What it means for Crypto.com price to have overcome this critical hurdle

- Crypto.com price shows a willingness to move higher after flipping the $0.115 hurdle.

- If CRO flips past the $0.122 hurdle, investors can expect a 14% upswing to $0.140.

- A daily candlestick close below $0.098 will invalidate the bullish thesis.

Crypto.com price is ready to bounce after it recently overcame a resistance barrier. This move indicates that CRO is ready for a quick run-up to move past the recently formed range.

Crypto.com price checks off its lists

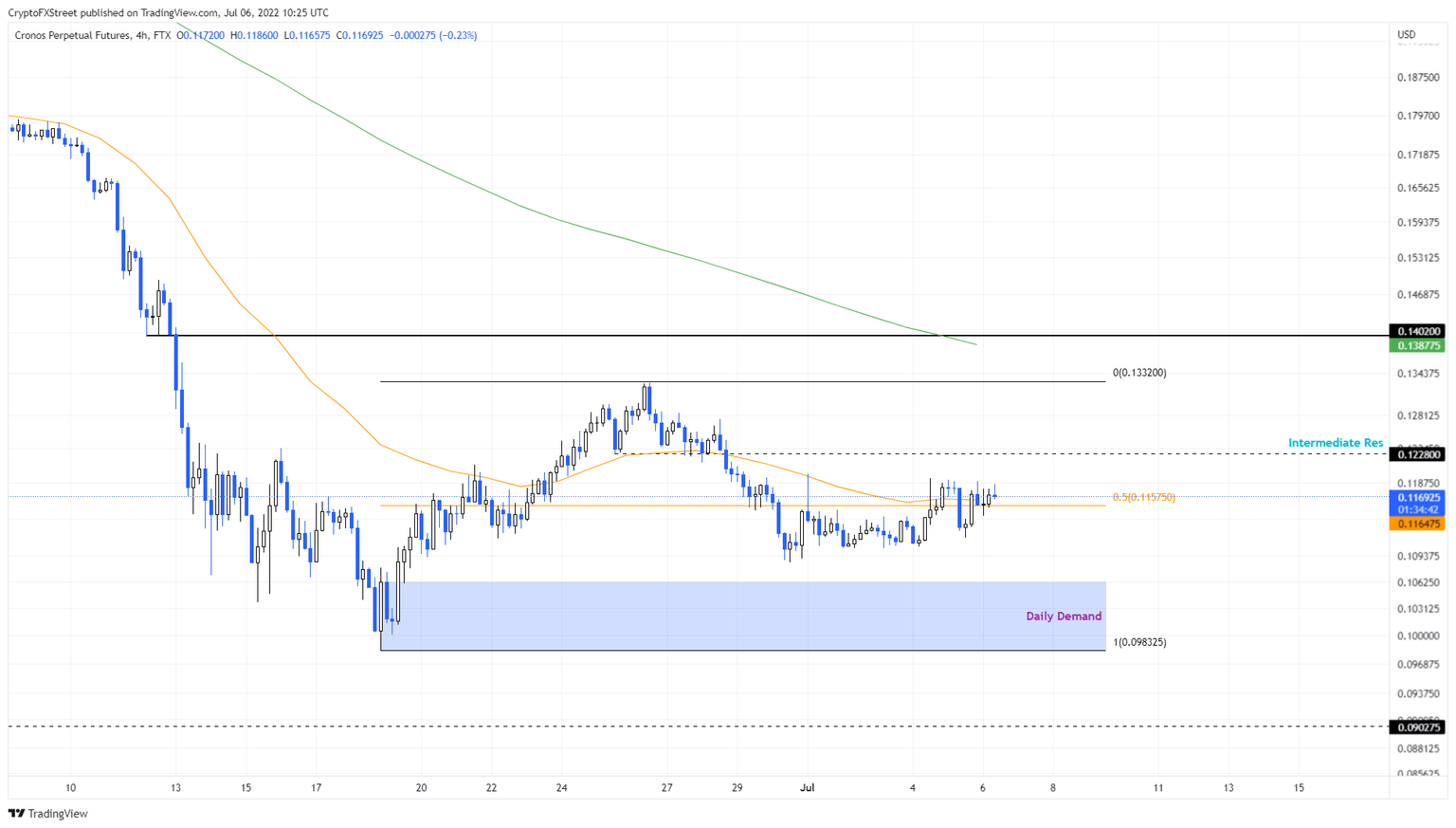

Crypto.com price rallied 35% between June 18 and June 26 and set a range, extending from $0.098 to $0.133. Since setting up this boundary, CRO has retraced 18% and came close to retesting the $0.098-to-$0.106 demand zone.

However, the shift in market structure has resulted in a preemptive recovery that has pushed Crypto.com price above the 50% retracement level at $0.115 and the 8-day Exponential Moving Average (EMA) at $0.116. This development suggests that the buyers are back and trying to take control.

In such a case, investors can expect Crypto.com price to retest the $0.122 hurdle and overcome it. Assuming this occurs, investors can expect CRO to rally 13% to retest the range high at $0.133.

In some cases, Crypto.com price might extend higher and tag the 34-day EMA at $0.138 or the $0.140 whole number. This move would constitute an 18% upswing.

CRO/USDT 4-hour chart

While things are looking up for Crypto.com price, a failure to stay above the range’s midpoint at $0.115 will indicate weakness and sellers trying to take control. In such a case, CRO has the $0.098-to-$0.106 demand zone to fall back on.

This area will provide buyers with another chance at a comeback, but a failure here that pushes Crypto.com price to a daily candlestick close below $0.098 will invalidate the bullish thesis.

In such a case, CRO could crash to the $0.09 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.