This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

With the fourth quarter of 2023 underway, crypto investors are looking ahead to see which digital assets have the potential to outperform the market in the coming months.

Major altcoins like XRP and Solana look poised for gains based on their technicals, while lesser-known tokens like Loom Network could also be set for a fruitful end to the year.

There are even some hot new altcoin ICOs taking place boasting high price potential – with Bitcoin Minetrix grabbing significant attention in this regard.

Ripple’s legal troubles continue to limit XRP’s price potential

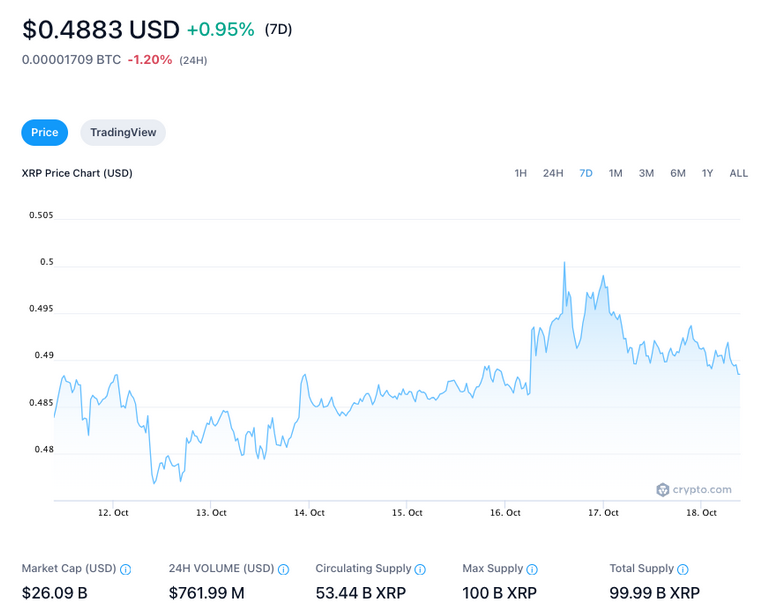

First up is XRP, which has experienced a wild ride in 2023 thanks to Ripple Labs’ ongoing legal battle with the SEC.

Although Ripple Labs has scored several victories over the SEC in court, they have yet to translate to the bullish momentum that XRP holders had hoped for.

Currently, XRP is trading around the $0.489 level, having fallen below the vital $0.50 zone last week.

Many analysts now see XRP testing support around the $0.470 level before any sustained upside move can occur.

However, if investor sentiment begins to improve towards the end of 2023, then there’s a chance that XRP could spike back to August’s high of $0.558.

XRP trading volume has sunk 25% in the past day, so the decreased trading activity suggests that investor interest may be waning

Regardless, while inherently unpredictable, XRP remains a top altcoin to watch through the end of the year.

Solana builds momentum into Q4 through new partnerships

Next up is Solana, currently ranked the world's seventh-largest cryptocurrency with a market cap of $9.9 billion.

Like XRP, Solana has experienced a volatile year so far, with the SOL price soaring over 151% throughout June and July before retracing 46% in the following months.

SOL is valued at $23.93 at the time of writing – roughly the same as in mid-January.

Price is creating higher highs and lower highs on the daily chart, indicating that an uptrend could be on the cards.

Many analysts see upside for Solana in Q4 as the network continues to onboard new projects and form global partnerships, like the one with the Dubai Multi Commodities Centre (DMCC).

Key support sits around $21.00, with the most prominent resistance zone at $25.00.

If SOL’s current bullish momentum persists, the token could retest resistance in the coming weeks and potentially break above for the first time since July.

Loom Network’s fundamentals crumble along with its price

Loom Network’s native token, LOOM, has seen a rough couple of days, with its price falling 65% since Sunday.

This price drop has surprised many investors, as the broader crypto market has been rebounding from recent lows.

LOOM saw an incredible rally over the past few weeks, gaining over 930% between September and its peak.

However, this surge lacked a foundation in strong fundamentals, with on-chain data showing that developer activity on the Loom Network has slowed over the past few years.

With many LOOM holders now opting to sell their tokens and take profits, the sudden departure of investors has furthered the token's sharp decline.

As interest in LOOM dwindles, the token's prospects for Q4 look increasingly bleak, with the nearest support zone around $0.1125 – a further 35% drop from today's price.

