XLM price hints at 23% upswing as Stellar flips crucial hurdle

- XLM price has flipped a crucial hurdle and eyes a rally to retest $0.22.

- Investors can expect Stellar to accumulate steam above 50% retracement level at $0.18.

- A four-hour candlestick close below $0.16 will invalidate the bullish thesis.

XLM price has been on a consolidative move for roughly two weeks and shows a tightening of the range. Regardless, the recent accomplishment suggests that a minor uptrend is likely for Stellar.

XLM price to sweep range high

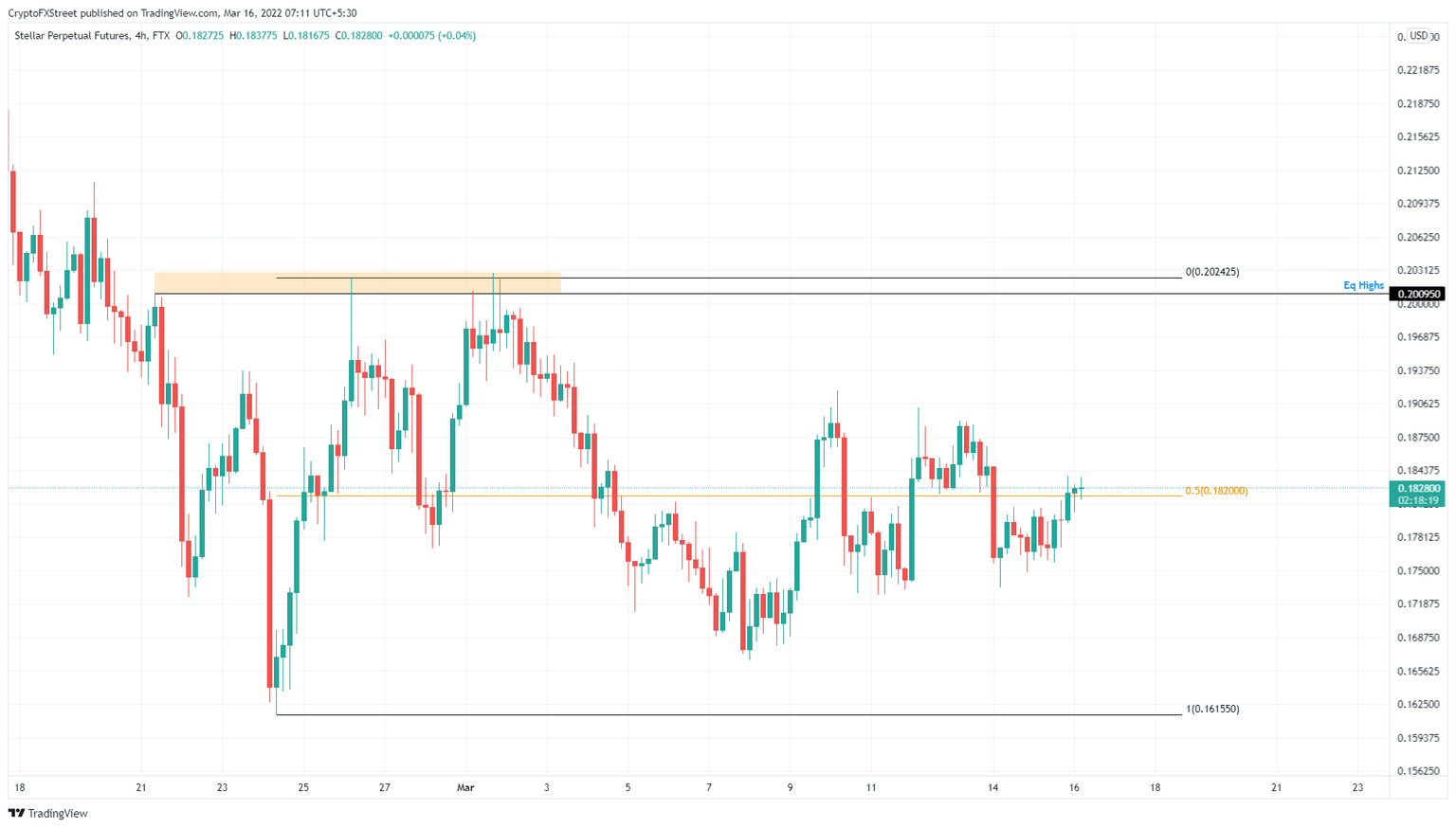

XLM price set up a range extending from $0.16 to $0.20 between February 24 and 26. Since then, the remittance token has not swept the range high or range low but has traded close to the 50% retracement level.

The recent attempts to move toward the range high fell short of momentum leading to a move below the range’s midpoint. However, on March 16, XLM price manage to produce a four-hour candlestick close above it, signaling the intentions of bulls to move higher.

Going forward, investors can expect the XLM price to make a run at the range high at $0.20 and collect the buy-stop liquidity resting above it. This move would constitute an 11% ascent from the midpoint and is likely where the upside is capped.

In a highly bullish case, XLM price could rally to $0.22, bringing the gain to 23%.

XLM/USDT 4-hour chart

On the other hand, if XLM price fails to sustain above the $0.18 hurdle, there is a good chance, bears will take control. In such a case, the remittance token will most likely retrace to the range low at $0.16.

Here, buyers have a chance at a comeback, but a four-hour candlestick close below $0.16 will create a lower low and invalidate the bullish thesis for Stellar.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.