WLD price primed for recovery as Worldcoin eyes possible partnership with PayPal and OpenAI

- Worldcoin looks to collaborate with PayPal and OpenAI to meet community where identity verification and financial technology intersect.

- Additional plans include launching its open-source blockchain, World Chain, after successful integration with Okta’s cybersecurity authentication service.

- WLD price remains down 4% on Thursday and nearly -45% in April.

Worldcoin (WLD) price is trading with a bearish bias on Thursday, conforming to the broader market gloom as AI crypto coins and meme coins alike bleed in the aftermath of the Bitcoin (BTC) price dump. The dump for WLD price comes despite the network’s plans to partner with established players in the industry, but the governing chart pattern hints that all is not over for the token.

Also Read: Worldcoin looks set for comeback despite Nvidia’s 22% crash

Worldcoin plans collaborations with PayPal and OpenAI

Worldcoin, Sam Altman’s iris-scanning project that falls under the Tools For Humanity umbrella, is planning a collaboration with PayPal and OpenAI. Fortune reports that Alex Blania, the CEO of Tools for Humanity, indicated possible collaborations with OpenAI. He also alluded to ongoing conversations with PayPal, but tangible developments on the matter remain undisclosed.

FORTUNE: Sam Altman’s Worldcoin eyeing partnerships with PayPal and OpenAIhttps://t.co/8HybS3a9OH

— Tree News (@News_Of_Alpha) April 25, 2024

The move is part of Worldcoin’s plans to partner with established players in the industry and solidify its presence in the market. So far, other standing collaborations include with cybersecurity firm Okta, bringing the company’s authentication service within Worldcoin’s reach.

Highlighting its commitment to innovation and collaboration, integration with PayPal and OpenAI would demonstrate the vision to establish itself where identity verification and financial technology converge. Users would experience a secure, decentralized identity and financial network in a volatile market that is also constrained by tough regulatory restrictions.

Meanwhile, the project remains the subject of controversy in different jurisdictions over privacy, data harvesting and regulatory restrictions. After issues with the US, Europe and African authorities, the Worldcoin Foundation recently announced World Chain will be a permissionless, open-source Layer-2 (L2) blockchain due for launch in mid-2024.

World Chain will expand integration with the Worldcoin protocol while at the same time incentivizing users with a World ID.

It would take big news to move the Worldcoin price to the upside, just as it would for the case of BTC. For now, WLD suffers the same fate as its peers in the AI crypto sector. Its peers, including Near Protocol (NEAR), Render (RNDR), SingularityNET (AGIX), Injective (INJ) and Fetch.ai (FET), are suffering from bearish sentiment spilling over from the BTC market.

Worldcoin price coils up for a breakout

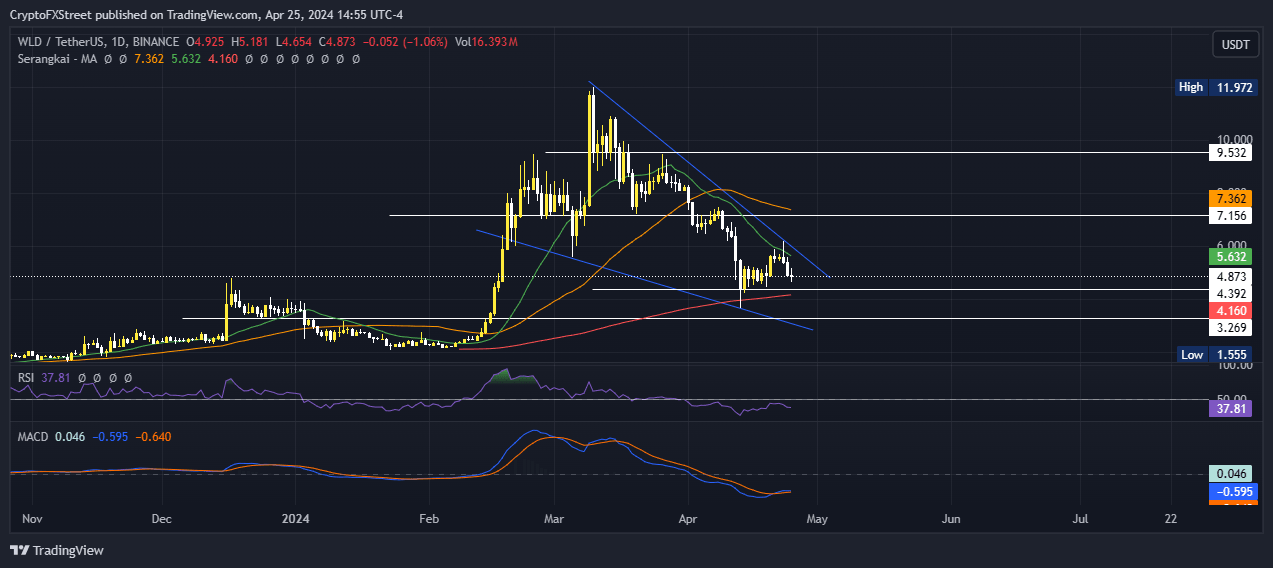

Worldcoin price is trading with a bearish bias, not only suffering overhead pressure from the 20- and 50-day Simple Moving Averages (SMA), but also technical indicators that suggest bearish sentiment in the market.

The Relative Strength Index (RSI) remains subdued below the 50 mean level. However, a closer look shows that the RSI has recorded higher lows relative to equal lows on the WLD price, interpreted as medium bullish divergence. This coupled with the bullish crossover on the Moving Average Convergence Divergence (MACD) suggests brewing upside potential.

Bullish momentum could push WLD price out of the upper boundary of the falling wedge pattern. This technical formation hints at a reversal of a downtrend, with a break above the resistance level signaling the opening of a long position.

While the $7.15 level will be a key level to watch, confirmation of further upside will only occur after the RSI flips above the mean level of 50 and the MACD forays into positive territory to show that bulls have taken over the market.

WLD/USDT 1-day chart

Conversely, if bearish momentum increases, WLD price could roll over below the immediate support at $4.39 before testing the 200 SMA at $4.16. This would produce a lower low, invalidating the bullish thesis, with a possible spiral to $3.26, 32% below current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.