XRP Price Prediction: Ripple targets $0.65 as the crypto rout resumes

- XRP price drops like a stone as sell-off engulfs the crypto market once again.

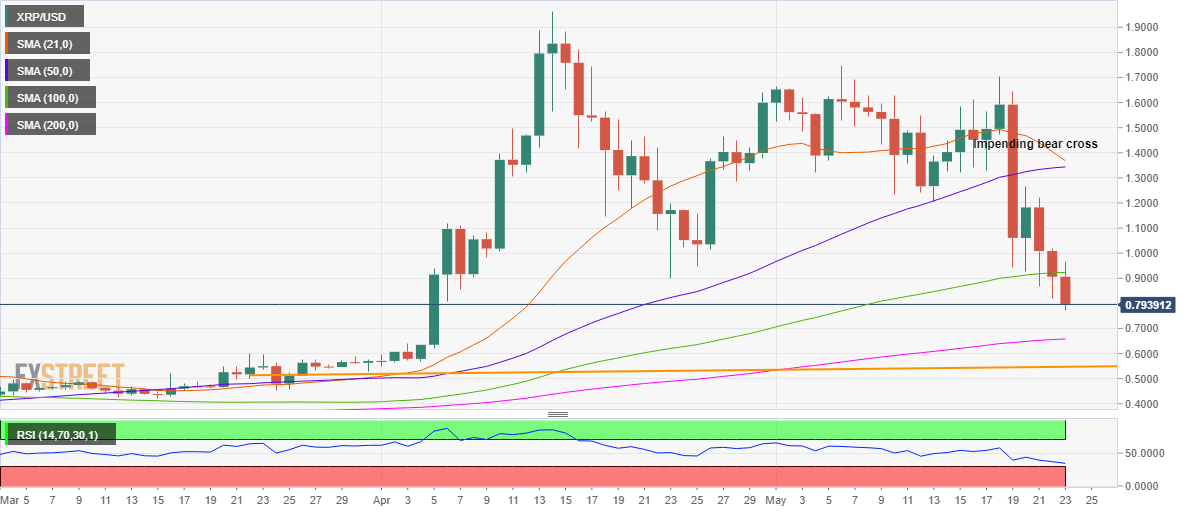

- Ripple eyes 200-day SMA after a break below the 100-day SMA support.

- Impending bear cross and bearish RSI add credence to the downside.

XRP price is extending the brutal Wednesday crash on Sunday, in the red for the third straight day while refreshing monthly lows at $0.7718.

A fresh selling wave has engulfed the crypto board once again, with Bitcoin shedding nearly 8% to near $34K levels. Ethereum threatened the $2000 threshold, down about 11% so far.

The risks remain skewed to the downside for the digital assets after China’s regulators tightened restrictions, banning financial institutions and payment companies from providing services related to cryptocurrencies, earlier on.

On Friday, China’s Vice Premier Liu He vowed to crack down on bitcoin mining and trading activities as part of efforts to curb financial risks.

XRP price looks south amid bearish technicals

After breaching the $1 mark on Wednesday, the XRP bears remain unstoppable and eye deeper losses, as depicted by Ripple’s daily chart.

The XRP price is witnessing another leg lower this Sunday, having closed Saturday below the mildly bullish 100-day simple moving average (SMA) at $0.9234.

The sellers now remain on track to test the critical 200-day SMA support at $0.6583, as the downside pressure intensifies.

The next relevant support for the XRP bulls is aligned at the horizontal (orange) trendline at $0.5469.

The last line of defense for Ripple is envisioned at the psychological $0.50 barrier.

The Relative Strength Index (RSI) keeps heading south, currently at 34.71, suggesting that there is more room to decline before the indicator enters the oversold territory.

Adding credence to the downside momentum, the price is on the verge of confirming a bear cross, with the 21-day SMA look to pierce through the 50-day SMA from above.

XRP/USD: Daily chart

However, if the XRP sellers fail to find acceptance below the 200-day SMA support, then a rebound towards the 100-day SMA could be on the cards.

Only a daily closing above the latter could bring a halt to the downward spiral in the near term.

Further up, the XRP bulls will try to recapture the $1 level on a sustained basis.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.