XRP price recovery likely as Ripple executives call out SEC and Chair Gary Gensler for their stance on crypto

- XRP price outlook is bullish as the asset tests the supply zone at $0.5174.

- Pro-XRP attorney John Deaton shared his views on the likelihood of a settlement by the SEC in its lawsuit against Ripple.

- Ripple CEO Brad Garlinghouse critiques the SEC and Chair Gary Gensler for their stance on the crypto ecosystem.

XRP price's long-term outlook is now bullish, as the altcoin sustains above critical support at $0.50. Several bullish developments have likely catalyzed the altcoin’s recovery. The possibility of a settlement in the Securities & Exchange Commission (SEC) vs. Ripple lawsuit and Ripple CEO Brad Garlinghouse’s statements in Mainnet 2023 set the stage for recovery.

Also read: Robert Kiyosaki warns of stock crash, says Bitcoin is a bargain today

XRP price recovery likely to continue with settlement in SEC vs. Ripple case

In a recent X.com space, pro-XRP attorney John Deaton shed light on the likelihood of a settlement in the SEC vs. Ripple lawsuit. The lawyer explained how the SEC could consider settling with Ripple if the outcome did not influence its litigation against other cryptocurrencies and firms. In the case of Ripple, the status of XRP as a security or non-security has a direct impact on the regulator’s lawsuit against Coinbase.

The SEC is, therefore, less likely to settle the case with Ripple and rather pursue the interlocutory appeal in an attempt to overturn Judge Analisa Torres’ ruling, according to Deaton.

Ripple executives call out SEC and Chair Gary Gensler for approach on crypto

CEO Brad Garlinghouse has expressed his discontent with the US financial regulator in interviews and appearances, like the one on September 20 at the Mainnet 2023 event. Garlinghouse took to the stage to critique the stance of the SEC and Chair Gensler on the crypto ecosystem. Find out more about it here.

XRP price outlook turns bullish

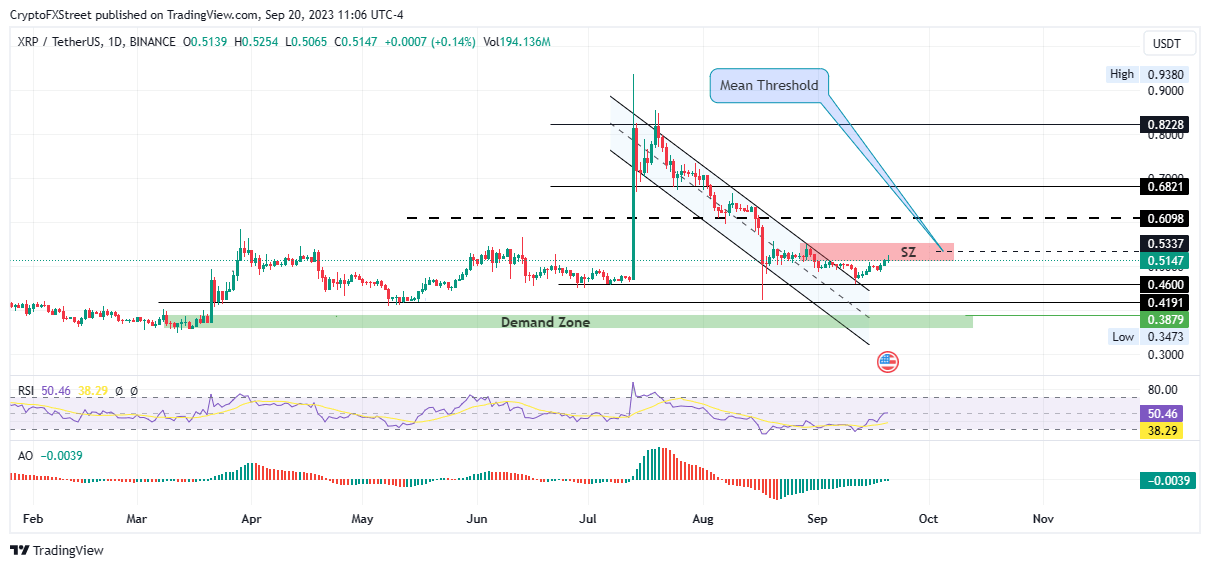

Lockridge Okoth, a technical analyst at FXStreet, evaluated the XRP price chart and shared his outlook on the altcoin. Okoth notes that the asset is currently testing the supply zone at $0.5174 and that la successful breach of this level could push XRP price to $0.5337. This level is significant as it marks the mean threshold of the zone and a decisive break would give bulls an opportunity to push XRP price higher.

XRP/USDT one-day price chart on Binance

Okoth believes that a rejection from the $0.5337 level could push XRP lower to test the foot of the uptrend at $0.4600. At the time of writing, XRP price is $0.5166 on Binance.

Ripple FAQs

What is Ripple?

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

What is XRP?

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

What is XRPL?

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

What blockchain technology does XRP use?

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.