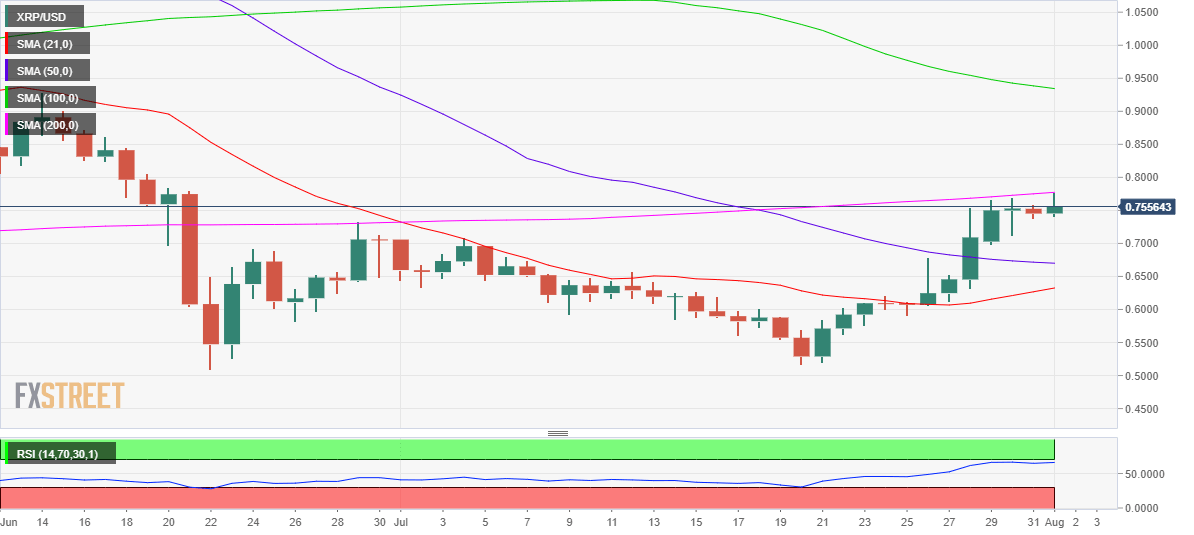

XRP Price Prediction: Ripple eyes a sustained break above 200-DMA to recapture $1.00

- XRP price challenges critical 200-DMA resistance at $0.7774.

- Bullish RSI could push for a firm break above the latter.

- The upside appears more compelling towards $1.00.

XRP price pauses its recent uptrend, consolidating in a familiar range for the fourth day in a row, as the digital asset bides time to resume the next leg higher.

Ripple’s rally picked up steam in the previous week, tracking its rivals – Bitcoin and Ethereum higher, recording a whopping 27% gain over the past seven days.

How is XRP price positioned on the technical graph?

The XRP price hit fresh seven-week highs at $0.7775 earlier this Sunday, before reversing to near $0.7600, where it now wavers.

Despite the retracement, Ripple adds 2.14% on the day, with the critical 200-Daily Moving Average (DMA) at $0.7774 capping the upside attempts (for now).

Meanwhile, the mildly bearish 50-DMA at $0.6700 continues to guard the bullish interests.

With the 14-day Relative Strength Index (RSI) sitting just beneath the overbought region at 65.96, there is more room to rise for XRP price.

However, only a daily closing above the 200-DMA barrier could revive the bullish momentum, opening gates for a rally towards the downward-sloping 100-DMA at $0.9343.

XRP/USD: Daily chart

Alternatively, the $0.70 round number could limit the declines should XRP bulls face rejection at the 200-DMA.

The next powerful support awaits at the 50-DMA, below which the bullish 21-DMA at $0.6325 could be on the sellers’ radars.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.