Why Crypto.com price could crash to $0.20

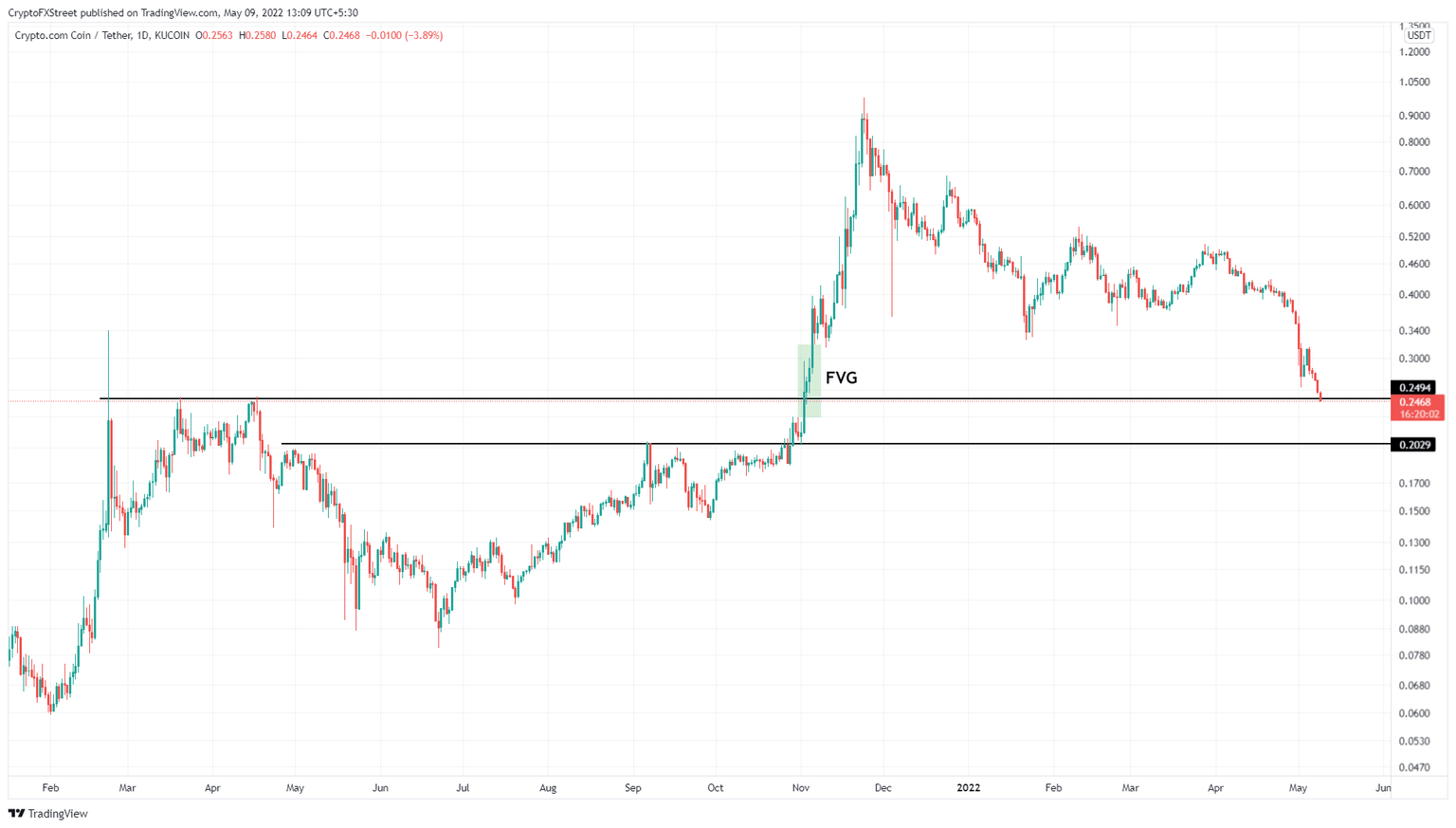

- Crypto.com price has crashed 35% from $0.370 and is currently testing the $0.249 support level.

- A decisive breach of the said barrier could further push CRO down to $0.202 barrier.

- A daily candlestick close above $0.376 will indicate a resurgence of buyers and alleviate the bearish thesis.

Crypto.com price held its support levels for the longest it could but finally the buyers capitulated, leading to a sudden crash in late April and early May. As a result, CRO has dropped to significant support levels and looks ready for more downswings.

Crypto.com price needs buyers

Crypto.com price was consolidating along with the $0.376 support level since an all-time high of $0.975 in November 2021. This level served as a major source of buying pressure, where investors bought CRO at a discount and hoped for a recovery rally.

However, on April 29, Crypto.com price breached this barrier and crashed 38% to where it is trading at the time of writing – $0.244. In doing so, CRO has breached another support level at $0.249. There is still hope for the altcoin, especially if bulls come to the rescue and move above the said barrier.

A failure to recover could trigger a further crash in Crypto.com price to $0.202, which would make sense as it would fill up the fair value gap, extending from $0.318 to $0.229. In total, this drop could amount to nearly a 20% correction.

CRO/USDT 1-day chart

While things are looking down for CRO, a daily candlestick close above $0.376 will indicate a resurgence of buyers and alleviate the bearish thesis for Crypto.com price. Such a move will flip the said barrier into a support level, allowing buyers to set a higher high above $0.497 and trigger an uptrend.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.