Zilliqa Price Prediction: ZIL must regain this important level to remain bullish

- Zilliqa price aims for a reversal after establishing a potential lower high at $0.10.

- The digital asset faces one critical resistance level that needs to be conquered by the bulls.

- If ZIL can’t hold $0.1, it will quickly drop to lower lows.

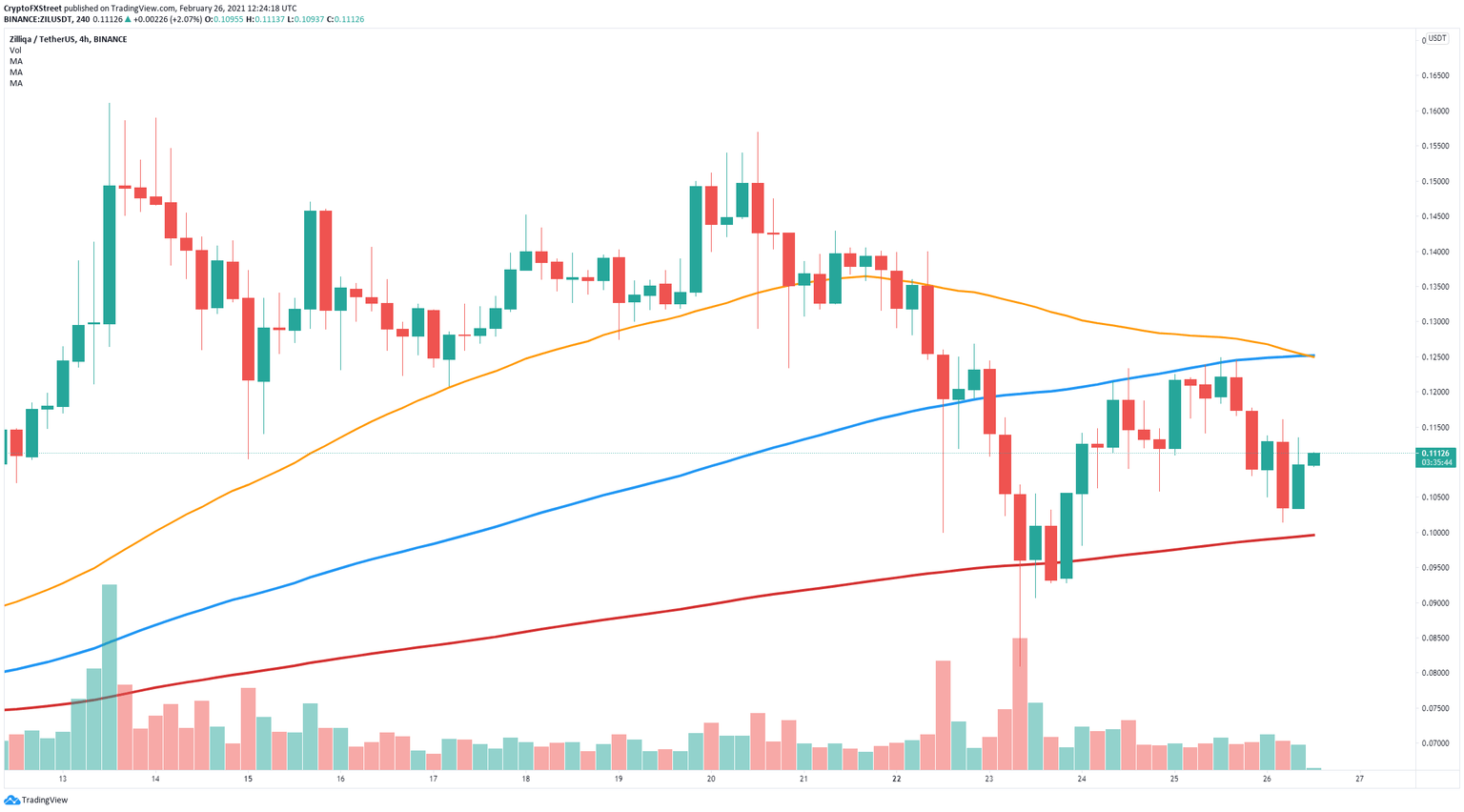

Zilliqa had a massive sell-off down to $0.09 but defended a critical support level and bounced towards $0.124. Now, the digital asset aims for a full-blown reversal as long as the bulls can hold the 200-SMA and conquer a critical resistance point.

Zilliqa price needs to beat $0.125 for a massive breakout

On the 4-hour chart, the most significant resistance barrier is located at $0.125 which coincides with the 50-SMA and the 100-SMA, as well as the previous high after the recent bounce.

ZIL/USD 4-hour chart

Zilliqa bulls must hold the 200-SMA at $0.10, establishing a higher low and then climb towards the key resistance point. A breakout above $0.125 has the potential to push Zilliqa price towards $0.15.

On the flip side, if ZIL bulls cannot hold the critical 200-SMA support level, the digital asset will quickly dive towards the last low established at $0.08, and perhaps even lower.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.