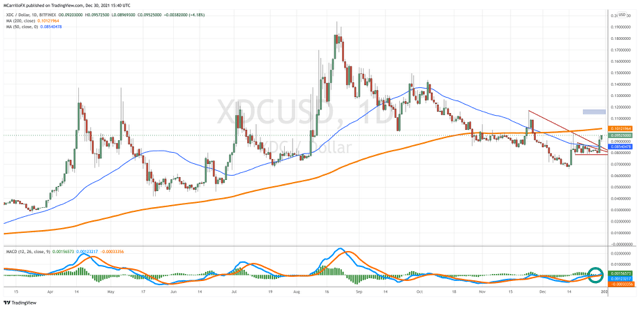

XDC rallies 20% and points to 0.1000 and 0.1175 in the short term

XDC Network, the token of the Hybrid Blockchain XinFin, is extending gains after rebounding on Wednesday. XinFin's network has resolved technical problems over the last few days and the coin is trading at 2-week highs.

On Thursday, XDC extended Wednesday's bounce at 0.0800 against the US dollar and traded above the 0.0950 area. Before, XDC/USD was stuck around 0.0800 for almost two weeks.

The coin's weakness came two weeks ago when it was trading on a positive note around 0.9800. Nevertheless, a "panic interface conversion error" caused technical problems on the XinFin Blockchain network, leading to a decline in price.

As a result, transactions in the XinFin network hibernated while the market awaited the resolution of the problems. This led to depressed trading in XDC. As soon as the network fixed the issue, XDC resumed its upside and left the 0.0800 area behind.

XDC jumps 20 percent in two days

XDC has been trading in rally mode for the past two days, with the token jumping 20 percent from Wednesday's opening price of 0.0800 to Thursday's intra-day high of 0.0957, its highest since December 16.

Analysts agree that the rally this week is a result of the XinFin network fixing, which allowed for trading to resume this week on the XinFin network. A good example is GlobianceDEX, the first decentralized exchange in the XinFin network whose trading volume grew to its highest level since December 15.

XDC/USD is currently trading at 0.0952, up 4.18 percent for the day. It has also broken above yesterday's high of 0.0947. Analysts believe that the 0.1000 level is just a matter of time, as increased liquidity and tradability of the XDC may propel the pair to levels not seen since November 26.

The break above the resistance line from the December 18 high, as well as the breach of the 50-day MA acting as resistance, confirms the short-term upside. It was crucial to consolidate above 0.0900, but a close above Wednesday's high at 0.0947 would open the door to further gains.

Following the 0.1000 psychological area, the next resistance comes at the 200-day moving average at 0.1012, then 0.1100, and finally, the November 24 high at 0.1175, XDC/USD’s target.

Author

Mauricio Carrillo

Witbrew

Mauricio is a financial journalist, senior content strategist, and inter-markets analyst with over ten years of experience in stocks, forex, commodities, and cryptocurrencies.