- The crypto market is exposed to price shocks more and more commonly.

- Fundamental indicators are oversold, opening up the tension to the upside.

- Bears have reacted quickly by closing the door on a potential consolidation.

At the time of the American session opening, it seems that the US dawn has brought a new bullish movement among the market's leading cryptocurrencies.

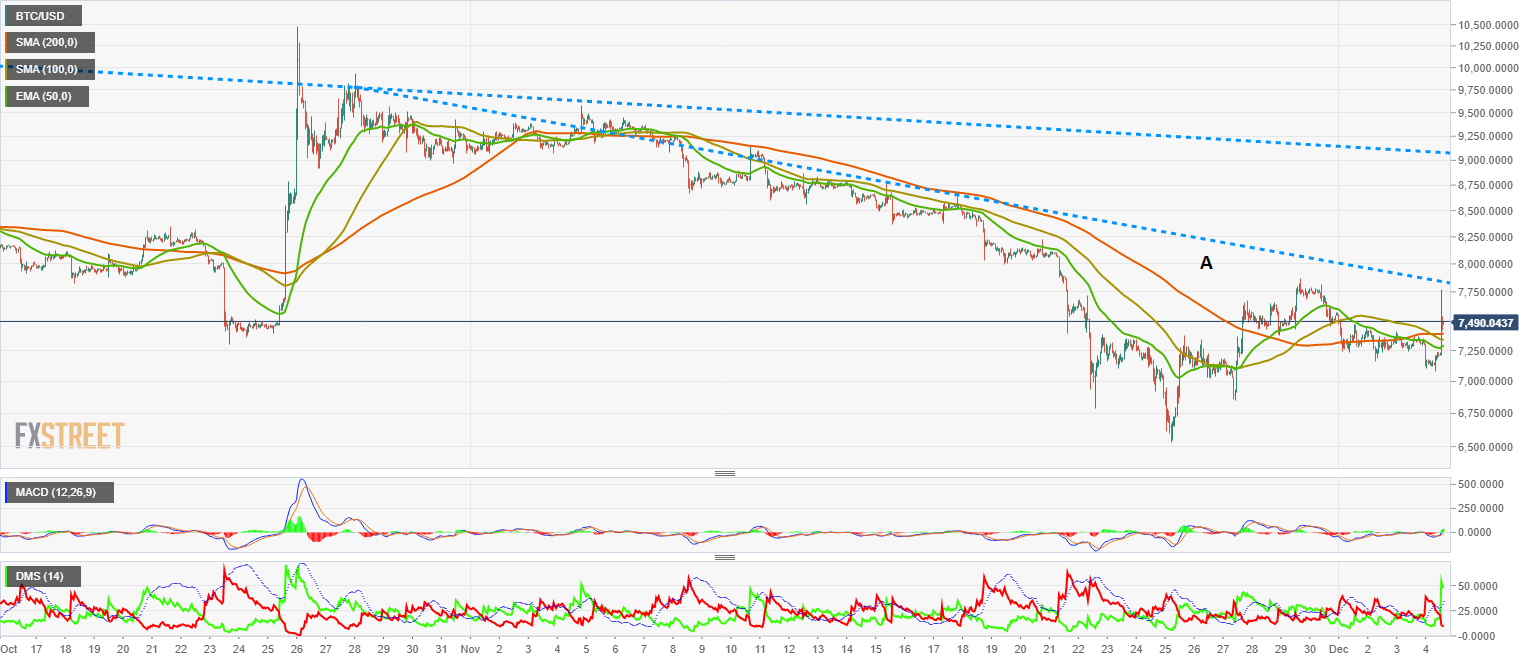

Bitcoin

Bitcoin soars and leaves the intraday high at $7,770. It is therefore very close to crossing up the bearish trend line from the late October highs. The price level that would currently change the outlook to bullish is at $7,850 (Point A).

The signals provided by Intotheblock.com, it can help us to have a better understanding of what may happen in the next few days.

Intotheblock gives us four different signals in its tool and a fifth that groups the previous 4 and unifies the signal message.

The summary indicator indicates that the Bitcoin is mostly bearish, counting two bearish signals (Net Network Growth and Large transactions) and two neutral signals (In The Money and Concentration).

