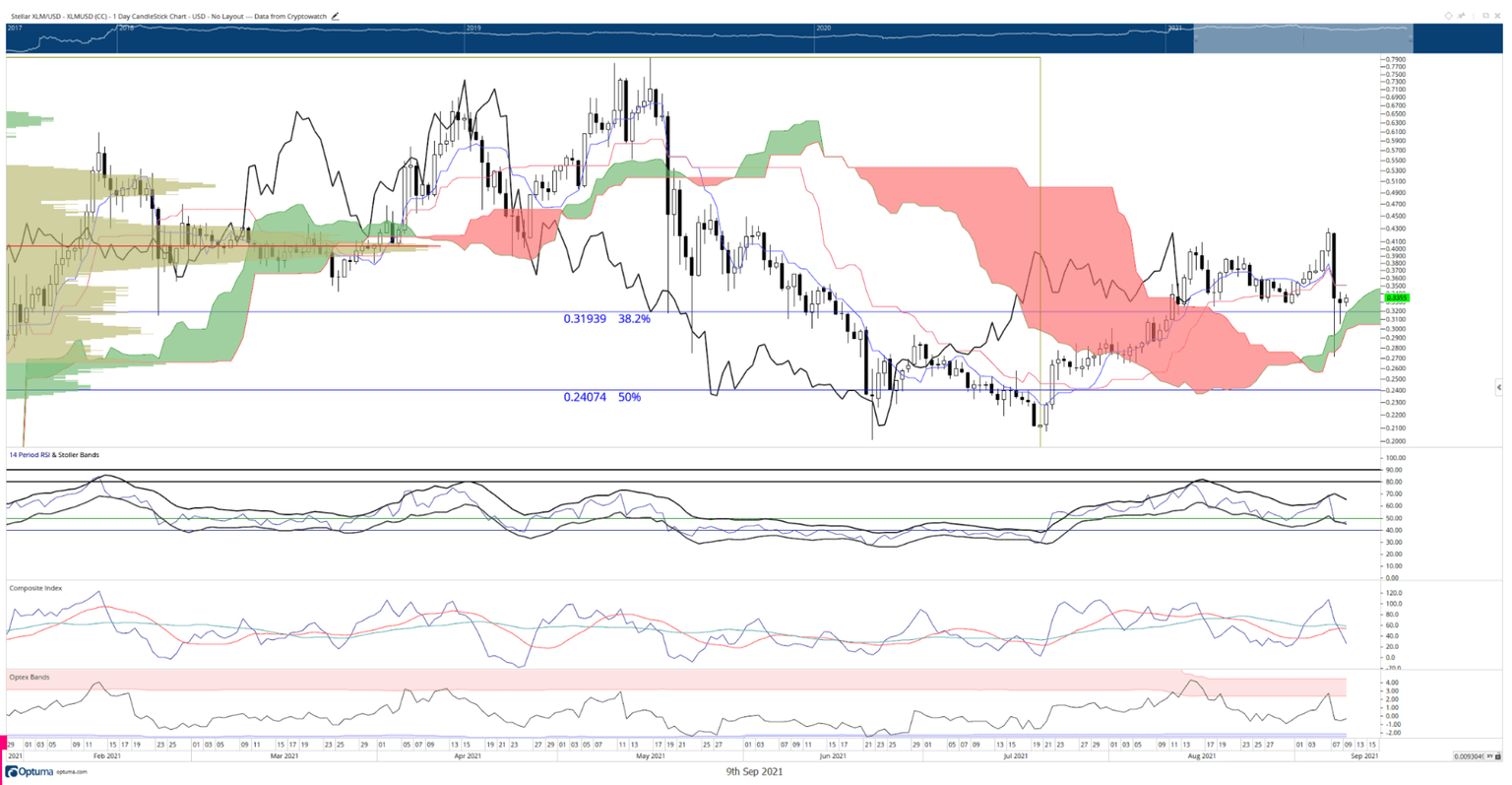

XLM Price Prediction: Stellar bears to take control if $0.40 resistance holds

- XLM price action struggles to regain a clear move towards the $0.40 level.

- Strong Ichimoku resistance levels ahead.

- The inside bar creates possibilities for both bulls and bears.

XLM price has consistently struggled to make any meaningful push against the critical $0.40 resistance level. The 2021 VPOC (Volume Point-Of-Control) is at $0.4042 and has acted as the primary obstacle for Stellar since August 13th, 2021. Now, the cross-border remittances token is under threat from holding $0.30 and could move down into the $0.20 value area.

XLM price warns of impending downside pressure

XLM price is currently below the daily Tenkan-Sen and Kijun-Sen levels at $0.3508 (both share the same price level). That condition is not overly concerning for bulls, but the location of the daily Chikou Span is a concern since it is below the candlesticks.

Thus, there is a real risk for Stellar to breach below the $0.30 value area and then begin trading in the $0.20 range. Bears will want to watch for a swift sell-off if XLM closes below the inside bar low of $0.3048.

XLM/USD Daily Chart

While the bears have a good hold of the short-term direction of XLM price, bulls can be patient and watch for several vital levels that will confirm the emergence of a new uptrend.

First, if bulls can push Stellar to close at or above $0.39, then that means the Chikou Span is back above the candlesticks and prices will be above the Tenkan-Sen and Kijun-Sen. Second, bulls will want to watch for follow-through higher if XLM closes above the inside bar high at $0.3426.

The 2021 VPOC will continue to be a strong resistance zone, but a third test of the VPOC soon after the last test will likely bring positive momentum to push XLM price higher.

Author

FXStreet Team

FXStreet