XRP Price Prediction: Ripple tests key 200-day SMA resistance near $0.31

- Ripple rose above 200-day SMA on Friday but closed the day below that level.

- With a break above $0.31, XRP could target $0.38.

- Bearish pressure is likely to build up if price falls below $0.25.

Ripple closed the second straight day in the positive territory on Friday and continues to edge higher on Saturday. As of writing, XRP was up nearly 5% on a daily basis at $0.2980.

Daily close above 200-day SMA to attract buyers

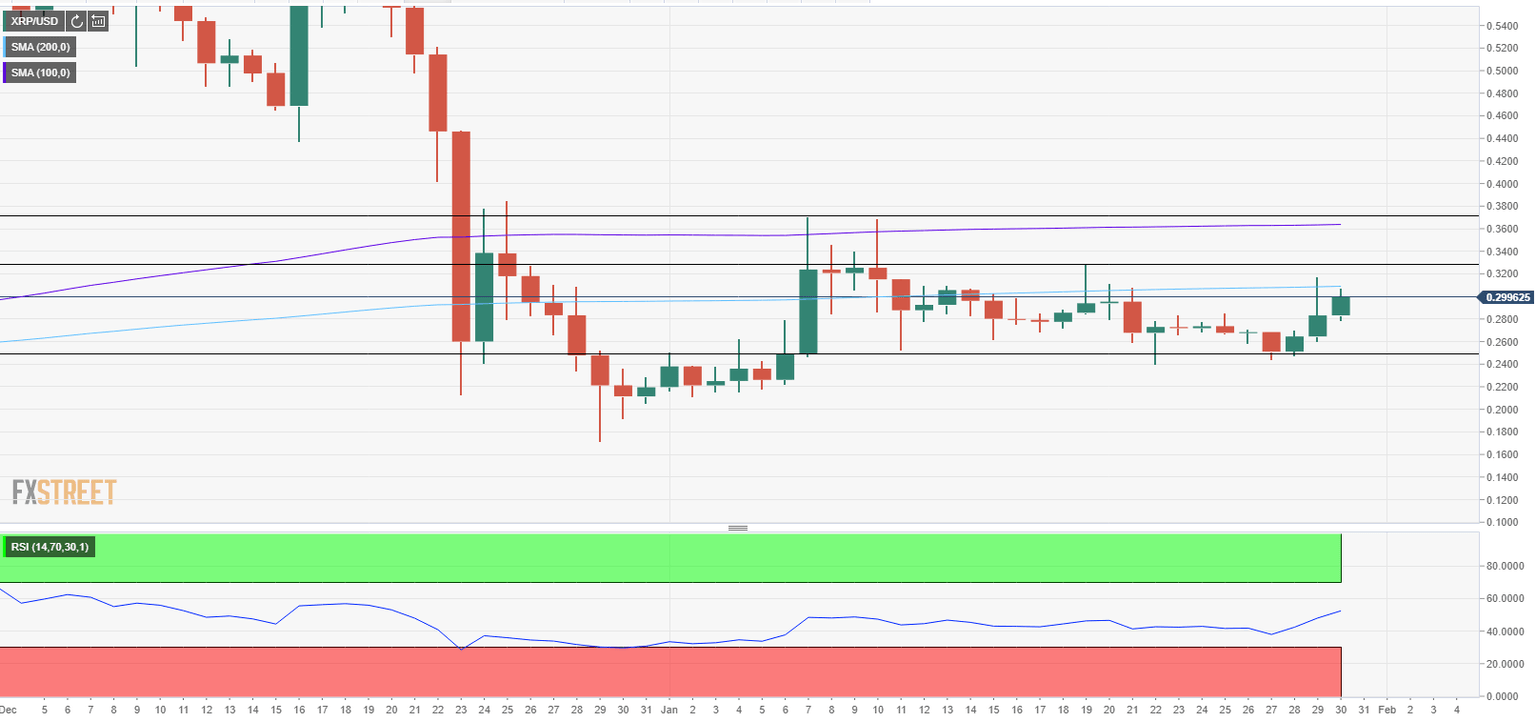

On Friday, the price rose above the 200-day SMA, which is currently located at $0.31, for the first time in two weeks but closed the day below that level. Currently, Ripple remains within a touching distance of this critical resistance and a convincing breakthrough could bring in more buyers. On the upside, $0.33 (static resistance, Jan. 19 high) aligns as the initial hurdle ahead of $0.38 (100-day SMA, Jan. 7/10 high).