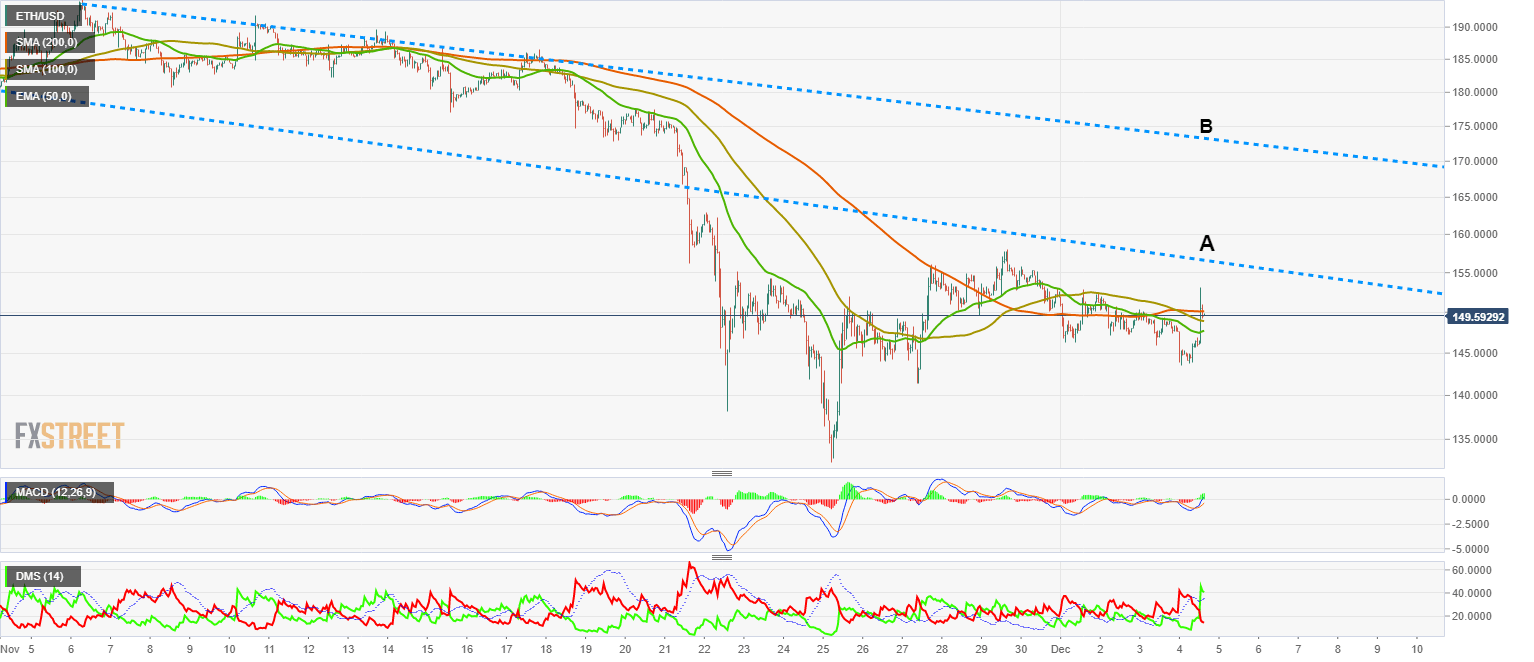

Ethereum

Ethereum is trying to join the party but is finding strong resistance at the $150 price level. It has been able to overcome it for a few moments, but sellers have quickly appeared and have brought it back to the resistance level.

The ETH/USD pair has two important levels to overcome in order to regain energy and be able to move up strongly. The first is at $156.5 (A), while the second and final level prior to entering bullish mode is at $173.5 (B).

According to the signals provided by Intotheblock.com can help us understand better what may happen in the coming days.

Intotheblock gives us four different signals in its tool and a fifth that groups the previous 4 and unifies the message of the signal.

The summary indicator shows even more important low levels than in the case of Bitcoin. There are 3 out of 4 bearish indicators in this case, and only the Ethereum Concentration indicator moves in the neutral zone.

