XLM price presents buying opportunity, targets $0.30

- XLM price action continues to lag the major and its peers in performance.

- Several trade opportunities on the long and short sides of the market now exist.

- Upside potential is significant compared to the marginal risk to the downside.

XLM price action finally showed some bullish momentum, mostly due to the broader market making moves. Buyers remain on the sidelines for Stellar, with sellers now in the wings. However, an opportunity now exists for bulls and bears.

XLM price develops two trade setups for bulls and bears

XLM price has two trade setups available, one on the $0.0053/-box reversal Point and Figure chart, the other on the $0.01/3-box reversal Point and Figure chart.

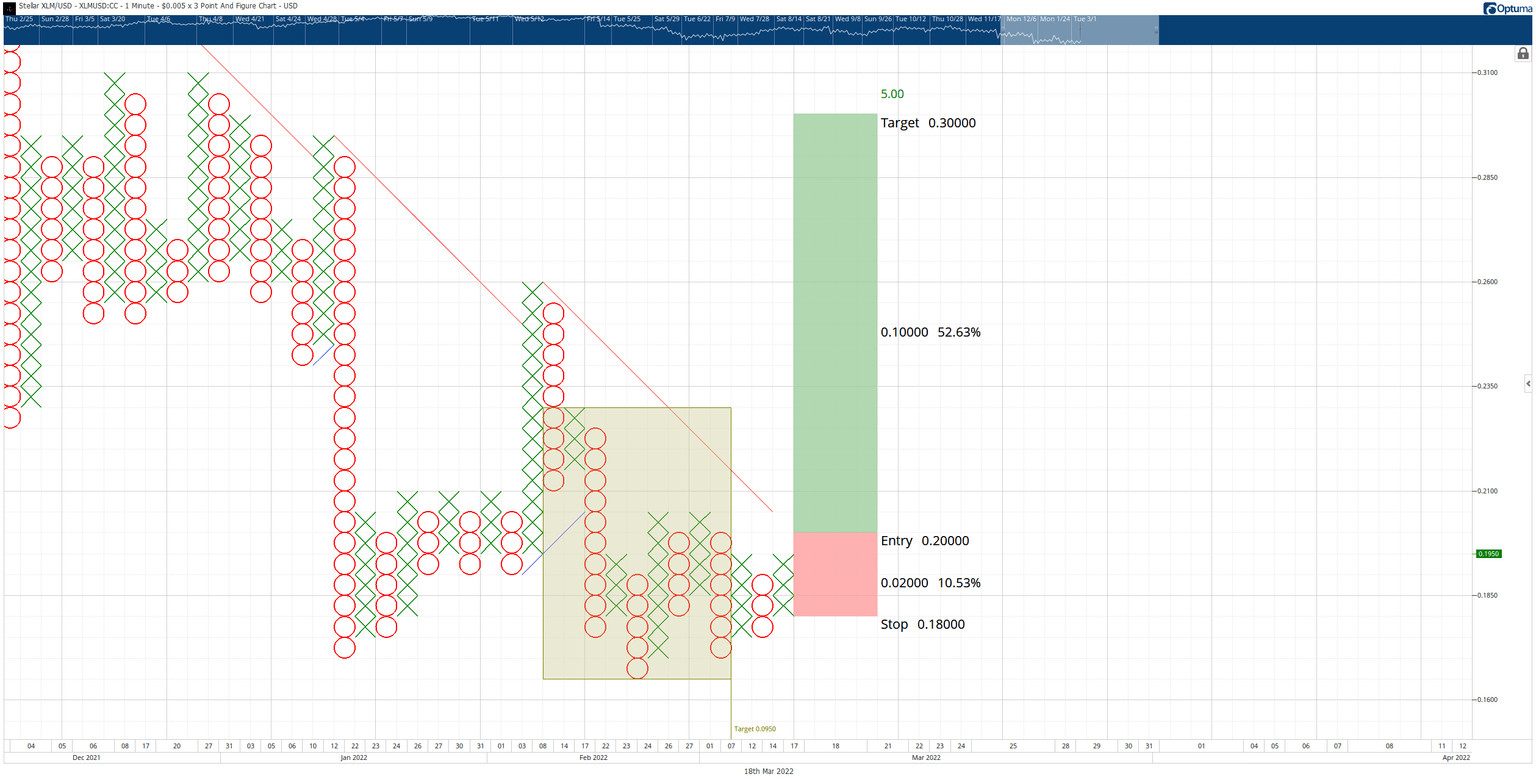

The theoretical long opportunity now exists for XLM price with a buy stop order at $0.20, a stop loss at $0.18, and a profit target at $0.30. The trade setup may appear like an early or inappropriate entry (double-tops are not sufficient for an entry). Still, in this case, the break of a double-top also breaks the current bear market angle (red diagonal line) and converts the $0.005/3-box reversal Point and Figure chart into a bull market.

