Why Ethereum hard fork is imminent, ETH proof-of-work proponents debate

- ETC Cooperative wrote a letter to ETH proof-of-work proponents criticizing a hard fork ahead of the Merge.

- Ethereum proof-of-work supporters argue that miners cannot move their resources to ETC for shortage of computing power pool.

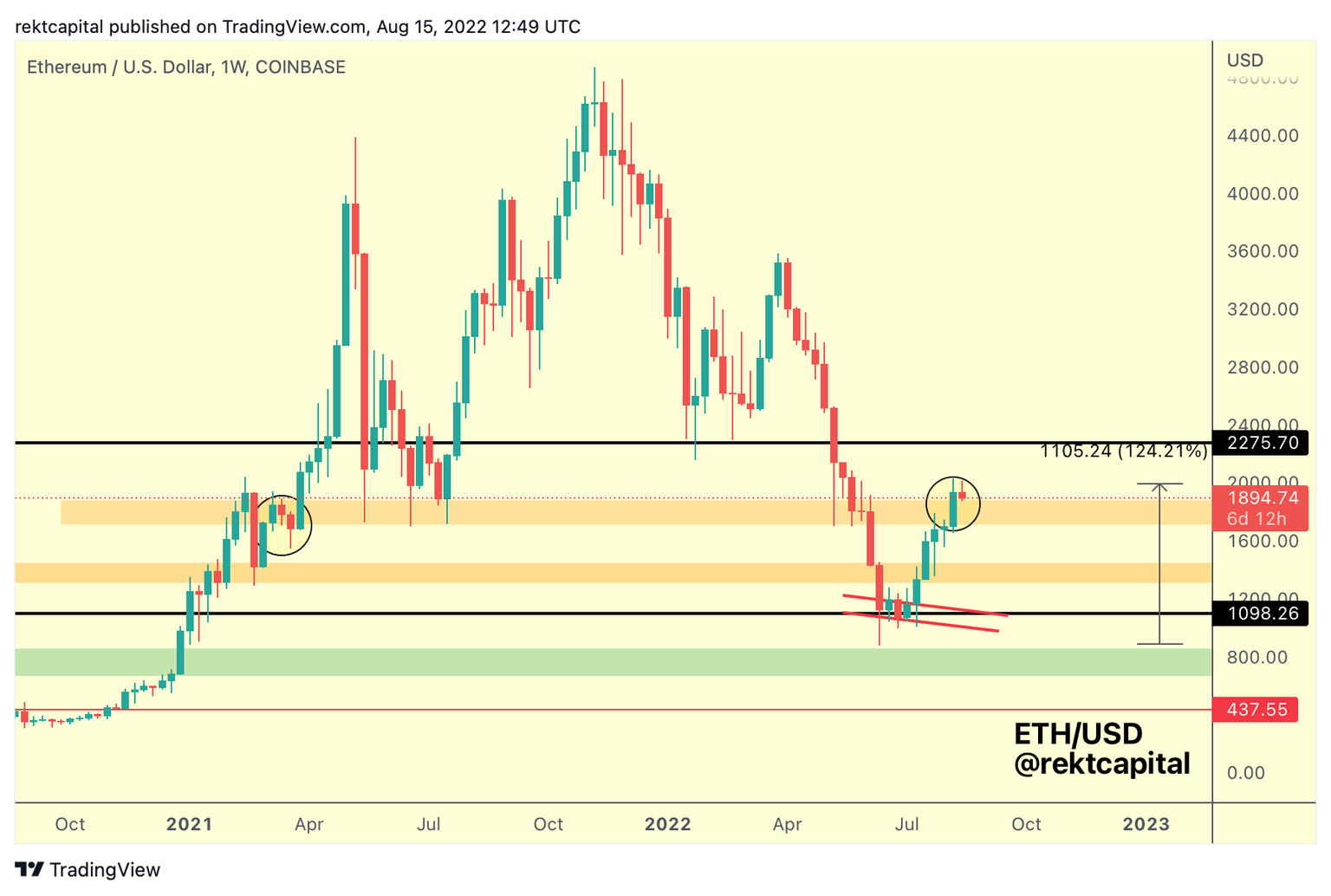

- Ethereum price continued its downward spiral, dropping to the $1,900 level.

As Ethereum prepares for its upgrade from proof-of-work to proof-of-stake, there is a group of miners preparing for a hard fork. ETC cooperative criticized the plan for a hard fork of the Ethereum network, however, proof-of-work proponents responded negatively.

Also read: How high could Ethereum price go with Triple Halving

Ethereum hard fork is imminent as Merge draws close

The group of Ethereum proof-of-work supporters responded to ETC Cooperative’s open letter. The group argues that an upgrade of Ethereum "The Merge" will inevitably form a hard fork of Ethereum. Irrespective of objections held by different groups, the community, exchanges, miners and mining machine manufacturers are in favor of a hard fork.

The difficulty bomb has been defused and Ethereum developers are working towards the transition to proof-of-stake. At the same time, ETH pow supporters believe a Merge is imminent. While ETC Cooperative argued that proof-of-work supporters and miners can switch to the Ethereum Classic network.

However, Ethereum pow supporters argue that ETC’s small pool cannot hold the entire computing power of miners joining the network. The response of ETHW supporters to ETC co-operative’s letter reads:

ETH has accumulated a computing power of 996 TH/s, while ETC only has a meager 27 TH/s, switching to "Ethereum Classic" mining sounds simple, but it's actually a shoe for all miners.

Proof-of-work supporters argue that ETC has not been able to attract a computing power pool in the past five years, and it is likely that the network fails to lure ETHW supporters. Therefore, ETC will exist side by side with Ethereum proof-of-work.

Ethereum proof-of-work supporters are unsure whether proof-of-stake will exist five years from now. All parties should therefore unite as backup for DeFi and NFT projects, competing with Ethereum proof-of-stake.

Proof-of-work supporters assure a permanent, stable running Ethereum chain

Ethereum proof-of-work supporters assured the ETC Cooperative that a stable running Ethereum chain will be maintained. As developers prepare for the hard fork, major code changes have been implemented and have entered the testing cycle. ETH pow supporters recommend that pow proponents use the time ahead of the Merge to do joint testing with mining pools, miners, and miners, and the time is loose.

Ethereum price is ready for a run to $2,000

After the recent decline in Ethereum’s price, analysts have predicted a run up to $2,000 in an ETH price rally. Ethereum price posted 4% losses overnight. Rektcapital, a technical analyst argues that the Ethereum price dip currently in progress could stop. Ethereum price is likely to retest $2,250 again.

ETH-USD price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.