XLM bears to shake out bulls if $0.30 holds as resistance

- XLM price gets a dead-cat bounce to return to test $0.30.

- Rally may be temporary and not a sign of a recovery or a resumption of any bull market.

- Bears are likely to pounce on any weakness.

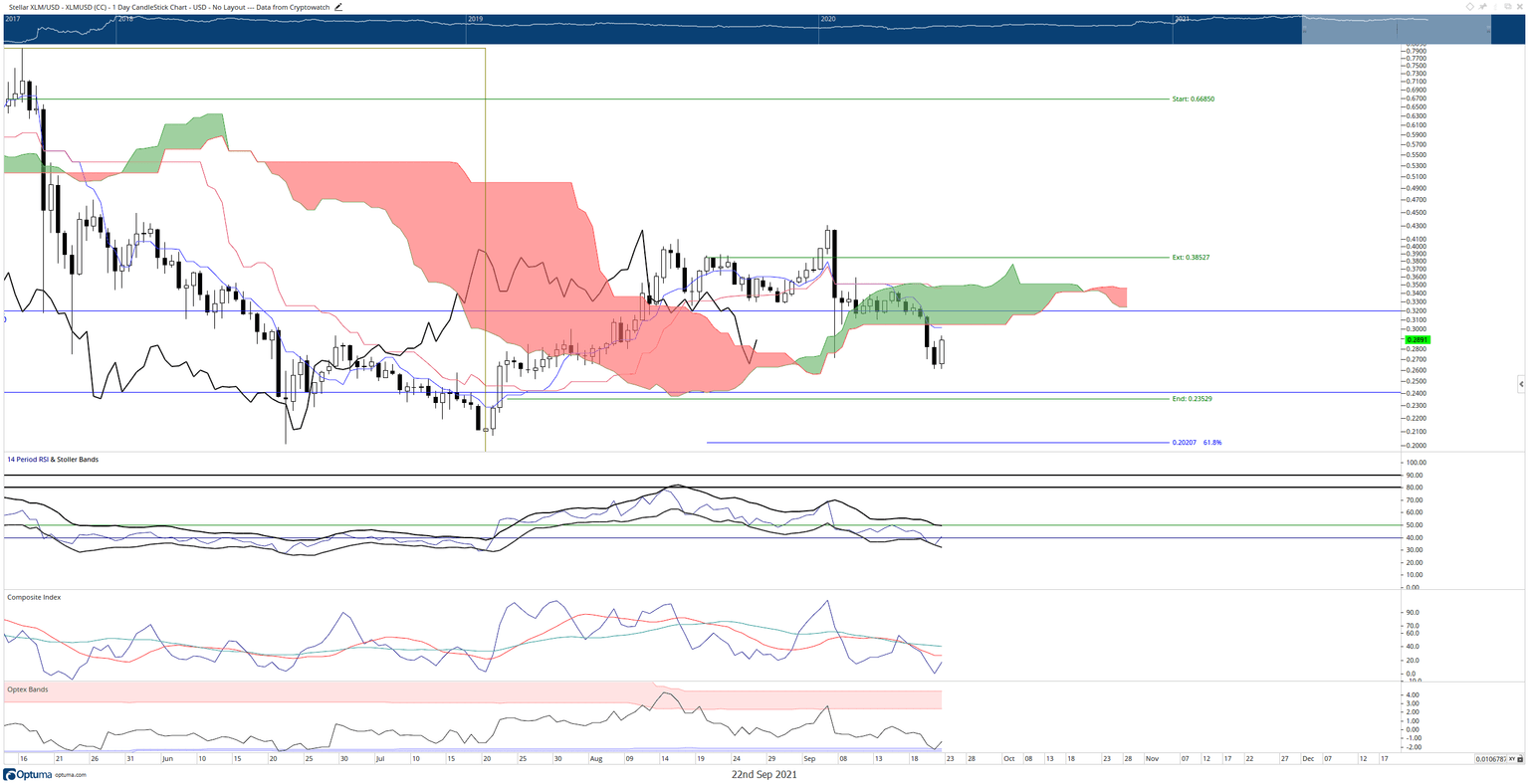

XLM price is flirting with testing the $0.30 value area but faces a collection of Fibonacci and Ichimoku zones ahead. If bulls cannot breach and stay above $0.30, then XLM bears are likely to regain control and push XLM further south.

XLM price gets ready for a big battle between the bulls and bears

XLM price has followed the broader market to trade higher and into the double-digit percentage gains. Shorts who entered at the bottom feel the pain while bulls who’ve held on feel some relief. Both sides of the market are about to make a big test to see whether the breakdown below $0.30 was an honest move favoring the bears – or a fakeout that will favor the bulls.

$0.30 is a vital price level beyond its psychological value. The 50% Fibonacci retracement, the bottom of the Cloud (Senkou Span B), and Tenkan-Sen reside with the $0.30 value area. If bulls fail to breach above $0.30, then a continuation move for XLM price below the $0.20 levels is next. The significant swing low that bears will target is $0.145 – the last high volume node and Fibonacci confluence zone for 2021 (and near the 2021 low).

XLM/USD Daily Ichimoku Chart

Bulls have a difficult path ahead of them if they wish to invalidate any bearish momentum. First, a close above the Kijun-Sen and 50% Fibonacci retracement at $0.31 would likely bring in some early buyers. Ultimately, however, bulls need to push XLM price into a condition where the Chikou Span is above the candlesticks and price is above the Cloud. For all of those conditions to occur, XLM price needs to close near $0.40.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.