With over 97% of ALGO holders underwater, Algorand price faces danger from its own investors

- Algorand price emerged as one of the slowest recovering assets in the last quarter, noting a consistent decline since February.

- At the moment, more than 97% of the addresses are facing losses majority of whose supply resides in the $0.94 to $02 02 range.

- The entire ALGO supply is dominated by investors, making it vulnerable to panic selling, an example of which can be seen in the last four weeks when 1.4 billion ALGO was sold by holders.

Algorand price has had a rather unimpressive run these past few weeks, crushing its investors' hopes of a recovery on the back of Bitcoin price crossing $30,000. Consequently, investors seem to be choosing what is best for them, i.e., selling to offset losses, but this action of theirs can be significantly more impactful than they can anticipate.

Algorand price continues its descent

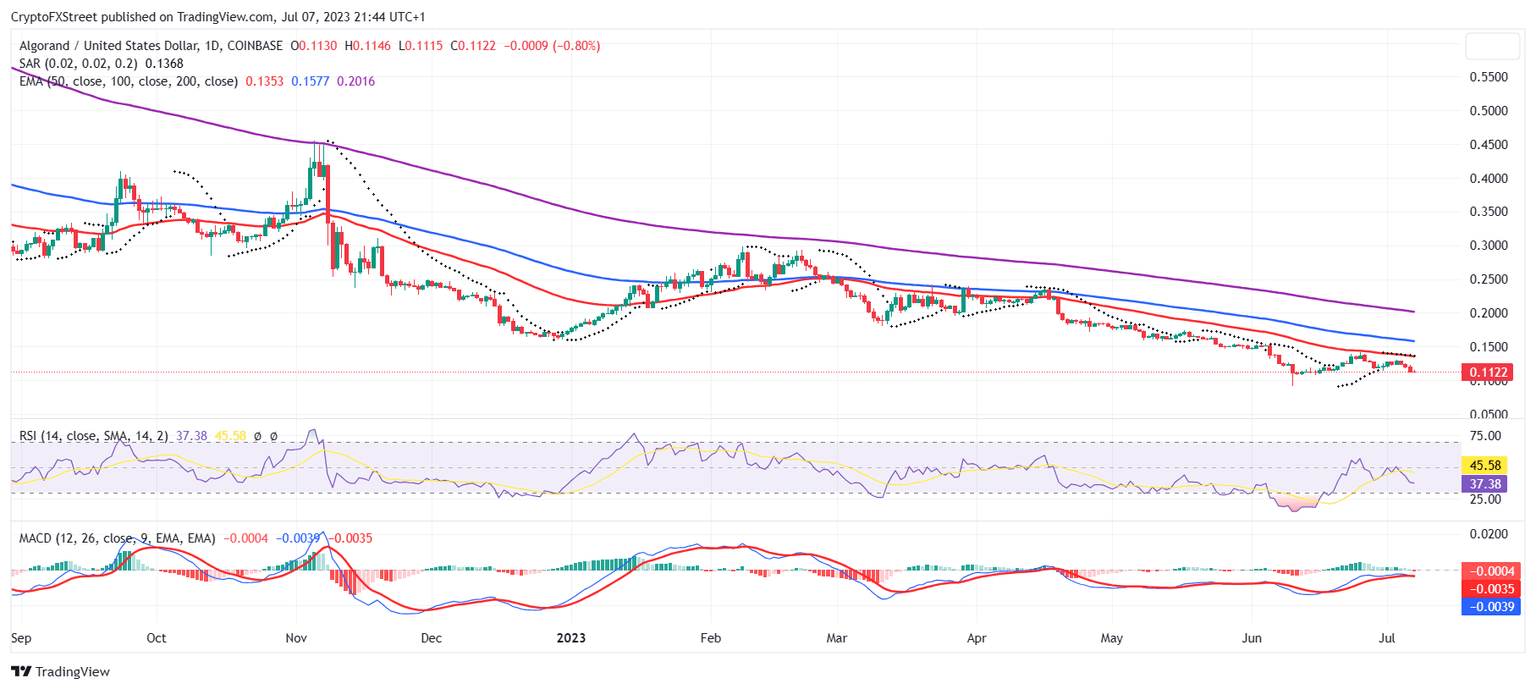

Algorand price since late February has been in a consistent decline falling from $0.285 to $0.112 at the time of writing. While most of the other cryptocurrencies in the market have registered extensive to at least some amount of recovery, ALGO failed to do so.

