Crypto.com slashes card rewards, CRO tokens drop 11% as community reacts

Revisions to Crypto.com’s card and staking rewards sent token prices tumbling as much as 11% as the community expressed dismay over the changes that go into effect after June 1.

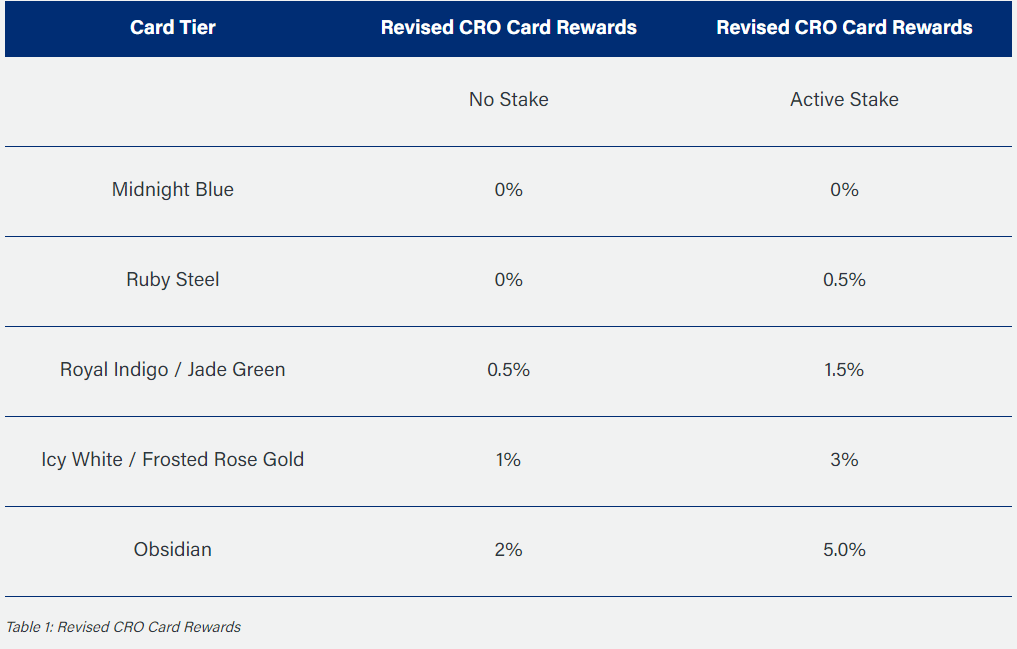

In a blog post on Sunday, Crypto.com said it would reduce rewards on the usage of its Visa-enabled cards based on the tiers offered. Lower tiers – such as Midnight Blue and Ruby Steel – would get 0%, Royal Indigo and Jade Green would get 0.5%, Icy White and Frosted Rose Gold would get 1%, while Osbidian, the highest tier, would get just 2%.

Revised tier rates. (Crypto.com)

Monthly rewards on the lower tiers would be capped from $25 to $50, while there would be no rewards cap on the higher tiers, the company said.

Staking rewards on Crypto.com’s cards would additionally cease after completion of the 180-day period for all those who staked on May 1 or before, except for cards of the lowest two tiers.

These are a steep drop from current rates of 1% on the lower-tier cards, to over 8% on the highest tier, depending on staked funds. Crypto.com’s prepaid cards are a popular product within crypto circles, allowing users to load up supported cryptocurrencies or stablecoins and spend fiat at Visa merchants.

Meanwhile, other benefits on the cards, such as cashbacks on subscription services and complimentary airport lounge access, would continue. Furthermore, interest rates on Crypto.com’s Earn product, which allows users to earn up to 14% on crypto holdings, remain unchanged.

Community reacts

Card users expressed dismay over the changes in social media posts on Reddit and Twitter. Most comments criticized the decision. “I’m going to continue to use the card for the remainder of my staking period and then unstake and say goodbye to the card,” claimed one Reddit user. “Not the end but they just lost a lot of customers,” said another.

Some on Twitter said yield rates offered on decentralized finance (DeFi) applications were much more lucrative as a use of idle capital.

