VeChain price reaches the limit, easy money in VET has been made

- VeChain price falls flat at the resistance formed by the Anchored Volume Weighted Average Price (VWAP) and the daily Ichimoku Cloud.

- The VET six-day Rate of Change (ROC) shows the best gain since the April high.

- The digital token holds the 50-week simple moving average (SMA) on a closing basis, improving outlook.

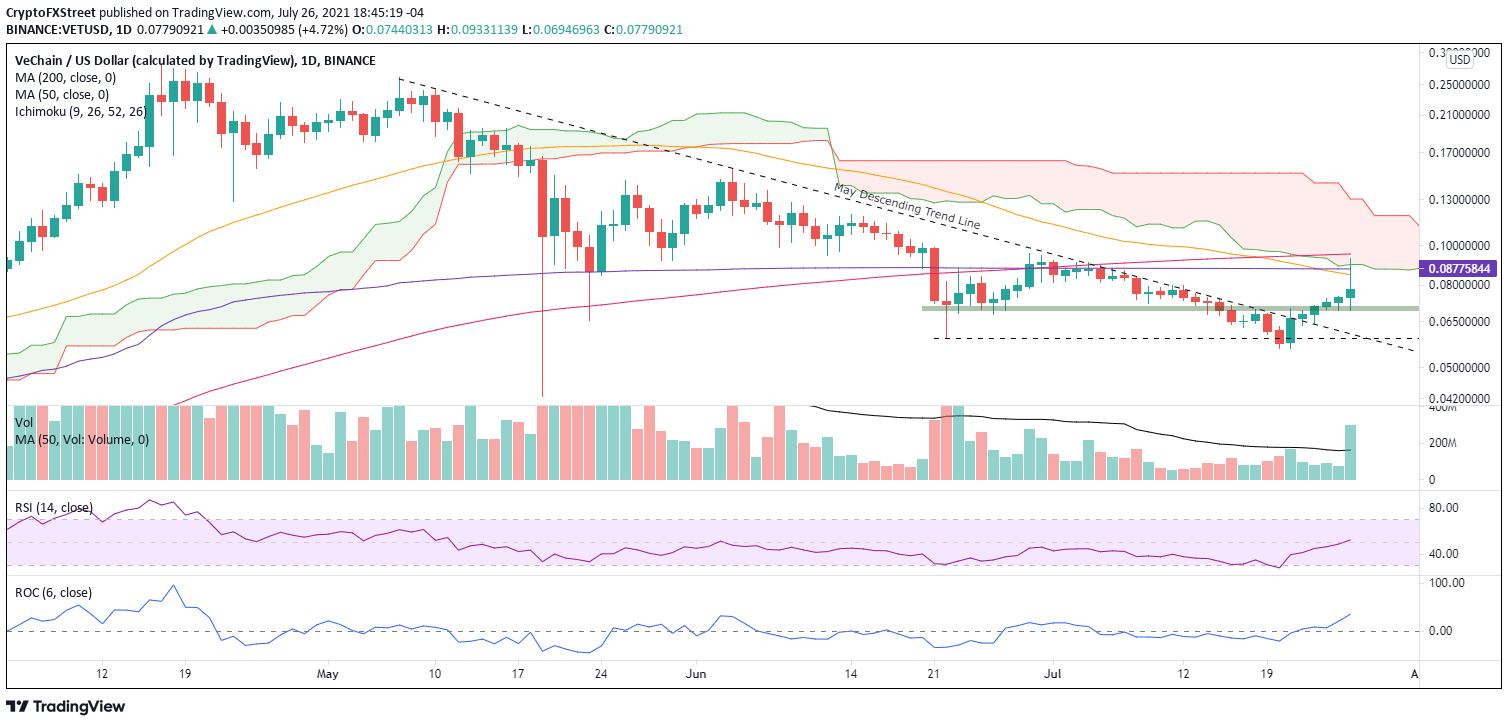

VeChain price did trade below the June 22 low in July but has responded with a 40% return (based on the current price) over the last six trading days, a sign of commitment and emotion in a cryptocurrency that had lead the market lower. However, the easy money has been earned as VET is now confronted by four credible indicators, forming a commanding resistance level that will limit the upside for at least the short term.

VeChain price needs a pick and shovel as the hard work starts now

On July 20, VeChain price recorded an oversold reading on the daily Relative Strength Index (RSI) but responded the next day with the best daily gain since May 31, putting the cryptocurrency in the position to break the dominant descending trend line beginning at the May high. On July 22, VET was released from the downtrend and set off a rally to today’s high of $0.093.

The advance from the July 20 close below the June 22 low of $0.059 reached 63% at today’s high before reversing strongly. Some will attribute the VeChain price reversal to the bearish Amazon news regarding Bitcoin. Still, the more objective explanation is that VET met the 50-day SMA at $0.084, the Anchored VWAP from January 3 at $0.087 and the lower bound of the daily Ichimoku Cloud at $0.089. The 200-day SMA reinforces those resulting levels of resistance at $0.095.

In the short term, VeChain price will be pressed lower as profit-taking continues after the remarkable spurt higher. Recognizable VET support begins with today’s low of $0.069, aligned with a range of price congestion extending back to late June that held over the last two days.

Any VeChain price weakness below $0.069 will invite a test of the May descending trend line crossing with the June 22 low of $0.059. A failure to hold targets lower prices for VET and confirms the current rebound as a dead cat bounce.

VET/USD daily chart

To entertain higher prices, VeChain price will need to begin with a daily close above $0.095, where the 200-day SMA matches the June 29 high. It then becomes the battle to overcome the inherent resistance attributed to the daily Ichimoku Cloud.

The easy money has been made after VeChain price tagged key resistance today. The issue moving forward for investors is if the rebound is the beginning of a sustainable uptrend or just a dead cat bounce. VET will need to get out the pick and shovel if it is a real turnaround, as the barriers to continued bullish outcomes are great.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.