I’m making money. Simple right?

Selling Covered Calls

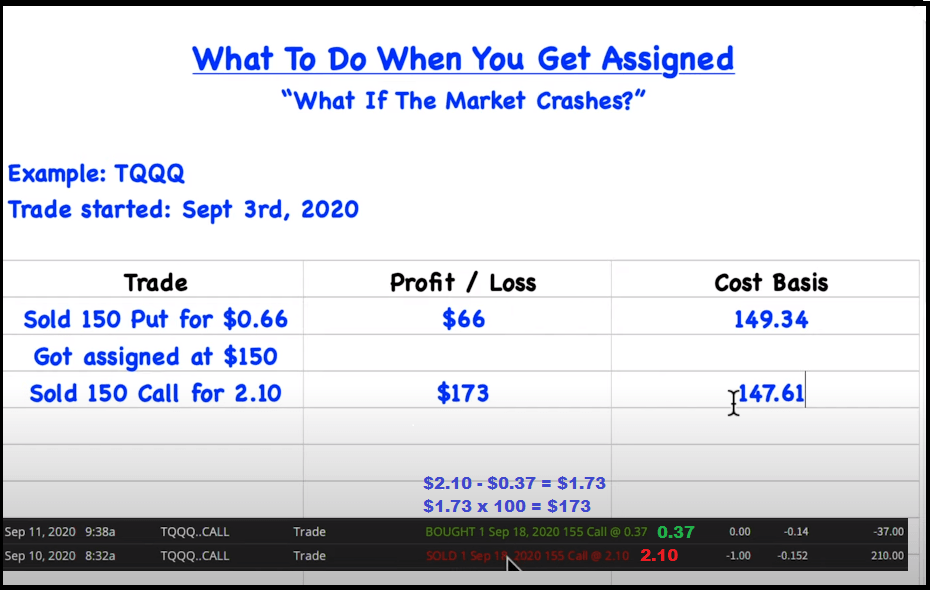

Now that we have been assigned, this is where we start selling Covered Calls.

When you sell Covered Calls against these shares, the goal is to try and sell them at that strike price of that Call, while collecting more premium.

Here’s the trade that I did. I sold a 155 Call for $2.10 on the 10th after realizing 90% of the profits, I bought it back for $0.37 the next day. So $2.10 minus $0.37 means I made $173. And now my cost basis gets reduced by another $1.73.

Well, now our cost basis is going lower. Our cost basis of $149.34 drops by $1.73, so our new cost basis is now $147.61. This means that if the stock goes back to $147.61 we break even, and if it goes above we are making money. Easy right?

Next, I sold the September 80 Call, the September 18 150 Call, for $0.45, then bought it back for $0.05. So this means at this point we made another $40, bringing our cost basis down by another $0.40 to $147.21.

The stock kept going against us. It was going down and this is what many of you are concerned about.

“What do I do if the stock keeps going down?”

Well, you keep selling premium, and by doing so, you’re lowering the cost basis. Well, what I did next was really cool.

Selling More Puts?

So next, I sold actually two puts for $110 and $118. So that averages out to $114. Then I bought them back at $0.06. This means $114 minus $0.06. So we made another $108 here.

Now I’ll explain in a moment why I sold a put here even though right now since we own stocks, and we should be selling calls. There’s a very specific reason for it, and I’ll explain it to you.

Looking back at our trade, we are lowering our cost basis to $146.13. Next, after we sold the puts and they expired worthless I actually sold another 100 put for $2.40 and bought it back for $24. So we made another $216 here. Bringing our cost basis down again from $146.13 minus $2.16 to now $143.97.

When To Sell Puts INSTEAD Of Calls

So if you are supposed to sell Covered Calls during this stage of The Wheel Strategy, why did I sell those Puts? I already owned 100 shares of TQQQ that were assigned to me, so why risk getting assigned more?

Well, I sold these Puts, instead of Calls for a specific reason. At this stage of The Wheel Strategy is where you normally would sell Calls, however, if you are on this part of this strategy, and the market is tanking, you have to make an adjustment to this strategy if the price keeps dropping, to help keep your cost basis as low as possible.

These were 100 Puts, meaning if the price would have dropped below $100 at expiration for either of them, and I would have been assigned the shares.

If that were to happen, I would now own 100 shares at $100 each, on top of the 100 shares I already own at $150 each. So now I own 200 shares, I paid a total of $250 for, bringing the average price per share to $125.

Getting assigned these shares would have lowered my cost basis tremendously. If you subtract the total Premium I received on all of these trades, which was $12.05 a share ($1,205 overall) from the average price per share, which in this case is now $125, this comes to a cost basis of $112.95.

This is what the cost basis would have been IF I was assigned these additional 100 shares at $100 each. I wasn’t assigned these shares, however, and my final cost basis was $137.95.

Do you see why getting assigned is a good thing? People are afraid of getting assigned, but as long as you have adequate buying power, and are following my methods for picking good stocks, assignment should be looked at as a good thing

Selling Premium

You see, this is what the Wheel does. You can sell premium while you own the stocks. Let’s take a look.

So I then sold a $150 call for $1.57, bought it back at 15. So this means that I made another $142 bringing down my cost basis again to $142.55.

Now, I don’t want to bore you and make this article too long here, but long story short, as you can see, I sold a few more of the calls and I bought them back.

So overall, by just selling premium, even though I still owned the stock, I was continuing to lower my cost basis. At this point, the stock was down $2,770.

However, by doing this, by selling more calls and puts here, I was able to make $1,748 in premium.

So this means I made $17.48 per share on these 100 shares. So if you take the $150 minus $17.48 right now, right now my cost basis to break even on this trade is $132.52.

So as soon as TQQQ goes back to $132. Now, what happens if TQQQ keeps going down? I will keep doing what I’ve been doing, following The Wheel Strategy.

I’ll keep collecting premium until at some point, I can sell these shares for a profit.

Recap

So now you know what to do when you get assigned with a Wheel trade, and hopefully, it becomes less scary for you.

I look forward to getting assigned with a Wheel trade because that allows me to sell calls and make even more money.

If the stock keeps going down, I’ll just keep selling, and I will continue to lower my break even more and more.

So, right now, TQQQ does no longer have to go all the way up to 150. It only needs to go up to $132.52.

I just wanted to address this process because I know that many people who are trading this strategy are concerned saying,

“Oh my gosh, what if I get assigned with a Wheel trade?”

It’s a good thing. It’s a good thing and now you know why.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.