Solana price presents day trading opportunities amid a questionable downtrend

- Solana price has lost 22% of its market value since mid-September.

- The Volume Profile indicator is still questionable as to who dominates the market.

- Invalidation of the bullish idea is contingent upon a few factors mentioned below.

Solana price could show a bounce soon. Key levels have been identified.

Solana price is a trader's chart

Solana price has day traders watching the bulls closely, attempting to reclaim grounds with the 8-day exponential moving average. The bullish retaliation comes after Solana's recent 22% decline since mid-September. On larger time frames, the Solana price is stair-stepping into support on the Relative Strength Index. Thus, this is a crucial time for the centralized smart contract token and keeping a close eye is justified.

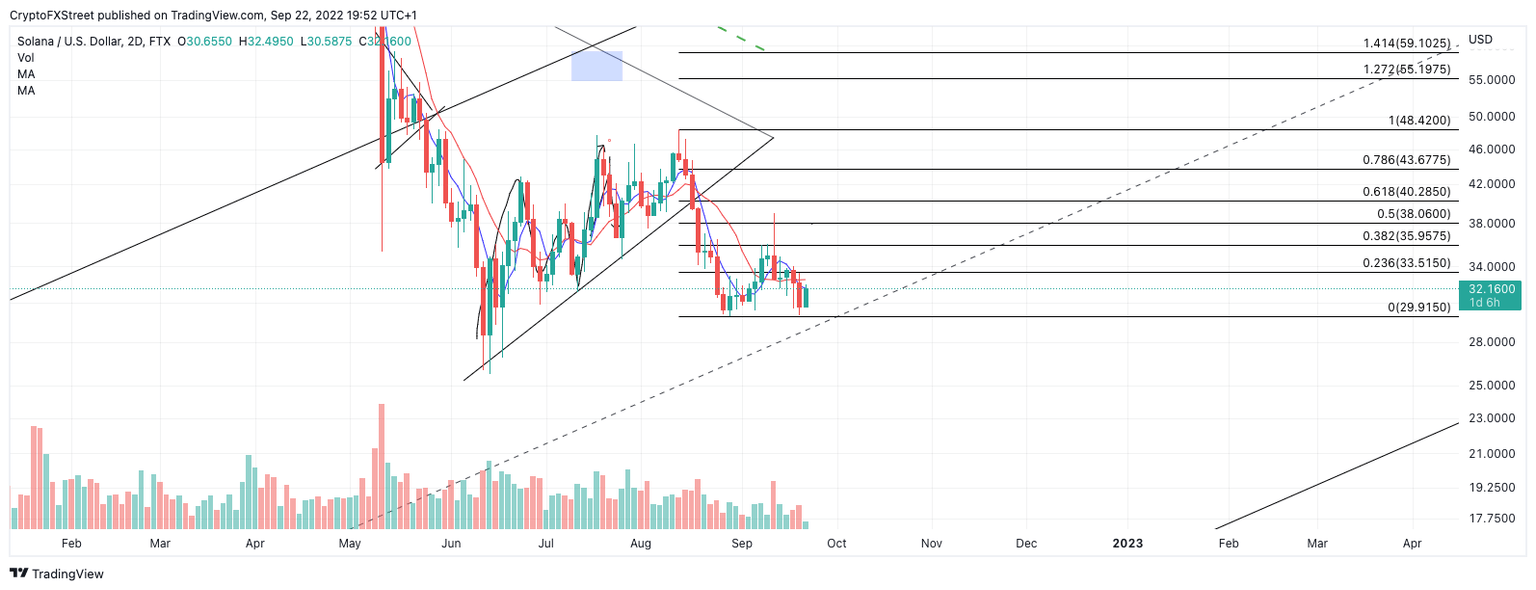

Solana price currently auctions at $32. The downrtrend's power is still up for debate as the Volume Profile Indicator shows a sparse reading. If the bulls can hurdle the 21-day simple moving average at $33.14, then a more confident countertrend trade idea will present itself.

SOL USDT 2-Day Chart

A daily close above $33.14 should give sidelined bulls permission to the 38.2% Fibonacci retracement level (based on the previous swing high to swing low) marked at $35.95.=

Invalidation of the bullish idea is contingent upon the June 14 swing low at $25.75 holding up. If the bears were to breach this level, a further decline targeting a previous congestion zone near $20 could result in a 27% decrease from the current Solana price.

In the following video, our analysts deep dive into the price action of Solana, analyzing key levels of interest in the market - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.