XRP price poised for 42% breakout as whales go into a buying frenzy

- XRP price is contained inside a symmetrical triangle pattern on the 12-hour chart.

- XRP whales have recently bought a lot of XRP, increasing buying pressure.

- Only one key resistance level separates XRP from a 42% breakout toward $0.83.

XRP has been trading inside an uptrend for the past week as confidence in the digital asset increased again. XRP holders were able to receive authorization to present a motion on the SEC case against Ripple. This seems to have boosted the confidence of investors.

XRP price is one barrier away from $0.82

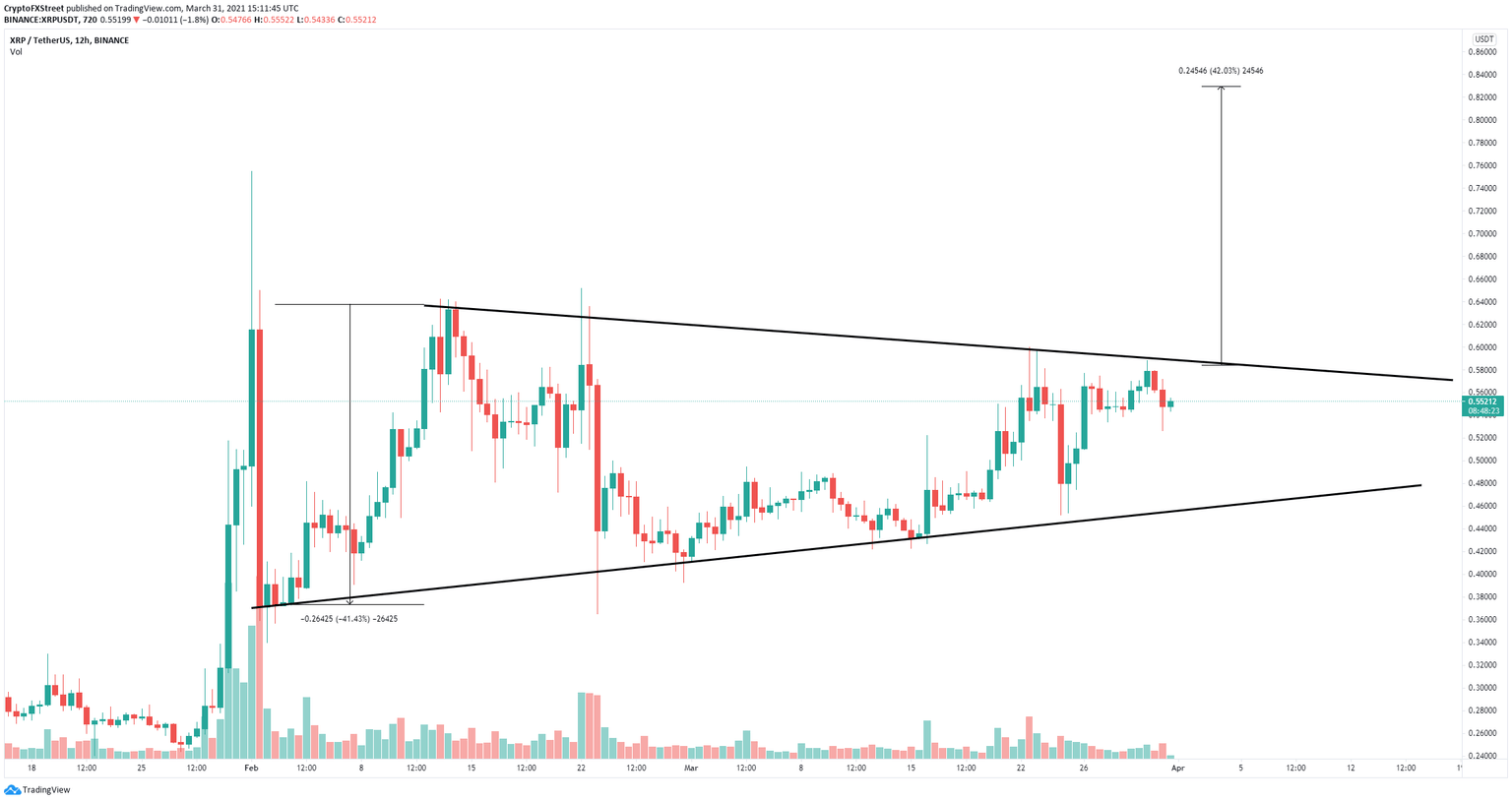

On the 12-hour chart, XRP has formed a symmetrical triangle pattern with its resistance trendline established at $0.584. A breakout above this critical point will quickly drive XRP price towards $0.82, a 42% move calculated using the height of the pattern as a reference point.

XRP/USD 12-hour chart

This breakout seems to be more likely because of a significant increase in XRP whales. The number of holders with at least 10,000,000 XRP spiked by five in the past 24 hours. Additionally, the amount of other large holders with 1,000,000 to 10,000,000 XRP has also risen from 1,175 on March 22 to 1,194 at the time of writing.

XRP Holders Distribution chart

However, a rejection from the upper trendline resistance at $0.58 would be significant. XRP price could quickly fall towards the lower boundary of the pattern at $0.455.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B17.12.43%2C%252031%2520Mar%2C%25202021%5D-637528113946432863.png&w=1536&q=95)