ALGO/US D 1-day chart

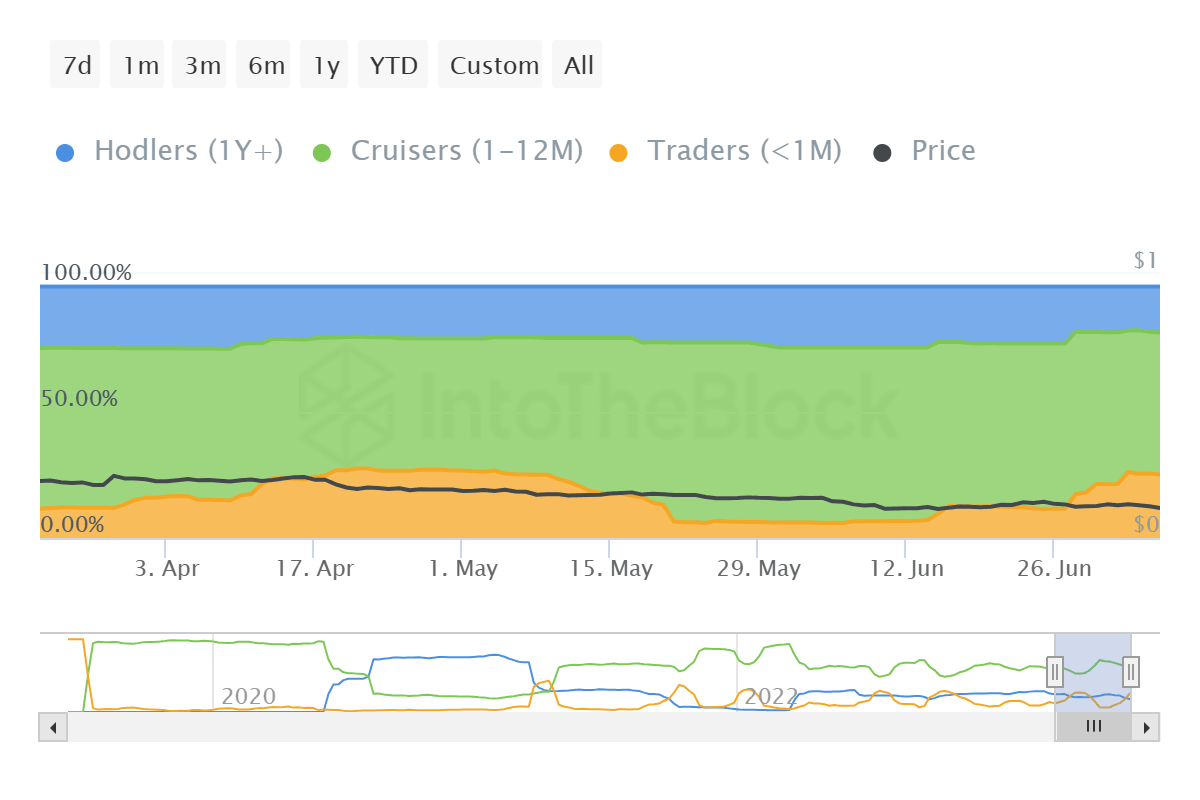

This lack of price rise was eventually reflected in ALGO holders' behavior, who began offloading their assets to prevent losses which grew significantly in the past couple of days. This selling mostly came from mid-term holders, i.e., investors who have been holding on to their supply for more than a month but under a year.