XLM/USD $0.005/3-box Reversal Point and Figure Chart

The long trade idea represents a 5:1 reward for the risk. A three-box trailing stop is an optional risk management tool that can help protect any profit made post entry. This theoretical long opportunity will be invalidated if the short entry identified below is triggered first.

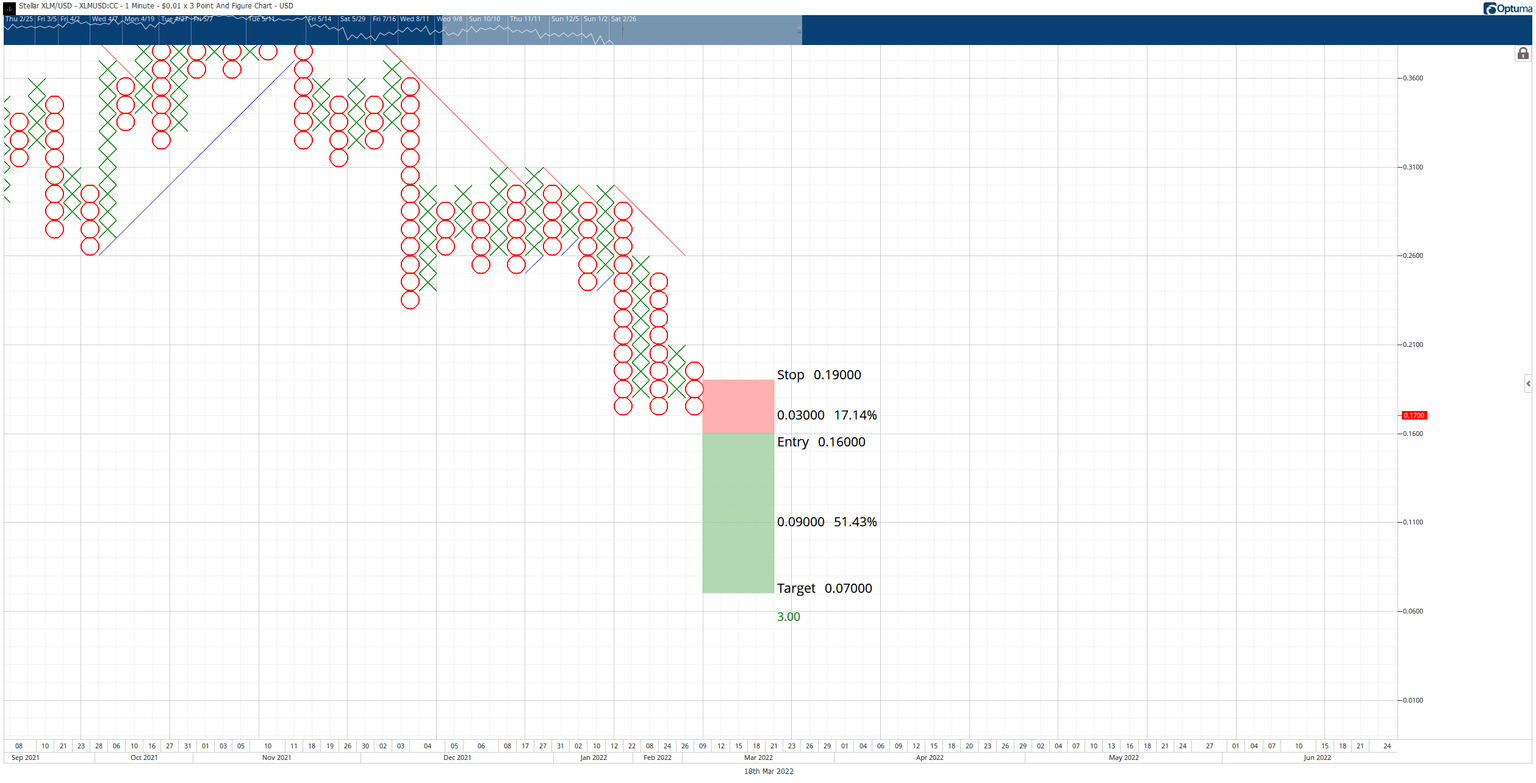

The theoretical short trade idea is a sell stop order at $0.16, a stop loss at $0.19, and a profit target at $0.07. The short entry is based on the breakout below a triple-bottom pattern. The $0.07 profit target would put XLM price below the 2021 lows and back at the 2020 Volume Point Of Control. The Volume Profile between $0.09 and $0.16 is extremely thin, warning that a capitulation move in the form of a flash-crash may occur.

XLM/USD $0.01/3-box Reversal Point and Figure Chart

The short trade setup represents a 3:1 reward for the risk, with a 3-box stop-loss versus the normal 4-box stop loss. A two-box trailing stop would help protect any implied profit. The short idea is invalidated if XLM price triggers the long entry identified above before the sell-stop is triggered.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.