VeChain price shakes off collective capitulation, primed for at least a 30% gain

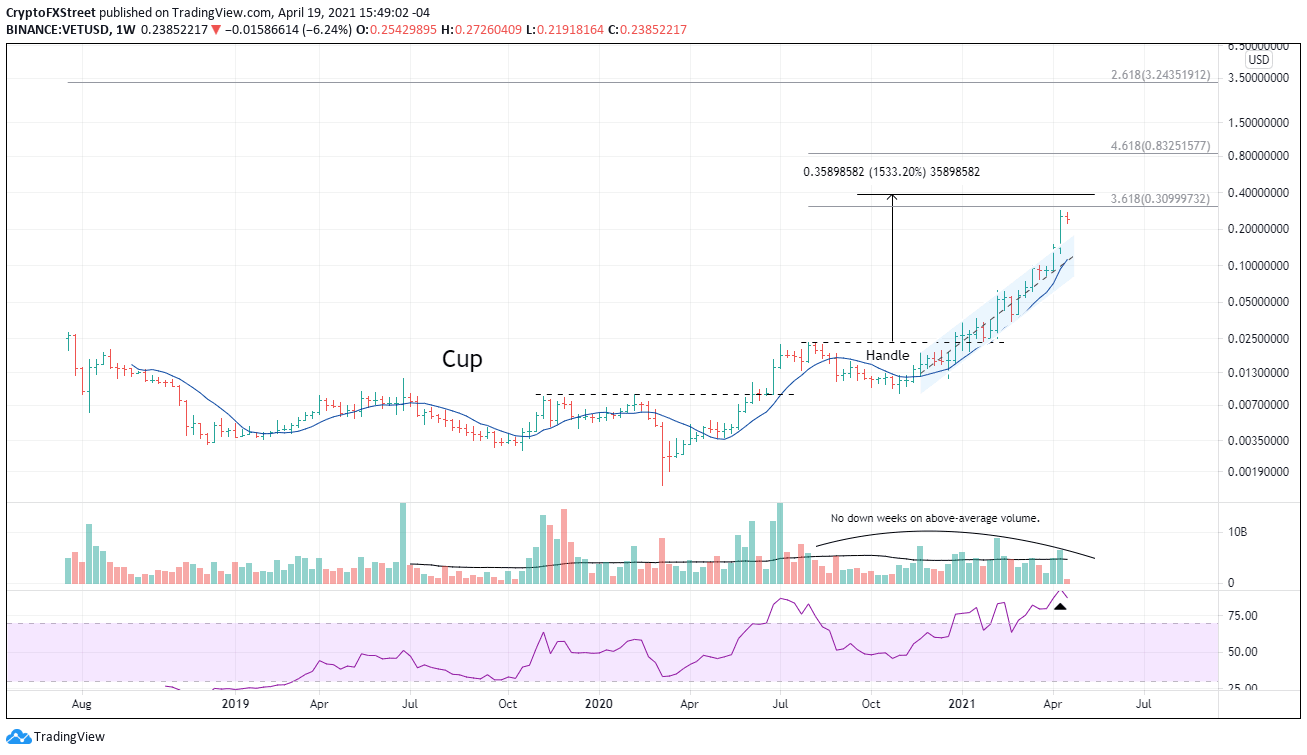

- VeChain price climbed over 1100% from cup-with-handle breakout in early January.

- Extended technical conditions limit potential for triple-digit gains from current price.

- VET mentioned in the 2021 Forbes Blockchain 50.

VeChain price from the weekly perspective looks very bullish, a breakout from a rising channel and a close near the high. No hint of a 40% decline, but that was the case this weekend. It shows there remains a high number of committed speculators around the world, despite the lofty prices. Still, the technicals indicate that the upside is probably limited to a 30-60% gain from the current price.

Vechain price correlation with Bitcoin proves short-lived after big rebound

VET emerged from a cup-with-handle base in early January and has rallied over 1100%, mainly staying in the bounds of a rising channel until last week. The blow-off move of last week has cleared some critical short-term resistance levels but put VET close to the 361.8% Fibonacci extension of the handle correction in late 2020 and within a couple of solid days from the common cup-with-handle measured move target of $0.3824.

An ideal outcome for bullish speculators is one or two inside weeks to remove the price compression of the significant gains last week, putting it in a better position to notably extend the rally. However, if VET shoots for new highs this week, look for $0.3099 to be a point of resistance, a 30% gain, followed by the cup-with-handle measured move target at $0.3824, providing around a 60% gain for speculators.

A sustained pause in the advance to let the moving averages catch up with price would raise the odds of a test of the 461.8% extension of the handle in 2020 at $0.8325 and carry VET into the orbit of $1.00.

VET/USD weekly chart

Some technical indicators are flashing a sell signal, such as the weekly Relative Strength Index (RSI). Hence, speculators need to be prepared for a sustained correction of the massive gain in 2021. Great support is at the channel’s upper trendline at $0.1705 and then the convergence of the channel’s mid-line with the 10-week SMA around $0.1125.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.