VeChain price to follow historical precedent, as VET braces for a 27% decline

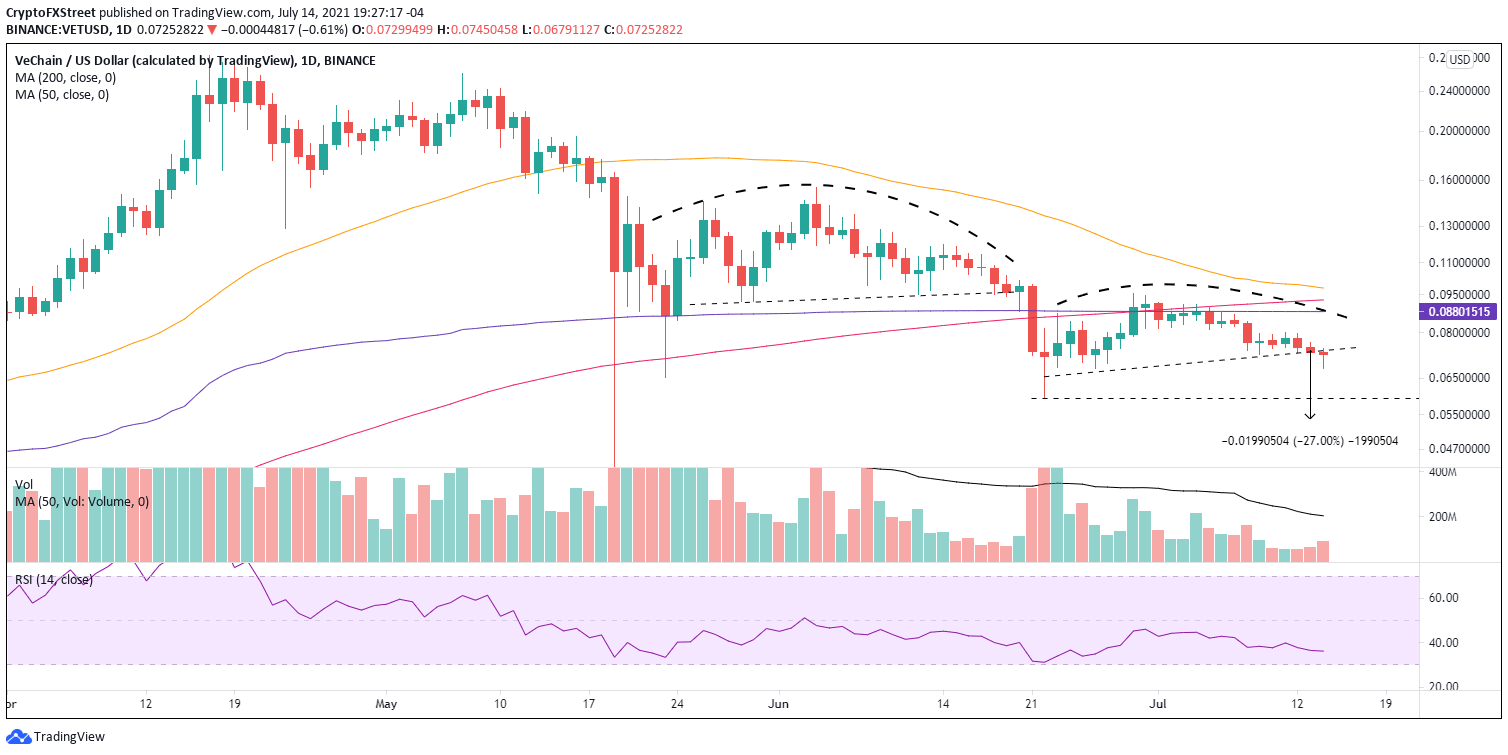

- VeChain price structure has morphed from a bear flag pattern to a head-and-shoulders pattern, similar to a month ago.

- VET is nearing a bearish Death Cross pattern as the 50-day simple moving average (SMA) convergences with the 200-day SMA.

- Daily volume has continued to edge lower, showing less engagement with the cryptocurrency, despite lower prices.

VeChain price triggered a head-and-shoulders topping pattern yesterday, confirming the fragility of the price structure plotted since the June 22 low. The mild VET rebound today does not disrupt the bearish outlook, and all the evidence continues to point to at least a break of the June 22 low of $0.059.

VeChain price displays interesting symmetry with prices in June

VeChain price, from May 23 until June 19, framed a head-and-shoulders pattern that began with a rising wedge pattern. The result of the topping pattern was a VET drop of nearly -40% over three days, including a -25.57% selloff on June 21. The magnitude of the decline matched the head-and-shoulders pattern's measured move of -39.72%.

Interestingly, VeChain price constructed a new head-and-shoulders pattern after the June 22 low that triggered yesterday. The measured move of the current pattern is just over -27%, indicating a price target of $0.053. The VET decline would smash the June 22 low, but it would be well above the crash low on May 19 of $0.042. Nevertheless, it should finally trigger an oversold reading on the daily Relative Strength Index (RSI), setting the foundation for a sustainable, impulsive advance.

VET/USD daily chart

To avoid the bearish outcome prescribed by the head-and-shoulders pattern, VeChain price needs a daily close above the high of the right shoulder at $0.079. If successful, VET would be poised to target the Anchored VWAP from January 3 at $0.088 and then the difficult 200-day SMA at $0.092, representing a rally of 27% from the current price.

A continuation of the VET rebound will struggle beyond the 200-day SMA as the 50-day SMA is close to activating a bearish Death Cross pattern, forecasting heightened downward pressure on VeChain price.

If VeChain price follows the precedent of the previous head-and-shoulders pattern, VET will at least reach the measured move price target of $0.053 before printing a firm low.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.