On the other hand, $0.25, the lower limit of the three-week-old horizontal channel, is a key support and the near-term outlook would turn bearish if the price drops below that level.

XRP/USD one-day chart

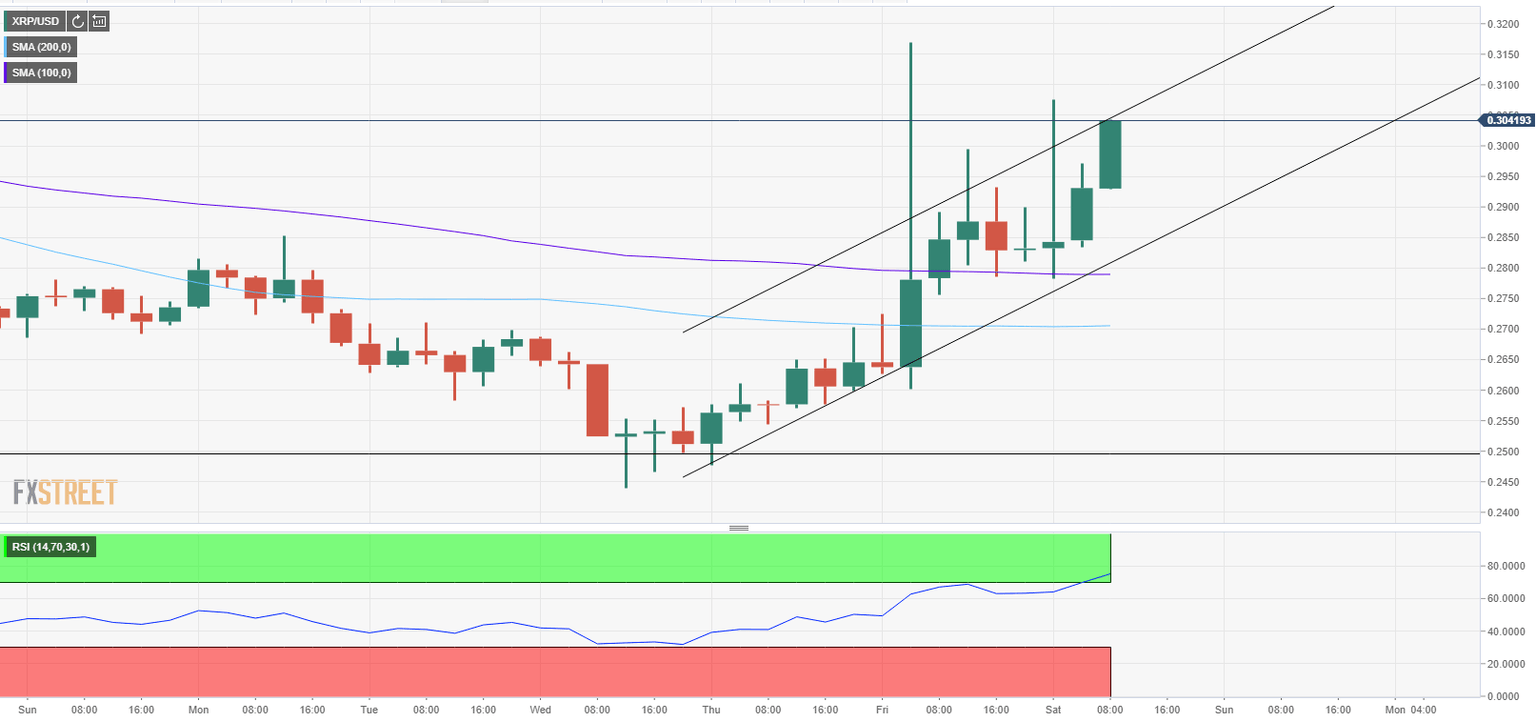

The technical developments seen on the four-hour chart confirms the bullish shift in the technical outlook. During the late American session on Friday, XRP rose above the 200 and the 100 SMAs on that chart and continues to trade near the upper limit of the ascending channel.

Ripple is on the verge of breaking out of its horizontal channel and could easily target $0.38. However, bulls need to commit to lifting the price beyond $0.31 in order for XRP to extend its rally.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.