Will Cardano price nosedive to $0.373 due to the FOMC meeting?

- Cardano price hovers inside the $0.377 to $0.440 range with liquidity objectives on both sides.

- A flip of $0.417 could trigger a bullish outlook that propels ADA to $0.440

- But a breakdown of the $0.408 barrier could catalyze a sell-off to $0.394 and $0.373.

Cardano price shows an interesting situation that presents opportunities regardless of the breakout direction. If investors plan to trade ADA, they need a comprehensive understanding of the triggers.

With the Federal Open Market Committee (FOMC) nearing, investors are expecting a sell-off in Bitcoin price, which could take altcoins, including Cardano, down with it.

July pre-FOMC price action vs current price action on $ETH. pic.twitter.com/L3fCo8MKYu

— Cold Blooded Shiller (@ColdBloodShill) October 31, 2022

Cardano price entices traders with a bullish outlook

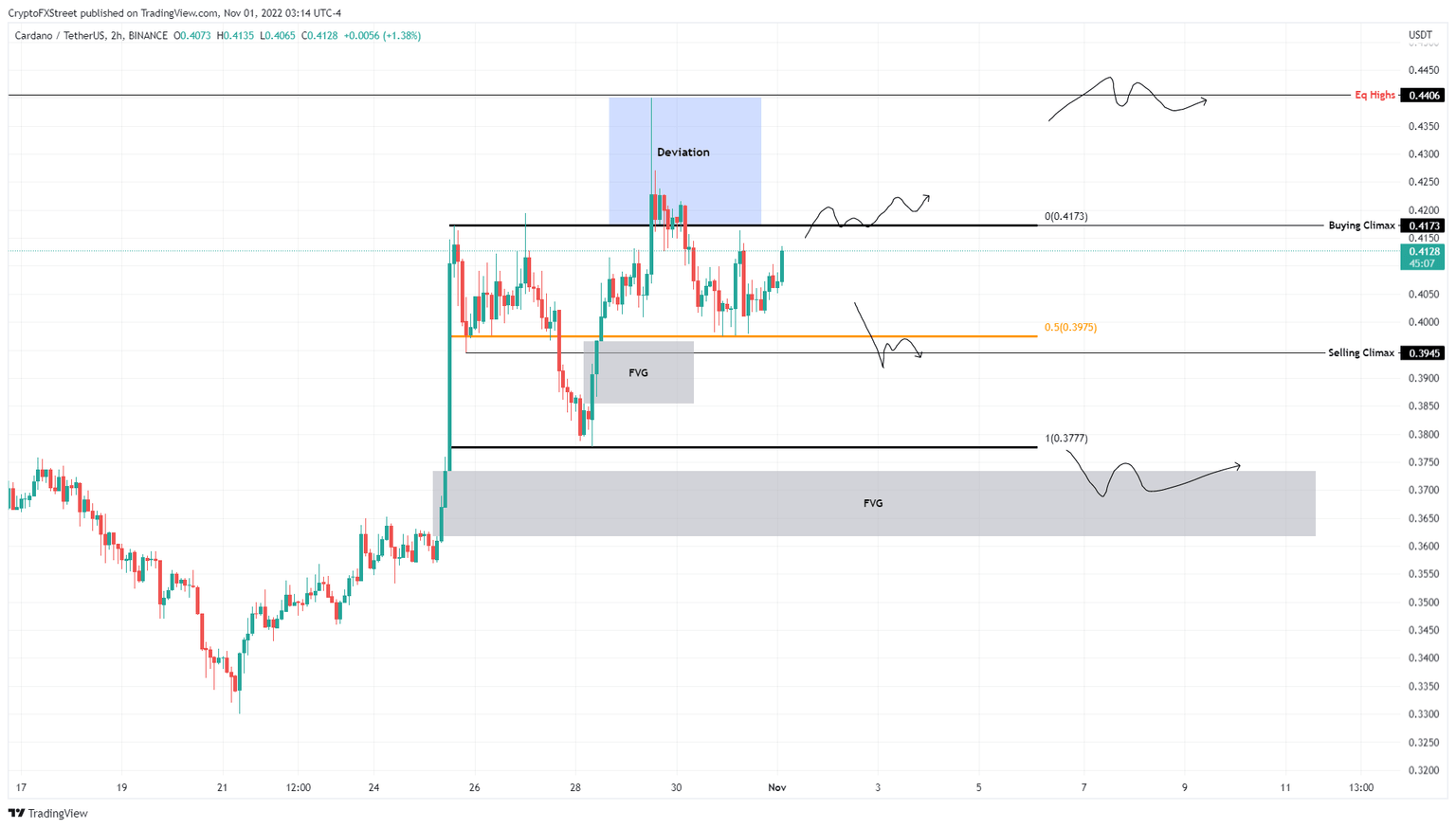

Cardano price shows that the buying climax occurred at $0.417 on October 25 after a 16% upswing. This move was immediately followed by a quick pullback to $0.394, which can be termed a selling climax. As ADA trades within this range, investors need to note the larger range, which extends from $0.3777 to $0.417.

After multiple tags of the midpoint at $0.397, Cardano price has rallied nearly 4% and is currently hovering below the range high at $0.417.

For a bullish outcome to play out, ADA needs to flip $0.417 into a support level, which will increase the odds of a 6% move to retest $0.440. Traders looking to play this move should note that rejection at $0.417 could lead to a sweep of $0.397 for sell-stop liquidity.

ADA/USDT 1-day chart

But a flip of the $0.397 support structure into a resistance level will spell trouble for these bullish investors. This development will be a key shift in market structure and could trigger a 5% downswing to retest the range low at $0.377.

While this move is enticing to scalpers, traders should note that there are two inefficiencies, extending from $0.385 to $0.396 and $0.361 to $0.373 Depending on the selling pressure, Cardano price could undo these gaps and bring the total downside move from 5% to 9%.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.