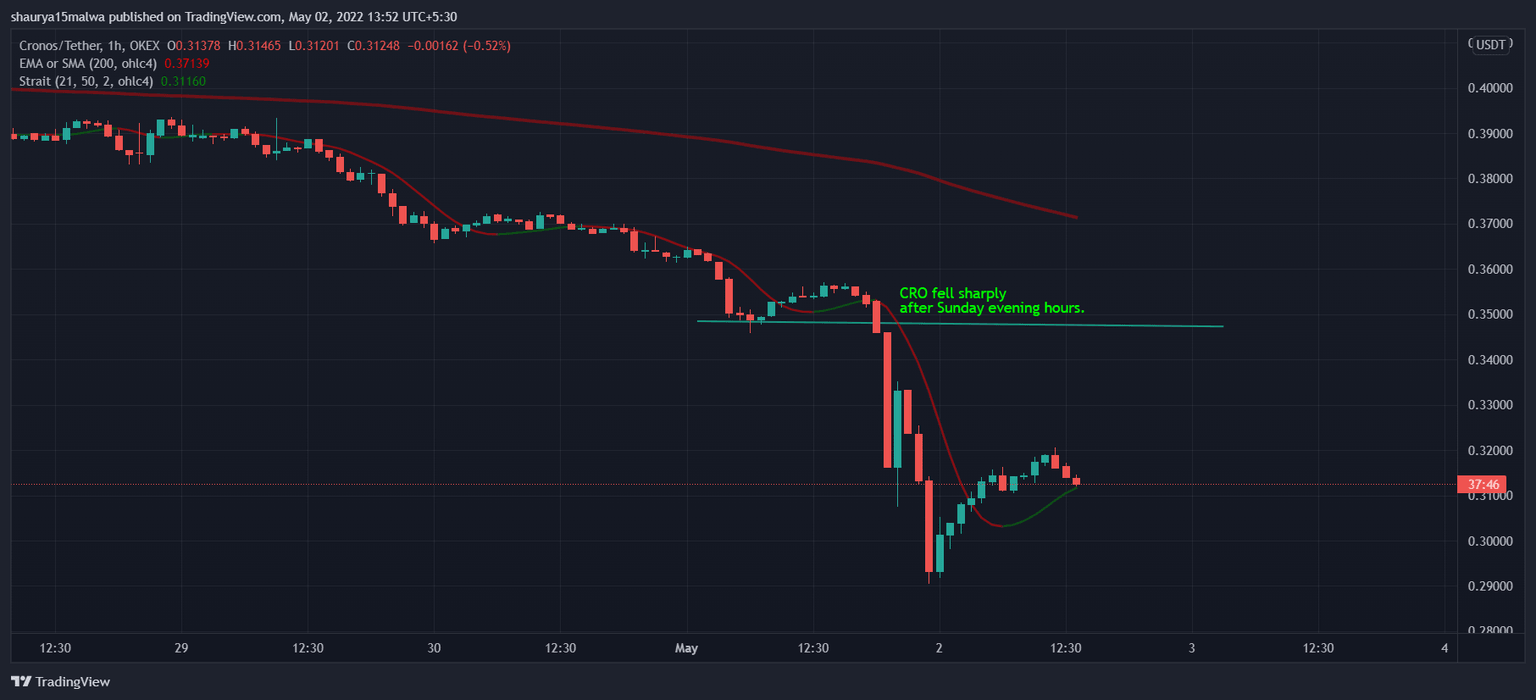

Prices of CRO, Crypto.com’s native tokens, fell 11% in the past 24 hours with the bulk of losses coming in the hours after the rewards decision. CRO traded over $0.36 on Sunday, and fell to as low as $0.29 in Asian hours on Monday before slightly recovering at writing time.

CRO prices fell sharply. (TradingView)

Some analysts explained that the lack of adequate rewards contributed to a lower fundamental value for CRO tokens, which led to the price drop.

"Staking CRO tokens enabled rewards for users and incentivized the use of their debit card," shared Edson Ayllon, Product Manager at dHEDGE, in a Telegram message. "Reducing cashback rewards reduced the intrinsic value proposition of CRO. This is similar to how DeFi protocols use liquidity mining to attract assets. It's often intended to bootstrap liquidity, and we see in DeFi that when the incentives dry up, often the token price takes a hit."

Crypto.com returned no requests for comments at writing time.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.