In the past month, following no recovery, these addresses started reducing their holdings, decreasing their holdings by more than 145, resulting in their domination coming down too. Mid-term holders now own only 56% of all ALGO, while short-term holders who keep their tokens for less than a month now own 25% of the entire circulating supply.

Algorand supply distribution

Even so, this cohort of investors is responsible for more than 5.43 billion ALGO worth more than $600 million. This makes their moves crucial to the price actions, which, if positive, can lead to recovery, but if negative, corrections are likely.

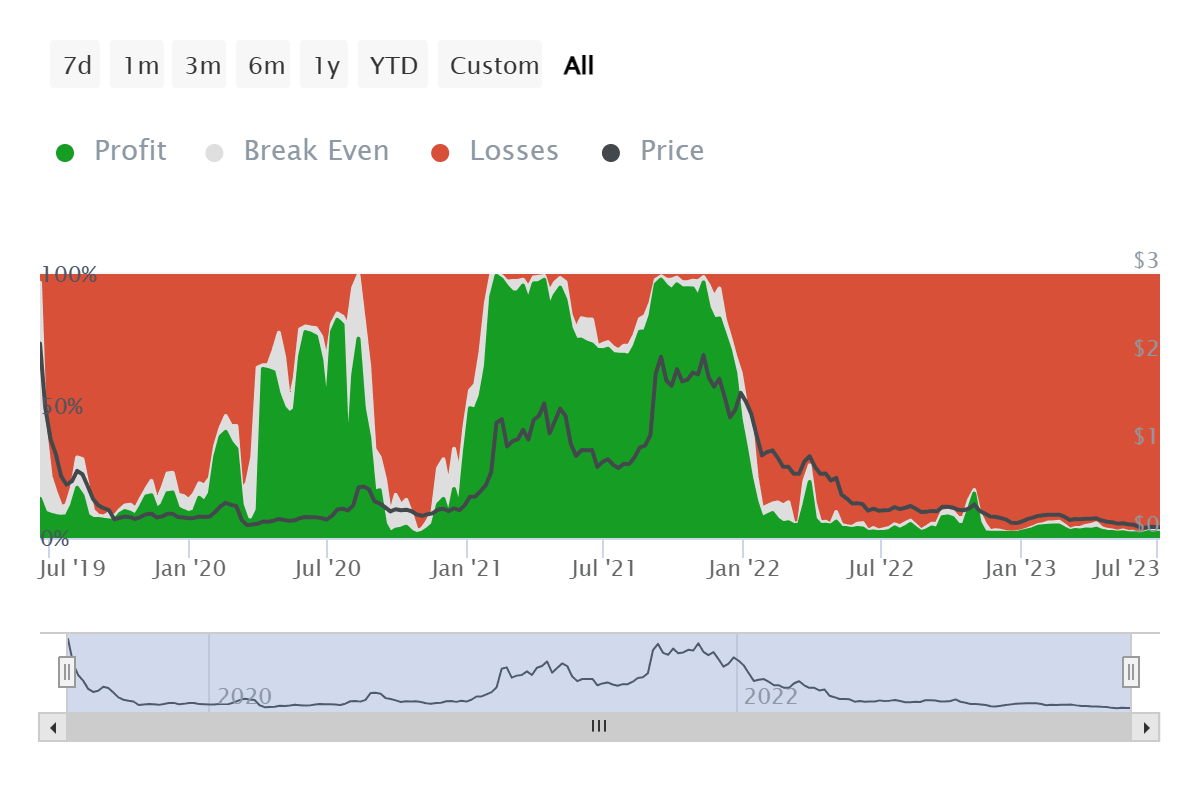

However, at the moment, it is difficult to expect a bullish outlook from them, given more than 97% of all ALGO holders are facing terrible losses. The concentration of investors underwater grew from 1% in November 2021 to 88% in just two months.

Algorand investors in losses

In the same duration, Algorand price fell from $0.202 to $.0.977, making it necessary for a climb back to this level in order to ensure that the investors are whole again.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.