XRP price prompts fear amongst investors as technicals signal another sell-off

- XRP price is displaying bullish fatigue on the Relative Strength Index.

- Ripple price is coiling into a triangular pattern.

- Invalidation of the bearish thesis is a breach at $0.465.

XRP price has investors questioning how low the digital remittance token can fall. As other cryptocurrencies are positioning for an anticipated countertrend spike, XRP price action diverges from the pact, hinting at another drop in the coming weeks.

XRP price is coiling for a breakout

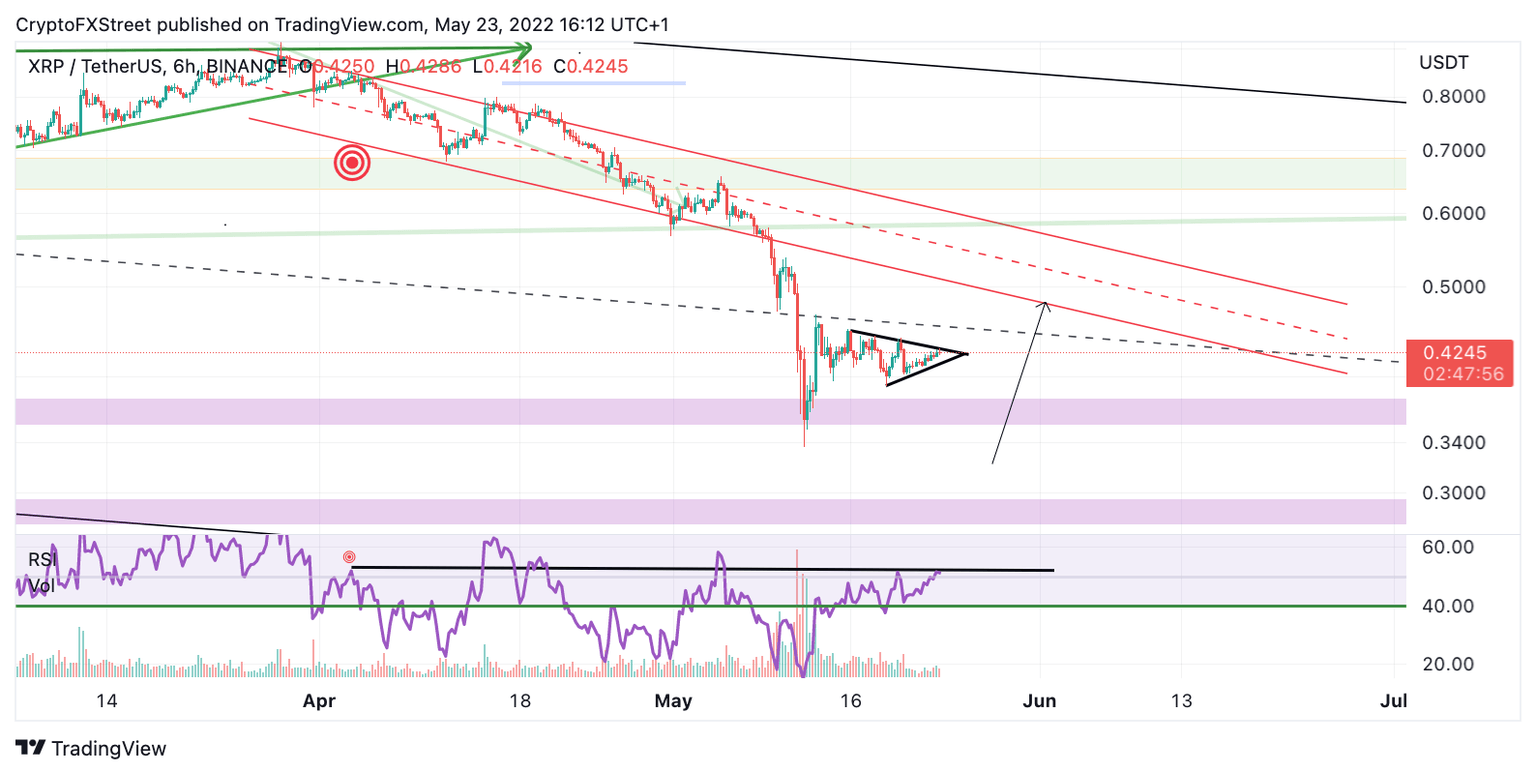

XRP price displays slightly bearish signals to start this week's trading session. The XRP price is printing lower highs and higher lows as the bulls and bears continue in the tug of war at $0.4250. The forming triangle pattern is undoubtedly set to send the XRP price into a strong rally. The directional breakout from the triangle could go either way. Still, this thesis will be written to justify a short-term bearish outlook while keeping an invalidation level tight to capture profits from the alternative bullish scenario safely.

XRP price most important cautious signal is the Relative Strength Index. The Ripple price continues to gain profitable grounds. At the same time, the RSI values the uptrend's power similar to the April 3 $0.80 when the XRP price also failed to produce a bullish breakout from a much larger triangle pattern. This subtle cue could be inducing XRP price into bullish fatigue as the bulls are not gaining much profit while competing with minimal support. If the technicals are correct, a fall into $0.31 could wipe out day traders' liquidity stops before a strong rally into $0.50 occurs.

XRP/USDT 6-Hour Chart

Still, invalidation is necessary to make sure some profit can be captured to counterbalance the risk of being early on the wrong side of the trade. An invalidation for the bearish trend line lies at a break at $0.4650. If the bulls can breach this level, an immediate buy entry can be placed while keeping the safety stop at the swing low at $0.3869. The bulls should be able to reconquer $0.50 and possibly $0.54 resulting in a 27% increase from the current XRP price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.