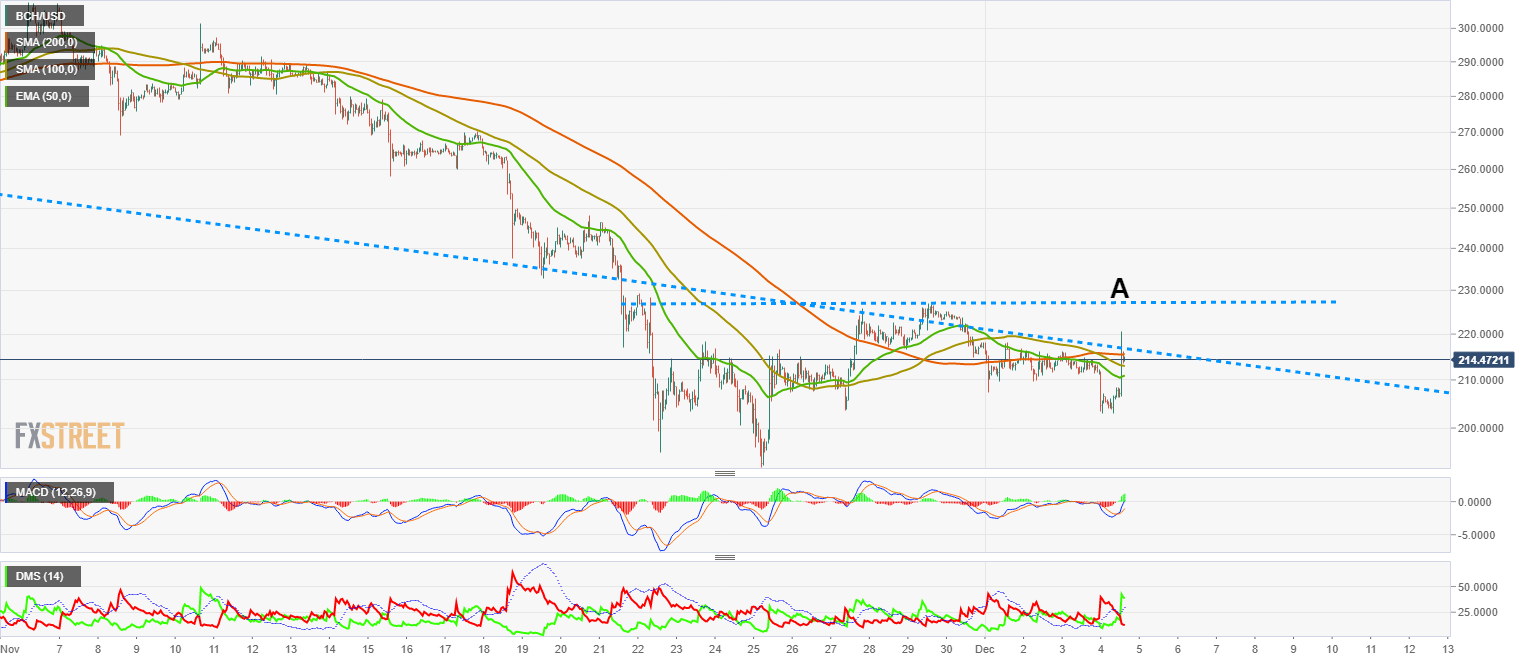

Bitcoin Cash

Bitcoin Cash has surpassed the $220 price level, but sellers have appeared and have taken it below the SMA200 on the 1-hour chart. The BCH/USD chart shows a very flat profile, with sharp jumps both up and down.

With the flash rise we've just seen, the BCH/USD pair has been in the bullish zone for a few moments, but sellers have brought it back to the bearish continuation scenario. A closing above the $226 (A) price level is necessary.

The signals provided by Intotheblock.com can help us understand better what may happen in the coming days.

Intotheblock gives us four different signals in its tool and a fifth that groups the previous 4 and unifies the signal message.

The compiled indicator shows an absolute bearish extreme. The indicators in a bearish position are 4 of 4, and reach an end that could be interpreted as a turn signal for being in an extreme bearish situation.

Litecoin

The Litecoin has momentarily surpassed the $47 level, but the emergence of sales has brought it back below the trend line from the relative highs on the one-hour chart.

The long-term chart tells us that the long term trend line is currently moving at $48, so a change from a bearish scenario like the current one to a bullish one is very likely to occur.

-637110714804337088.png)

The signals provided by Intotheblock.com can help us understand better what may happen in the coming days.

Intotheblock gives us four different signals in its tool and a fifth that groups the previous 4 and unifies the signal message.

The compiled indicator clearly shows a bearish profile, with 3 of the 4 indicators in the bearish zone and only one, the concentration one, in the neutral zone.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.