Why the Solana price could wipe out all returns since August

- Solana shows a significant uptick in volume amidst the recent decline.

- The largest candle within the current downtrend and consolidation belongs to the bears.

- Invalidation of the bearish thesis could occur if the bulls breach the $38.86 price level.

Solana price may be consolidating before it makes a move south. Key levels have been identified.

Solana price could fail soon

Solana price shows reasons to be concerned as an investor. Since September 13, the centralized smart contract token went on a 20% mudslide, falling to a monthly low at $30.01. The bulls have issued their first reaction to the slump, having retraced 15% before the bears dialed in more of their force.

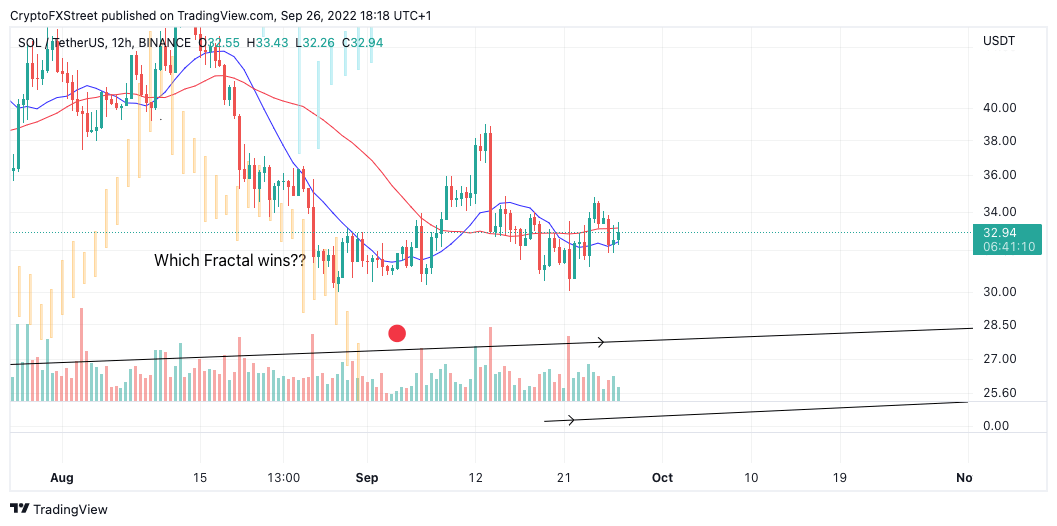

Solana price currently auctions art at $32.94. During the decline, the bears established a strong bearish engulfing candle, bringing the price from $38.86 to $33 in just 12 hours. The candle breached the 8-day exponential moving average (EMA) and was accompanied by a large uptick in volume. Solana is now re-testing the 8-EMA after failing to find support at the 21-day simple moving average (SMA) while dually failing to close above the large candle's closing price.

The bears could print a new low if market conditions persist, wiping the August lows at $30.00 out in the process. A previous support zone near $28.23 could be a probable bearish landing zone, resulting in a 15% decline from the current Solana price.

In the following video, our analysts deep dive into the price action of Solana, analyzing key levels of interest in the market - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.