Bitcoin Minetrix presale draws attention for passive income potential & raises $1.7m

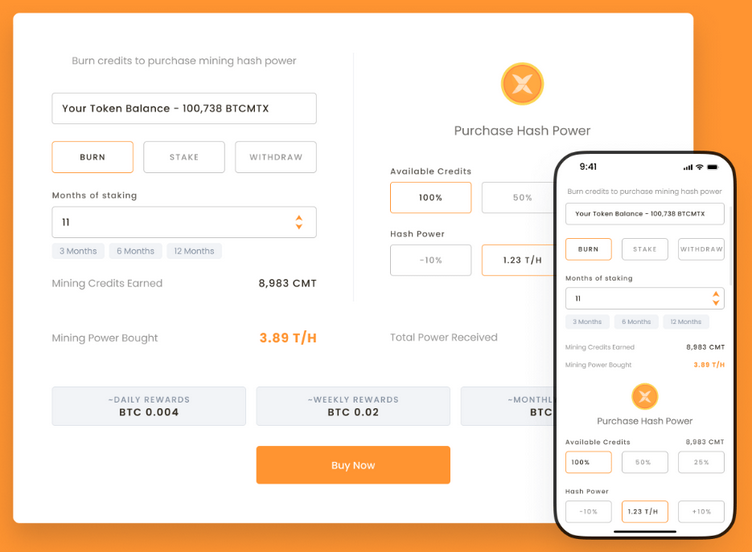

Lastly, Bitcoin Minetrix (BTCMTX) is an emerging token that has been attracting attention in recent weeks.

Bitcoin Minetrix introduces a novel “Stake-to-Mine” model that provides passive income opportunities for everyday investors.

Using this model, BTCMTX token holders can stake their tokens to earn "mining credits," which are then exchanged for cloud mining power to mine BTC.

This eliminates the need for expensive computing equipment, opening up the mining process to everyone.

BTCMTX tokens also provide staking rewards of 346% per year, with over 120.4 million tokens staked already.

These factors have helped create an early buzz around Bitcoin Minetrix’s limited-time presale, which has now raised $1.7 million in less than one month.

Currently, BTCMTX tokens are on offer for $0.011, although since the presale will take a tiered approach, this price point will only be available for 11 more days.

Analysts are bullish on BTCMTX’s outlook once it debuts on major exchanges later this year.

Joe Parys, who boasts a YouTube audience of over 383,000 people, even described it as having “big potential” in Q4.

Fellow YouTube analyst Michael Wrubel also commended Bitcoin Minetrix, highlighting its potential for passive income as a key reason to keep an eye on the project.

With presale momentum accelerating, many early backers believe now is the ideal time to buy BTCMTX tokens at the lowest price possible.

Visit Bitcoin Minetrix Presale

This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

ETF News provides quality insights in the form of financial guides and video tutorials on buying and investing in stocks. We compare the top providers and provide detailed insight into their product offerings. We do not advise or recommend any provider but want to enable our readers to make informed decisions and trade on their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss for your capital. Up to 67 % of retail investor accounts lose money trading with the brokers compared on this website. Please make sure you fully understand the risks and seek independent advice. By continuing to use this website, you agree to our Privacy Policy.

Recommended Content

Editors’ Picks

Crypto market outlook for 2026

Year 2025 was volatile, as crypto often is. Among positive catalysts were favourable regulatory changes in the U.S., rise of Digital Asset Treasuries (DAT), adoption of AI and tokenization of Real-World-Assets (RWA).

Sberbank issues Russia's first corporate loan backed by Bitcoin

Russia's largest bank Sberbank launched the country's first Bitcoin-backed corporate loan to miner Intelion Data. The pilot deal uses cryptocurrency as collateral through Sberbank's proprietary Rutoken custody solution.

Bitcoin recovers to $87,000 as retail optimism offsets steady ETF outflows

Bitcoin (BTC) trades above $88,000 at press time on Tuesday, following a rejection at $90,000 the previous day. Institutional support remains mixed amid steady outflow from US spot BTC Exchange Traded Funds (ETFs) and Strategy Inc.’s acquisition of 1,229 BTC last week.

Traders split over whether lighter’s LIT clears $3 billion FDV after launch

Lighter’s LIT token has not yet begun open trading, but the market has already drawn a sharp line around its valuation after Tuesday's airdrop.

Crypto Today: Bitcoin, Ethereum, XRP tilt toward breakout on risk-on sentiment

Bitcoin (BTC) kicked off October on a strong note, with the price breaking above $116,000 on Wednesday. Despite a market-wide expectation that September is usually a bearish month for cryptocurrencies, BTC posted gains of 5.31%.

Bitcoin: Fed delivers, yet fails to impress BTC traders

Bitcoin (BTC) continues de trade within the recent consolidation phase, hovering around $92,000 at the time of writing on Friday, as investors digest the Federal Reserve’s (Fed) cautious December rate cut and its implications for risk assets.